This form is used when the Assignor wishes to convey, assign and sell to the Assignee an undivided working interest in an oil and gas lease but reserves an overriding royalty interest payable on all oil, gas, and associated hydrocarbons produced, saved and sold from the Lands.

Pennsylvania Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease

Description

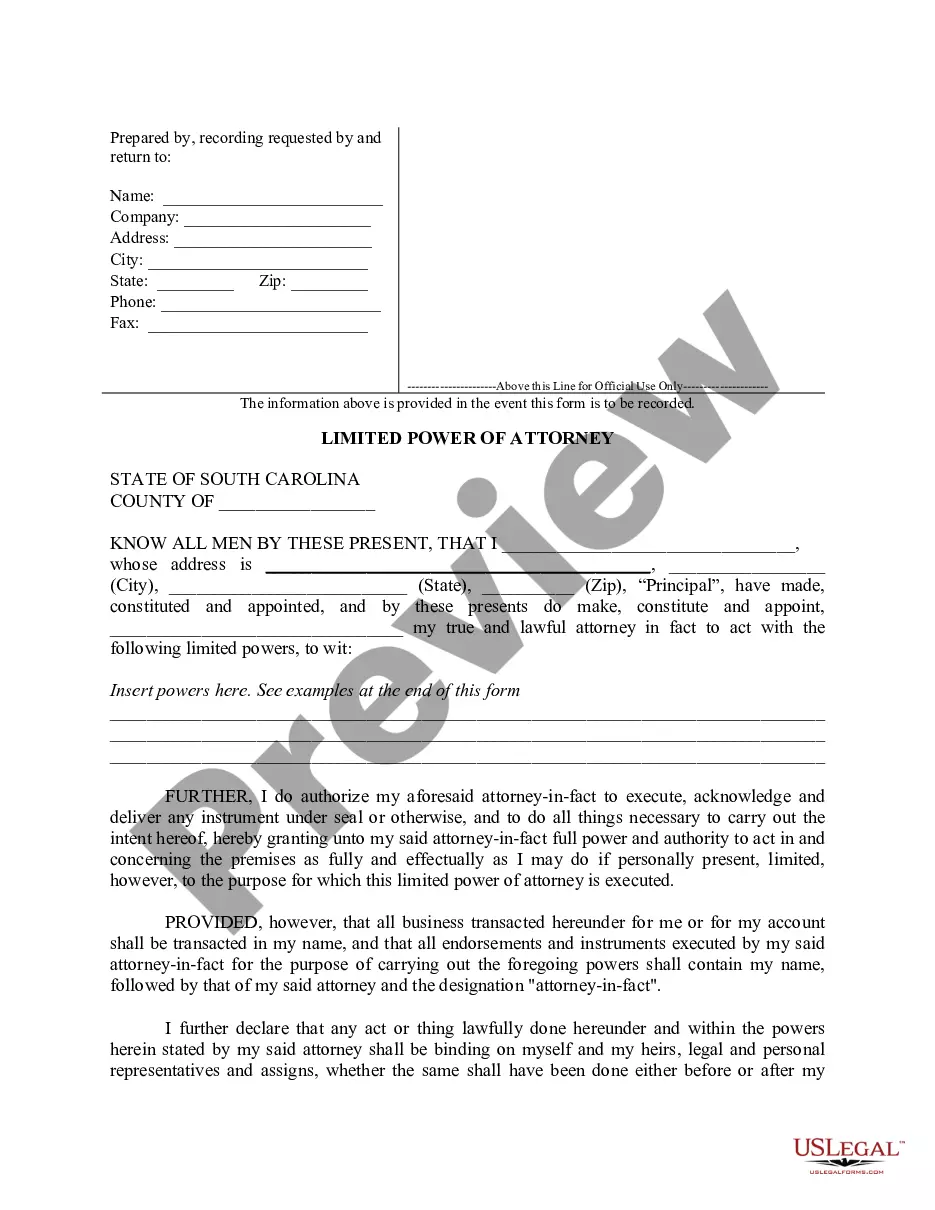

How to fill out Partial Assignment Of Oil And Gas Lease For Part Of Lands Subject To Nonproducing Lease?

Discovering the right authorized file format might be a struggle. Of course, there are a lot of templates accessible on the Internet, but how do you find the authorized form you require? Make use of the US Legal Forms web site. The services delivers a huge number of templates, including the Pennsylvania Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease, that can be used for enterprise and private needs. Every one of the varieties are examined by pros and meet up with state and federal specifications.

Should you be currently listed, log in in your accounts and then click the Download button to obtain the Pennsylvania Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease. Utilize your accounts to appear throughout the authorized varieties you might have acquired in the past. Visit the My Forms tab of your accounts and acquire one more copy of the file you require.

Should you be a new end user of US Legal Forms, allow me to share basic directions that you should comply with:

- Initial, make certain you have chosen the correct form for your personal metropolis/state. You may check out the shape while using Preview button and study the shape description to make certain this is basically the best for you.

- When the form fails to meet up with your requirements, make use of the Seach field to discover the proper form.

- Once you are positive that the shape would work, click the Buy now button to obtain the form.

- Choose the prices plan you need and type in the required info. Create your accounts and pay money for the transaction using your PayPal accounts or credit card.

- Pick the data file format and acquire the authorized file format in your product.

- Complete, revise and print out and indication the acquired Pennsylvania Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease.

US Legal Forms is definitely the greatest library of authorized varieties where you can find different file templates. Make use of the service to acquire expertly-made papers that comply with state specifications.

Form popularity

FAQ

O&G: oil & gas leases, or contracts, between the owner of minerals, typically called a ?lessor,? and a corporation, typically known as the ?lessee,? where the lessor gives the lessee the right to explore, drill, produce, and sometimes even store oil, gas and other minerals for a specified primary term, and as long ...

Historically, mineral owners (?lessors?) and landmen/oil companies (?lessees?) spend most of their time focusing and negotiating the bonus payment, primary term and royalty provisions of an oil and gas lease. These provisions are important, but they represent only a small number of the important elements of the lease.

Landowners who sign non-development leases receive revenue with no liability and no disruption to their property. Frequently Asked Questions: If I sign a non-development lease, will there be any drilling or related activity on my property? No. All drilling activities will take place on another property.

Partial Assignments: When an assignor conveys 100% record title interest in a portion of the lands in a lease, it creates a partial assignment. Partial assignments segregate the lease into two separate leases. Normally we assign a new lease number to the conveyed portion of the lease.

But not every acre of that land is being developed for energy. About 23 million Federal acres were under lease to oil and gas developers at the end of FY 2022. Of that, about 12.4 million acres are producing oil and gas in economic quantities.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

A full release of a single Texas oil and gas lease. This Standard Document releases all the lessee's interest in and to the lease. It also has helpful drafting notes explaining when releases are necessary and how to record them.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.