Pennsylvania Assignment of Record Title Interests

Description

How to fill out Assignment Of Record Title Interests?

It is possible to invest hours on the web trying to find the legal document web template that fits the federal and state demands you require. US Legal Forms gives a large number of legal forms which can be reviewed by professionals. You can easily obtain or print the Pennsylvania Assignment of Record Title Interests from my assistance.

If you already possess a US Legal Forms profile, you may log in and click on the Obtain option. Afterward, you may complete, change, print, or sign the Pennsylvania Assignment of Record Title Interests. Every legal document web template you purchase is your own property forever. To acquire one more backup associated with a acquired type, visit the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms website the very first time, follow the straightforward instructions listed below:

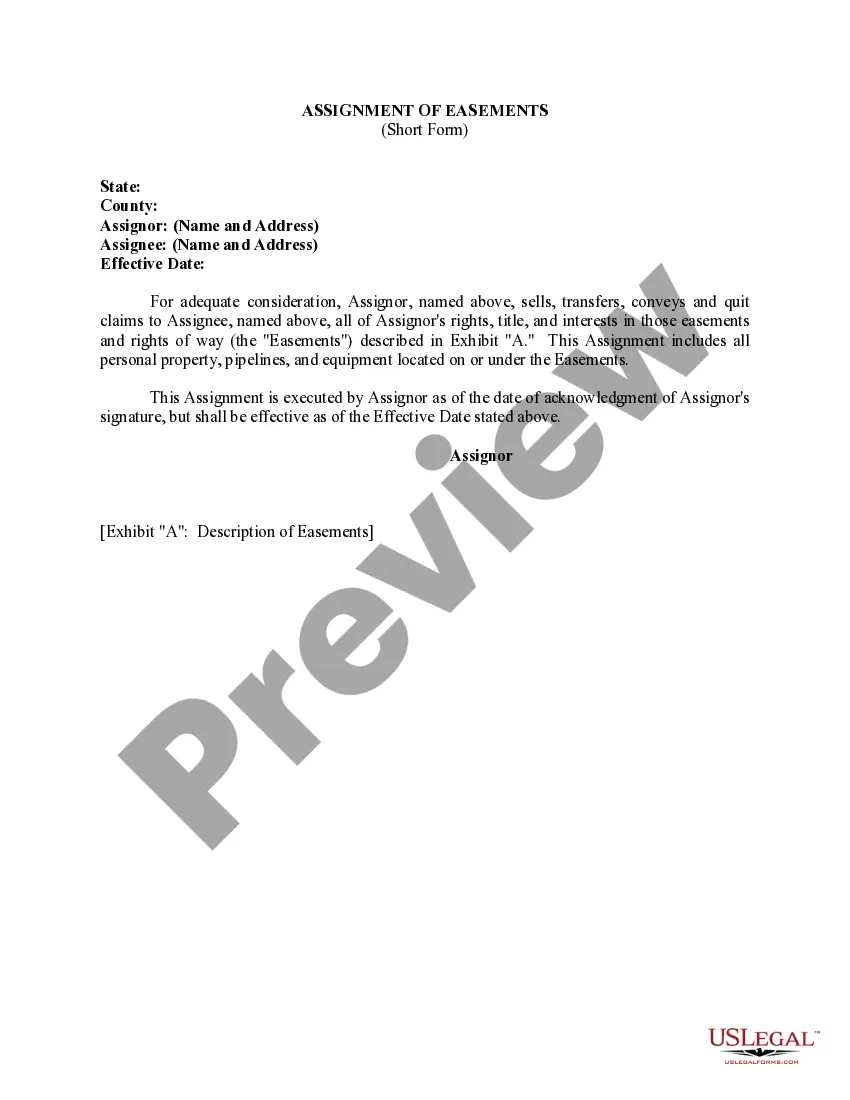

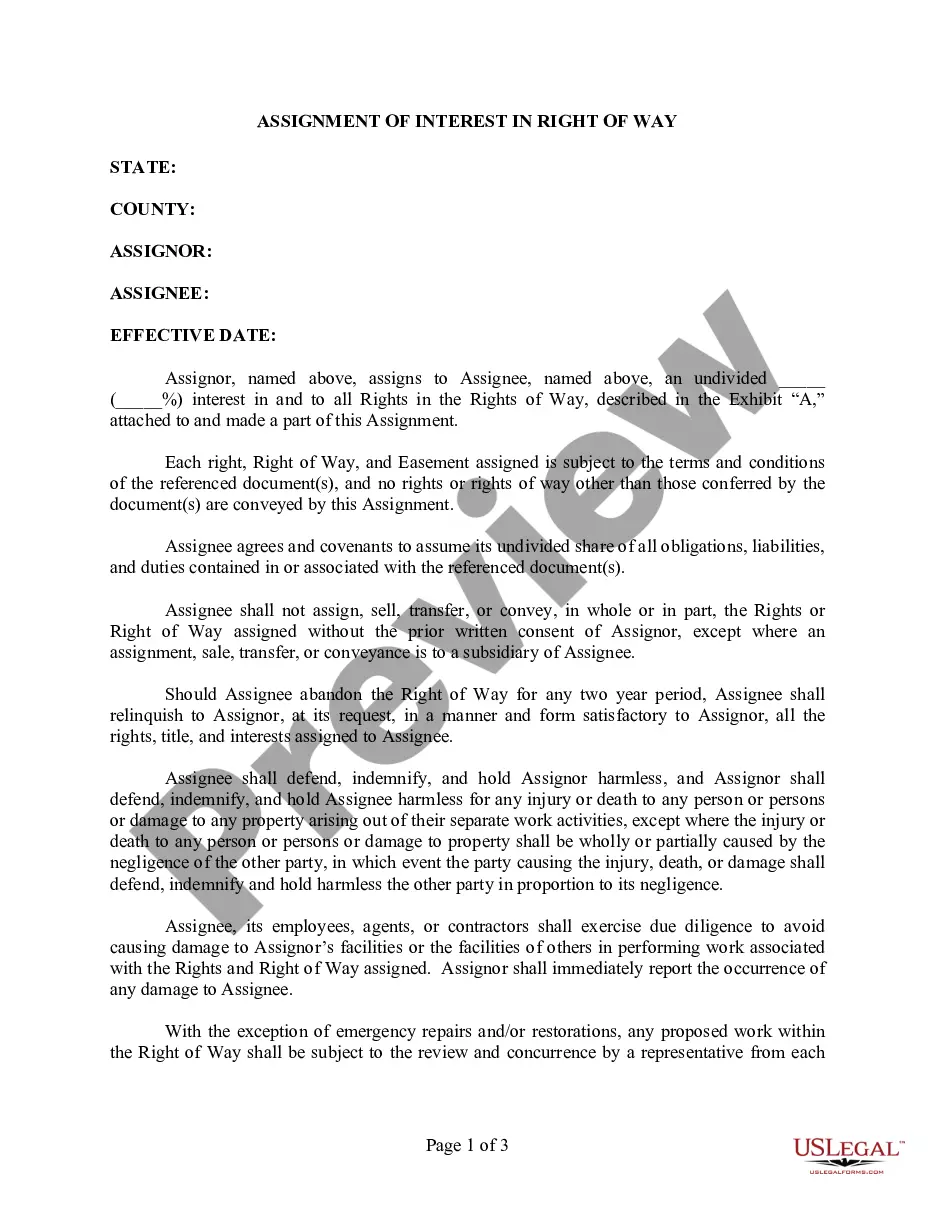

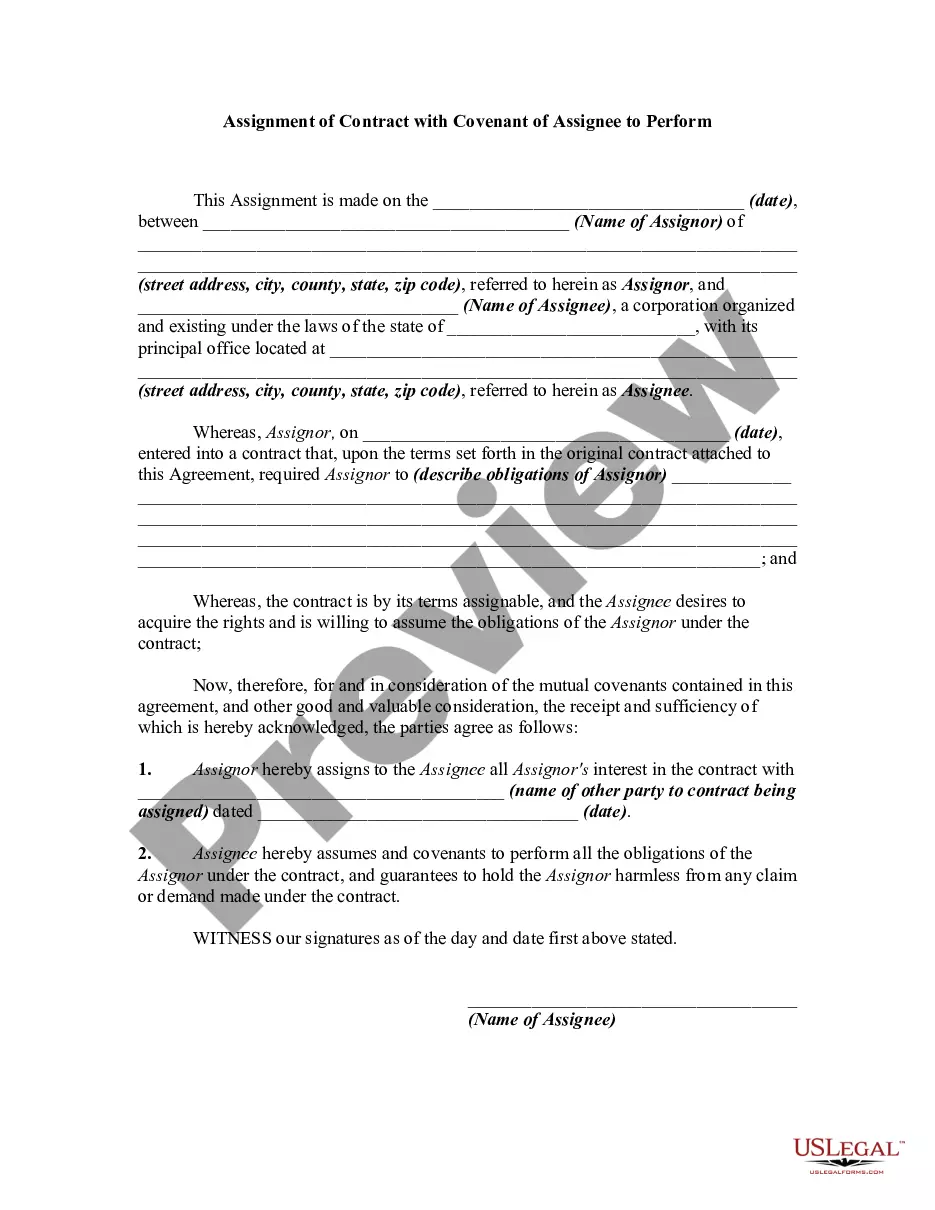

- First, ensure that you have selected the correct document web template for that state/city of your choice. See the type description to ensure you have selected the appropriate type. If readily available, utilize the Review option to appear from the document web template also.

- If you wish to find one more edition in the type, utilize the Search industry to discover the web template that meets your requirements and demands.

- When you have located the web template you need, just click Purchase now to continue.

- Choose the costs prepare you need, type your credentials, and sign up for your account on US Legal Forms.

- Full the purchase. You should use your credit card or PayPal profile to cover the legal type.

- Choose the formatting in the document and obtain it for your gadget.

- Make alterations for your document if possible. It is possible to complete, change and sign and print Pennsylvania Assignment of Record Title Interests.

Obtain and print a large number of document web templates while using US Legal Forms Internet site, that offers the most important selection of legal forms. Use professional and status-certain web templates to take on your organization or person demands.

Form popularity

FAQ

You, the buyer, must also sign and print your name on the PA title. Those signatures have to be notarized. Your Pennsylvania title transfer can be done online with eTags when you register your vehicle at the same time.

To transfer the vehicle to PA and obtain registration (plates) you will need the following: 1. ALL named parties on existing title must be present.

Out-of-state lienholders engaged in the business or practice of financing vehicles purchased by Pennsylvania residents, to be titled in Pennsylvania, must participate in the mandatory ELT Program.

You will need to provide the current title, proof of current plates, and registration renewal notice stamps on the license plate at the time of sale. You may also register your car before selling it in Pennsylvania, creating a new certificate of title at a county recorder's office once you've paid sales tax.

Yes, both parties must be present for the title to be signed and notarized by a Pennsylvania notary public who is duly licensed. The seller can assign the title to the buyer by completing the necessary sections on the back of the title certificate and signing it.

The seller's signature is required to be notarized or verified on the Pennsylvania title. The seller's signature may be required to be notarized on some out-of-state titles. The seller will need to provide the authorized PennDOT agent with proper proof of identification (PDF).

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate (including contracted-for improvements to property) transferred by deed, instrument, long-term lease or other writing. Both grantor and grantee are held jointly and severally liable for payment of the tax.

Some transactions are exempt from Transfer Tax. Some examples would be conveyances between husband and wife, parents and child, grandparent and grandchild, brothers and sisters. A one-time transfer is allowed between former spouses. Other exemptions are allowed in certain situations.