Puerto Rico Resignation Letter for Retirement

Description

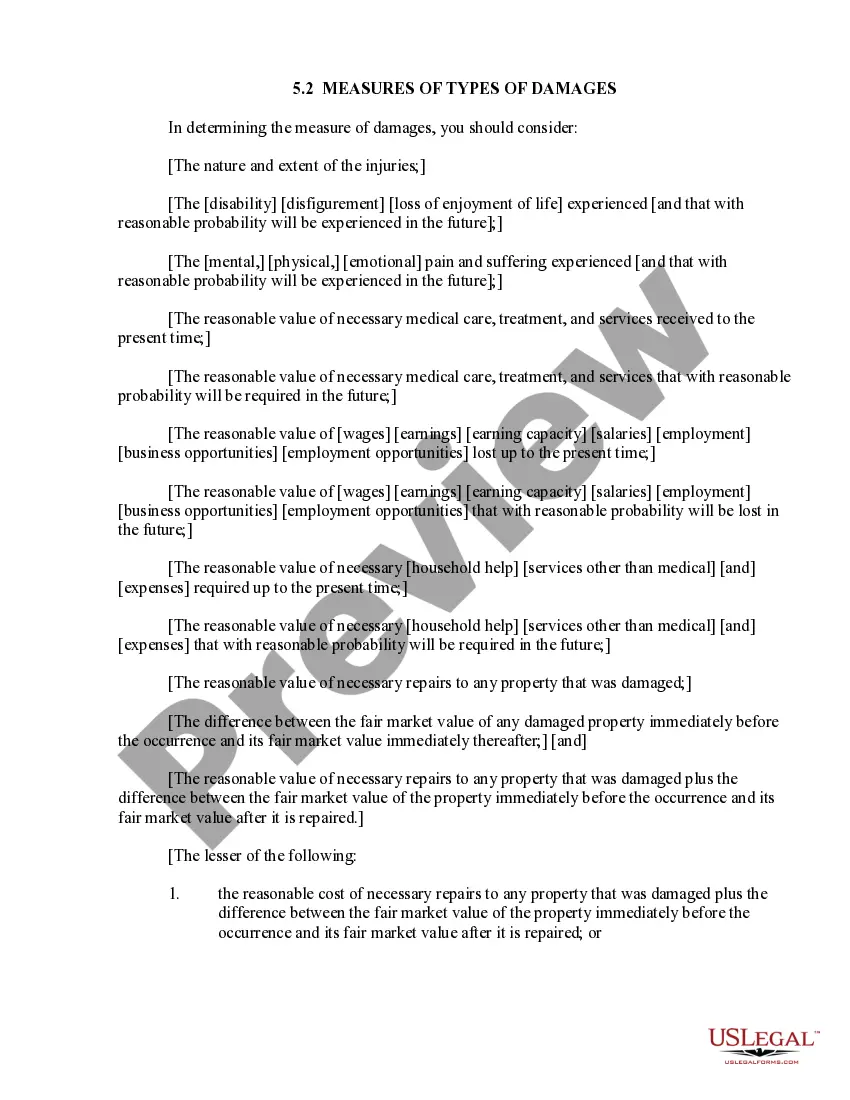

How to fill out Resignation Letter For Retirement?

In case you need thorough, acquire, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms, which are available online.

Employ the site’s straightforward and efficient search to locate the documents you need.

Various templates for corporate and personal purposes are organized by categories and claims, or keywords and phrases.

Step 3. If you are not satisfied with the document, use the Search field at the top of the page to find alternative versions of the legal document template.

Step 4. After you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your information to register for the account.

- Utilize US Legal Forms to discover the Puerto Rico Resignation Letter for Retirement with just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and then click the Acquire button to locate the Puerto Rico Resignation Letter for Retirement.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, consult the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review function to examine the form’s content. Be sure to read the details.

Form popularity

FAQ

In Puerto Rico, various types of income are subject to taxation, including wages, interest, and dividends. However, retirement income may have different tax treatments depending on its origin. Understanding the local tax laws is crucial for effective financial planning. When drafting your Puerto Rico Resignation Letter for Retirement, keep in mind the potential tax implications for your decision to retire.

Yes, Puerto Rico does tax retirement income, but certain types of income may be exempt or taxed at a lower rate. The tax implications can vary depending on the source of your retirement income. It’s wise to consult a financial advisor to understand your specific situation. Remember, incorporating a Puerto Rico Resignation Letter for Retirement into your retirement plan can help you clarify your next steps.

The Puerto Rico 1165 E plan is a retirement option designed for those working in specific professions. This tax-advantaged plan encourages saving for retirement, benefiting participants with a more secure future. Understanding how these plans work is essential when considering retirement in Puerto Rico. Additionally, as you plan, a Puerto Rico Resignation Letter for Retirement can help you communicate your intentions to your employer.

In Puerto Rico, there is no formal retirement income limit, but certain retirement plans may have contribution limits. It is crucial to familiarize yourself with the details of your retirement plan. You should also consider how your retirement strategy aligns with local tax regulations. Don’t forget, crafting a Puerto Rico Resignation Letter for Retirement might require mentioning your plans clearly.

Writing a resignation letter for retirement is a straightforward process. Begin with a clear statement of your intention to retire, followed by your last working day. Express gratitude for your experiences and offer to help during the transition period. By using a well-structured Puerto Rico Resignation Letter for Retirement template, you can ensure your communication is professional and clear.

Puerto Rico has specific tax rules regarding retirement income, which can differ from the mainland US. Generally, some retirement income may be exempt or taxed at lower rates, depending on the source. It is advisable to consult a tax professional familiar with Puerto Rican tax law. Be sure to consider how a Puerto Rico Resignation Letter for Retirement fits into your financial planning.

Yes, US citizens can retire in Puerto Rico without any restrictions. Puerto Rico offers a warm climate and beautiful scenery, making it an attractive destination for retirees. You can enjoy the benefits of citizenship while experiencing a unique cultural landscape. If you're considering your options, understanding how to write a Puerto Rico Resignation Letter for Retirement can help smooth your transition.

Yes, having a resignation letter when you retire is important. A Puerto Rico Resignation Letter for Retirement documents your intent and provides a formal record of your retirement. This letter also helps in clear communication with your employer and can make the transition smoother for both parties. Utilize platforms like uslegalforms to simplify the process and create a professional letter.

Yes, it is courteous and professional to give your employer notice of your retirement. Providing notice allows your employer time to plan for your transition and fill your role if necessary. Including this information in your Puerto Rico Resignation Letter for Retirement helps to establish a clear timeline for your departure. This process ensures a respectful exit from your position.

To resign when retiring, begin by preparing your Puerto Rico Resignation Letter for Retirement. After crafting your letter, schedule a meeting with your supervisor to discuss your decision personally. Provide your letter during the meeting and express your gratitude for the experiences you've had. This approach reinforces professionalism and helps in maintaining a positive atmosphere.