Puerto Rico Corporation - Transfer of Stock

Description

How to fill out Corporation - Transfer Of Stock?

Are you presently in a situation where you require documents for occasional business or personal purposes quite frequently.

There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Puerto Rico Corporation - Transfer of Stock, that are designed to comply with federal and state requirements.

Access all the document templates you have purchased in the My documents menu.

You can obtain an additional copy of the Puerto Rico Corporation - Transfer of Stock at any time, if required. Simply follow the relevant form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Corporation - Transfer of Stock template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

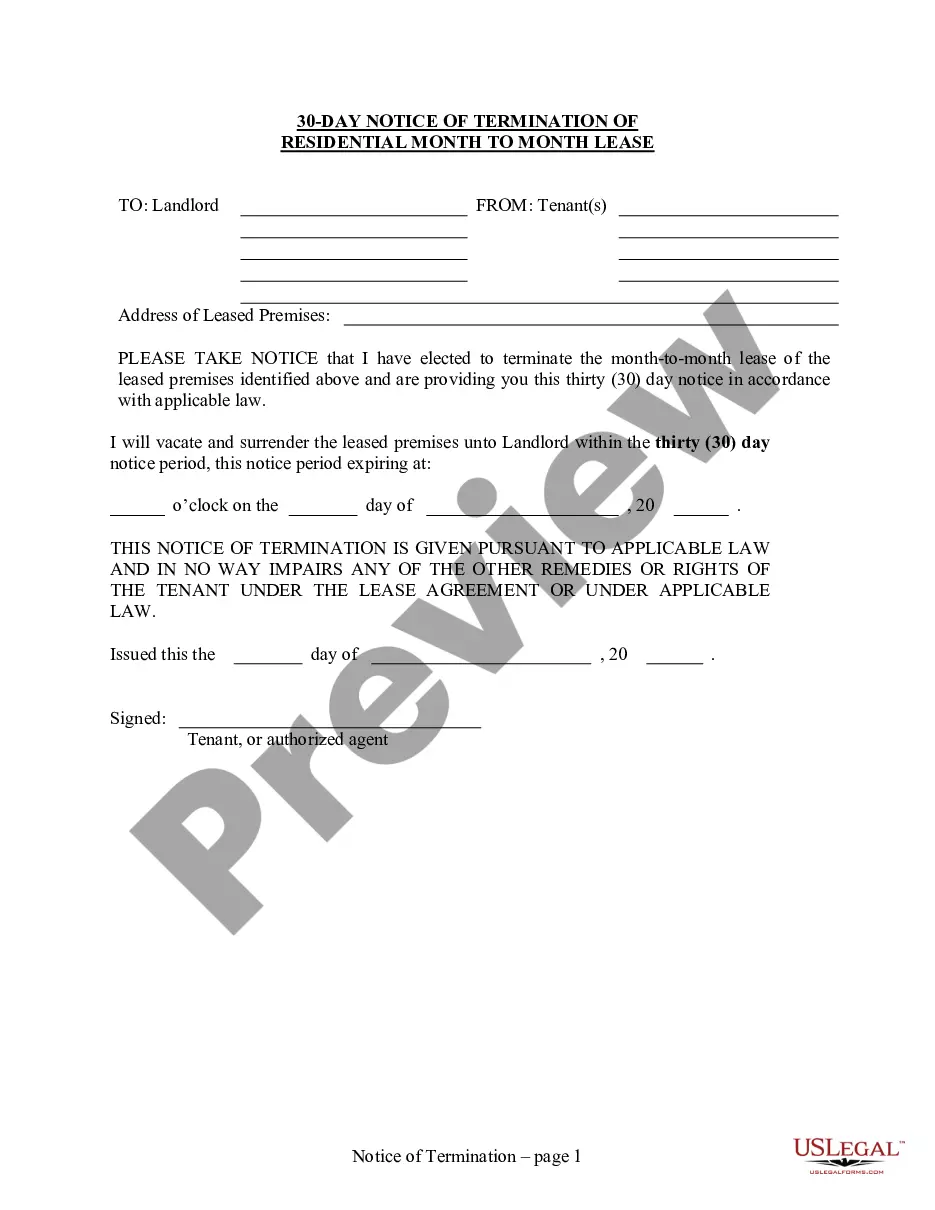

- Use the Preview button to review the document.

- Verify the information to confirm you have selected the correct form.

- If the document is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

- When you find the correct document, click Buy now.

- Choose the payment plan you desire, enter the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Yes, a US company can conduct business in Puerto Rico, often benefiting from tax incentives available to Puerto Rico Corporations. To operate legally, the company must register with the Puerto Rico Department of State. Familiarizing yourself with local regulations can help ease the transition. A well-structured approach allows for efficient stock transfers and ensures compliance within the unique business environment of Puerto Rico.

Filing your annual report for a Puerto Rico Corporation online is straightforward with the right resources. Start by visiting the Puerto Rico Department of State's website where you can access the necessary forms. Ensure you have all required information ready, including your corporation’s details and stock transfer documentation. Online filing streamlines the process and helps maintain your corporation’s good standing.

If you own a Puerto Rico Corporation, you may need to file a tax return in Puerto Rico depending on your income and business activities. Generally, all corporations operating in Puerto Rico must submit an annual tax return. Even if your corporation does not earn income, it is wise to consult with a tax professional to ensure compliance. Proper filing ensures smooth future stock transfers for your Puerto Rico Corporation.

To transfer shares in a Puerto Rico Corporation, you begin by drafting a stock transfer form, which identifies the shares being transferred and the parties involved. After this, both the buyer and seller need to sign the form, and it should be filed with the corporation's records. Adopting uslegalforms can simplify this process, ensuring you meet all legal requirements for a smooth transfer.

Transferring stock in a Puerto Rico Corporation involves several straightforward steps. First, you must prepare a stock transfer agreement, which outlines the terms of the transfer. Then, the stock certificate should be signed over to the new owner, and a record should be made in the corporation's books. Our platform, uslegalforms, provides templates and guidance to help you handle this transfer seamlessly.

To properly transfer a share in a Puerto Rico Corporation, you must complete a stock transfer form. This form typically requires the signatures of both the current shareholder and the new shareholder. Following this, you should update the corporation's stock ledger to reflect the change in ownership. Using uslegalforms can streamline this process, ensuring you have the necessary documents in order.

To register a foreign corporation in Puerto Rico, you must file with the Department of State and meet specific legal prerequisites. This process includes submitting necessary documentation and fees, ensuring compliance with local laws. Utilizing platforms like US Legal Forms can streamline the Puerto Rico Corporation - Transfer of Stock registration, making it efficient and straightforward.

While there is no formal tax treaty between the U.S. and Puerto Rico, the territory operates under unique tax provisions that shape its tax environment. However, both share certain similarities in tax laws. Having this knowledge is beneficial when considering the Puerto Rico Corporation - Transfer of Stock and other related transactions.

A foreign corporation, for U.S. tax purposes, refers to any corporation not incorporated in the 50 states. These corporations face specific tax obligations and regulations different from domestic entities. Knowing this distinction helps you understand the legal landscape surrounding a Puerto Rico Corporation - Transfer of Stock as well.

Puerto Rico is often regarded as foreign in the context of federal law. Although it is a U.S. territory, it has different regulations that apply. Therefore, when conducting business or transferring stock, understanding its foreign status is vital, especially with the Puerto Rico Corporation - Transfer of Stock implications.