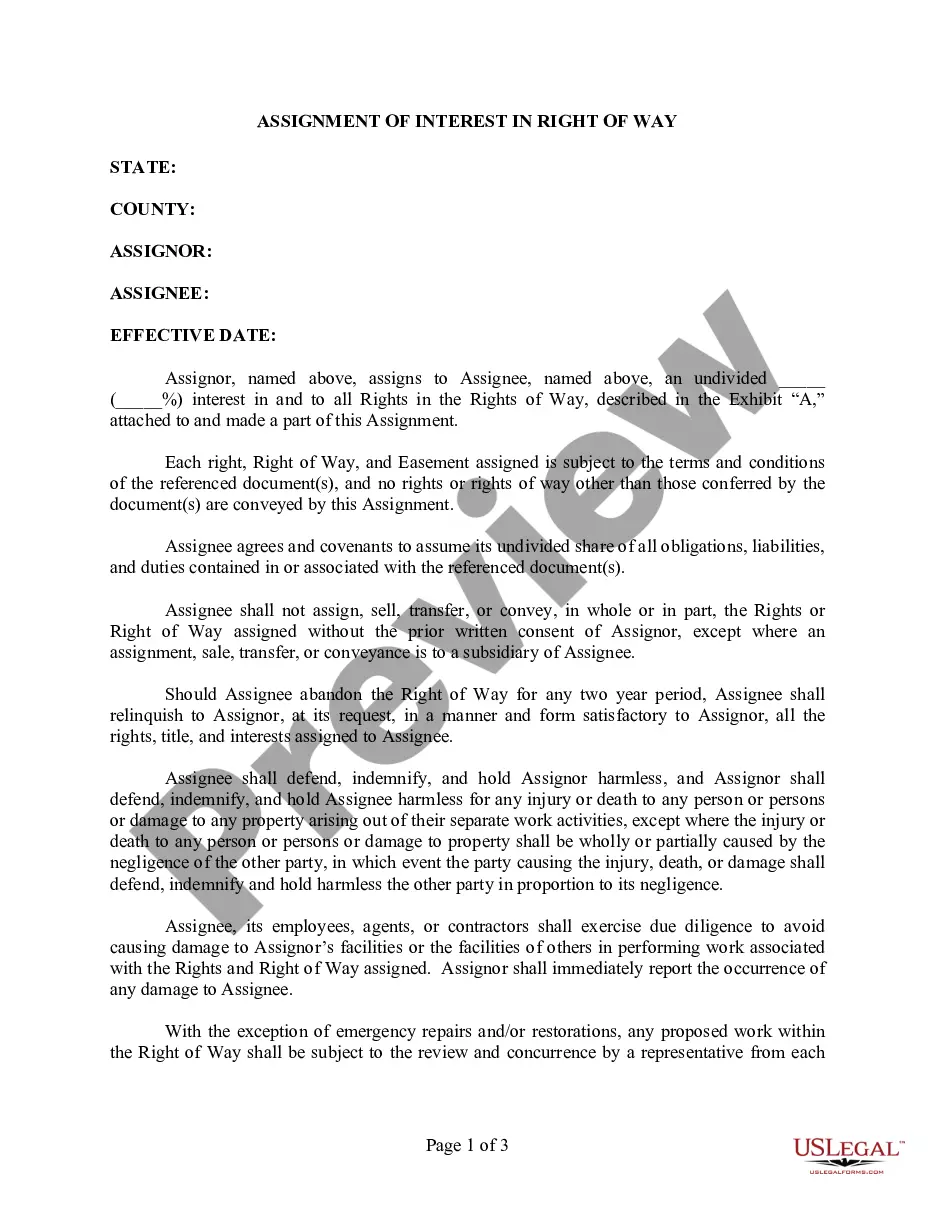

This office lease clause should be used in an expense stop, stipulated base or office net lease. When the building is not at least 95% occupied during all or a portion of any lease year, the landlord shall make an appropriate adjustment for each lease year to determine what the building operating costs. Such an adjustment shall be made by the landlord increasing the variable components of such variable costs included in the building operating costs which vary based on the level of occupancy of the building.

Pennsylvania Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease

Description

How to fill out Gross Up Clause That Should Be Used In An Expense Stop Stipulated Base Or Office Net Lease?

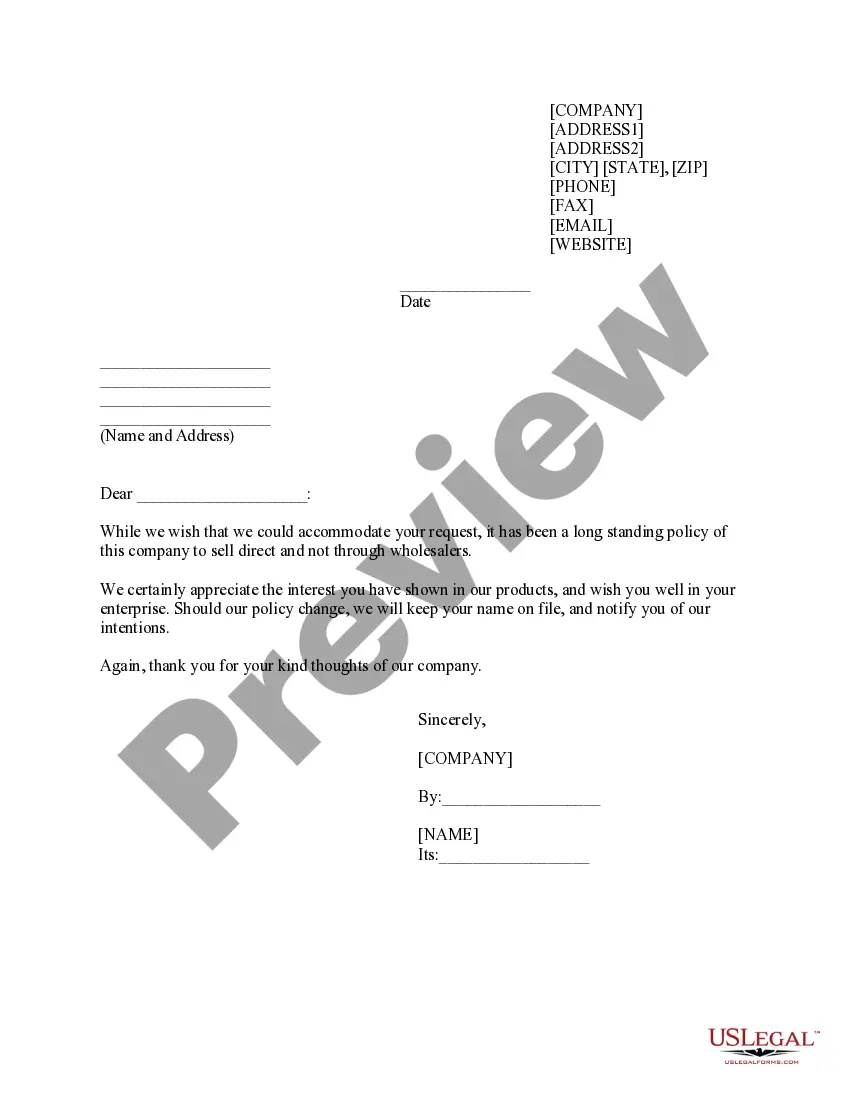

US Legal Forms - one of many most significant libraries of authorized forms in the United States - delivers a variety of authorized file layouts it is possible to download or printing. Making use of the web site, you will get thousands of forms for organization and specific uses, sorted by classes, suggests, or keywords and phrases.You can find the most up-to-date variations of forms much like the Pennsylvania Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease within minutes.

If you have a membership, log in and download Pennsylvania Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease from the US Legal Forms local library. The Down load option can look on each type you look at. You have accessibility to all in the past delivered electronically forms inside the My Forms tab of your own bank account.

If you wish to use US Legal Forms initially, listed below are straightforward recommendations to get you started off:

- Be sure to have selected the correct type for the town/area. Click on the Review option to review the form`s content material. See the type information to ensure that you have chosen the right type.

- When the type does not match your demands, use the Lookup discipline on top of the monitor to discover the the one that does.

- In case you are pleased with the form, validate your choice by simply clicking the Get now option. Then, select the prices plan you like and supply your credentials to sign up for the bank account.

- Process the transaction. Make use of your bank card or PayPal bank account to perform the transaction.

- Select the file format and download the form in your device.

- Make alterations. Load, revise and printing and sign the delivered electronically Pennsylvania Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease.

Each and every format you added to your money does not have an expiration time and is your own permanently. So, if you would like download or printing an additional duplicate, just go to the My Forms portion and click on about the type you require.

Get access to the Pennsylvania Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease with US Legal Forms, the most considerable local library of authorized file layouts. Use thousands of professional and status-particular layouts that meet up with your company or specific demands and demands.

Form popularity

FAQ

For the tenant, the benefit of an expense stop is that it reduces their required contribution to the landlord's operating expenses.

Essentially, the Base Year amount is synonymous with the Expense Stop amount, which is the actual amount of money that comprises the property taxes, insurance and operating expenses. Just like the Base Year amount, the tenant is responsible to pay any increase in those expenses above the Expense Stop amount.

An expense stop is a contractual provision that protects the property owner from rising expenses over the lease term. In such a case, the property owner typically agrees to pay all of the operating expenses in the first year of the lease, which is known as the ?base year amount? and sets the expense stop.

Correctly drafted, a gross up provision relates only to Operating Expenses that ?vary with occupancy??so called ?variable? expenses. Variable expenses are those expenses that will go up or down depending on the number of tenants in the Building, such as utilities, trash removal, management fees and janitorial services.

A mechanism in a Full Service Gross Lease, the Expense Stop is a fixed amount of operating expense above which the tenant is responsible to pay. Thus, the landlord is responsible to pay for all operating expenses below the Expense Stop, while the tenant is responsible for any amount above the Expense Stop.

In a full service gross lease, the tenant pays a base rental rate, and landlord is typically responsible for paying any additional expenses (such as CAM fees), except for those that go above a specific amount, called an expense stop.

With a modified gross lease, the tenant takes over expenses directly related to his or her unit, including unit maintenance and repairs, utilities, and janitorial costs, while the owner/landlord continues to pay for the other operating expenses.

Simply stated, the concept of ?gross up provision? stipulates that if a building has significant vacancy, the landlord can estimate what the variable operating expense would have been had the building been fully occupied, and charge the tenants their pro-rata share of that cost.