Iowa Auto Expense Travel Report

Description

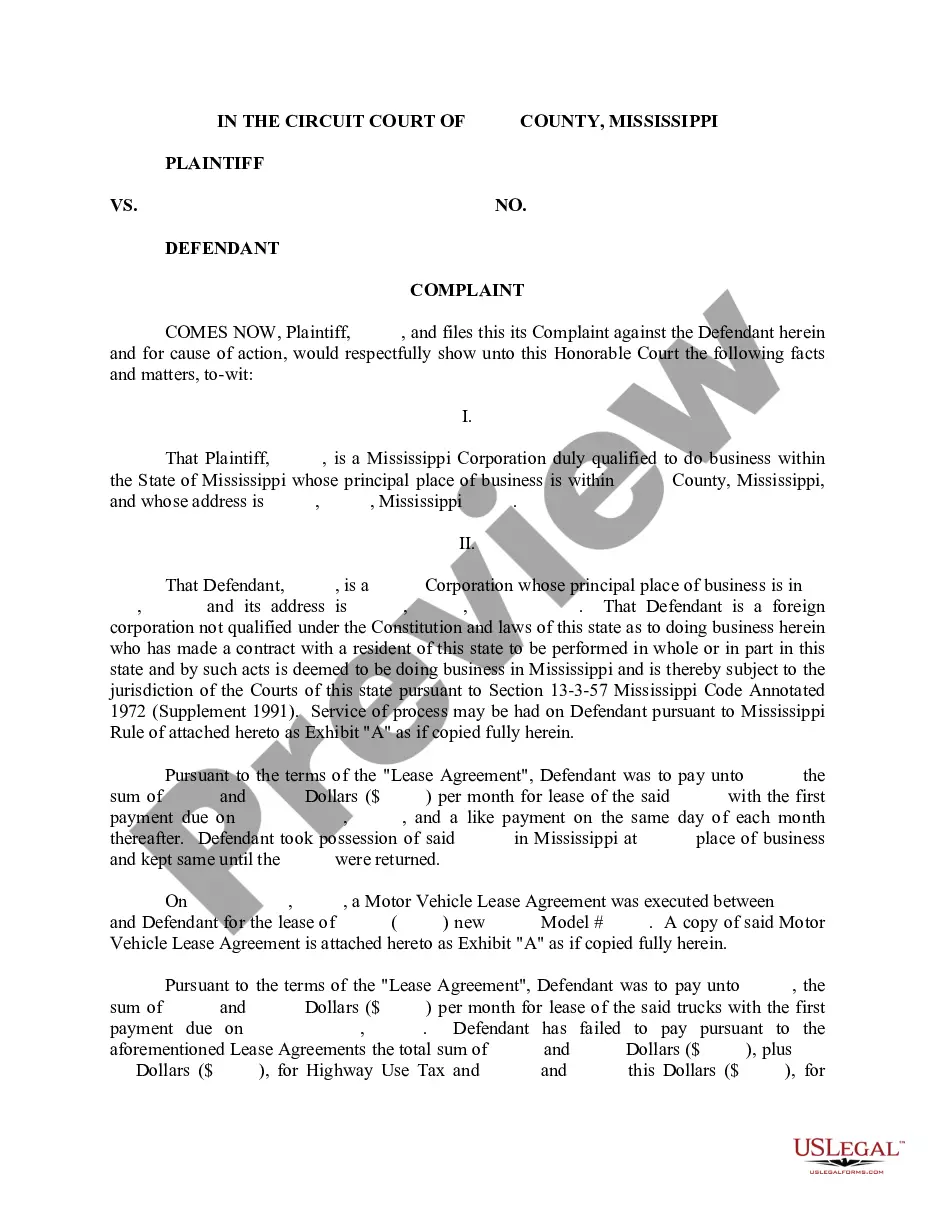

How to fill out Auto Expense Travel Report?

Selecting the optimal legal document format can be a challenge.

Clearly, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The service offers an extensive collection of templates, such as the Iowa Auto Expense Travel Report, which can be utilized for business and personal purposes.

You can view the form using the Review button and read the form details to verify that it is suitable for you.

- All the documents are verified by professionals and comply with state and federal regulations.

- If you are currently registered, sign in to your account and click the Download button to obtain the Iowa Auto Expense Travel Report.

- Leverage your account to search through the legal forms you have purchased previously.

- Go to the My documents section of your account to obtain another copy of the document you desire.

- If you are a first-time user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have chosen the correct form for your city/region.

Form popularity

FAQ

Travel expenses are costs that arise when conducting business away from your regular place of work. Common types include transportation, lodging, meals, and incidentals. The Iowa Auto Expense Travel Report is a great tool for capturing these expenses accurately, streamlining your reimbursement process.

An expense report is a formal document where individuals list all business-related expenses incurred within a certain period. It helps track spending and facilitates reimbursement from employers. If you're looking for a smooth process, the Iowa Auto Expense Travel Report can effectively document and manage your expenses.

The mileage rate for reimbursement in Iowa usually aligns with the IRS standard mileage rate. This figure may change each year, so it's essential to stay informed. Consider using the Iowa Auto Expense Travel Report to apply the correct mileage rate for your business travel needs.

An expense report travel expense report combines general expenses incurred during business travel into a single document. This report typically includes all business-related costs like mileage, meals, and lodging. Using an Iowa Auto Expense Travel Report can make compiling these expenses straightforward and efficient.

A travel expense report is a document that outlines all the costs associated with business travel. This report includes transportation, lodging, meals, and other related expenses. Leveraging the Iowa Auto Expense Travel Report helps streamline your submission process and ensures that you include every necessary detail.

The IRS mileage rate for travel expenses changes annually, and it reflects the costs associated with operating a vehicle for business purposes. For the latest updates, you should check the IRS website. When using the Iowa Auto Expense Travel Report, make sure to apply the current rate for accurate reimbursements.

Mileage reimbursement rules vary by company, but generally, employers should reimburse employees for business-related travel. It is important to keep accurate records of your trips, including dates, destinations, and purpose. Utilizing the Iowa Auto Expense Travel Report can simplify this process, ensuring you submit all necessary details for reimbursement.

The current IRS mileage rate is updated yearly and can be found on the IRS website or financial news outlets. For accurate reporting and reimbursement, incorporate this rate into your Iowa Auto Expense Travel Report. This will help you ensure compliance and maximize your eligible reimbursement.

The state of Iowa mileage reimbursement rate is subject to annual adjustments based on various factors, including the IRS guidelines. You can check the Iowa Auto Expense Travel Report for the most updated information. Keeping informed will assist you in budgeting your travel expenses accurately.

To receive mileage reimbursement, submit a request that details your travel, including the total miles driven, dates, and purpose of the travel. Use the Iowa Auto Expense Travel Report to organize your information efficiently. Following your company's procedures will ensure a smooth reimbursement process.