This form is used to when it has been discovered that through a drafting error the (Fraction or Percentage ) interest in the mineral estate conveyed in a Deed was stated incorrectly. It is the purpose of this instrument and the intention of Grantor and Grantee to correct this error, and to accurately state the actual mineral interest intended to be conveyed by the Deed.

Pennsylvania Correction to Mineral Deed As to Interest Conveyed

Description

How to fill out Correction To Mineral Deed As To Interest Conveyed?

Are you currently within a position where you need documents for sometimes organization or personal uses just about every day? There are a lot of legal papers web templates available online, but discovering types you can rely on is not easy. US Legal Forms offers thousands of type web templates, much like the Pennsylvania Correction to Mineral Deed As to Interest Conveyed, which can be composed to fulfill state and federal requirements.

When you are already acquainted with US Legal Forms web site and have an account, just log in. Following that, it is possible to acquire the Pennsylvania Correction to Mineral Deed As to Interest Conveyed web template.

Should you not have an profile and need to start using US Legal Forms, abide by these steps:

- Find the type you will need and ensure it is to the right metropolis/county.

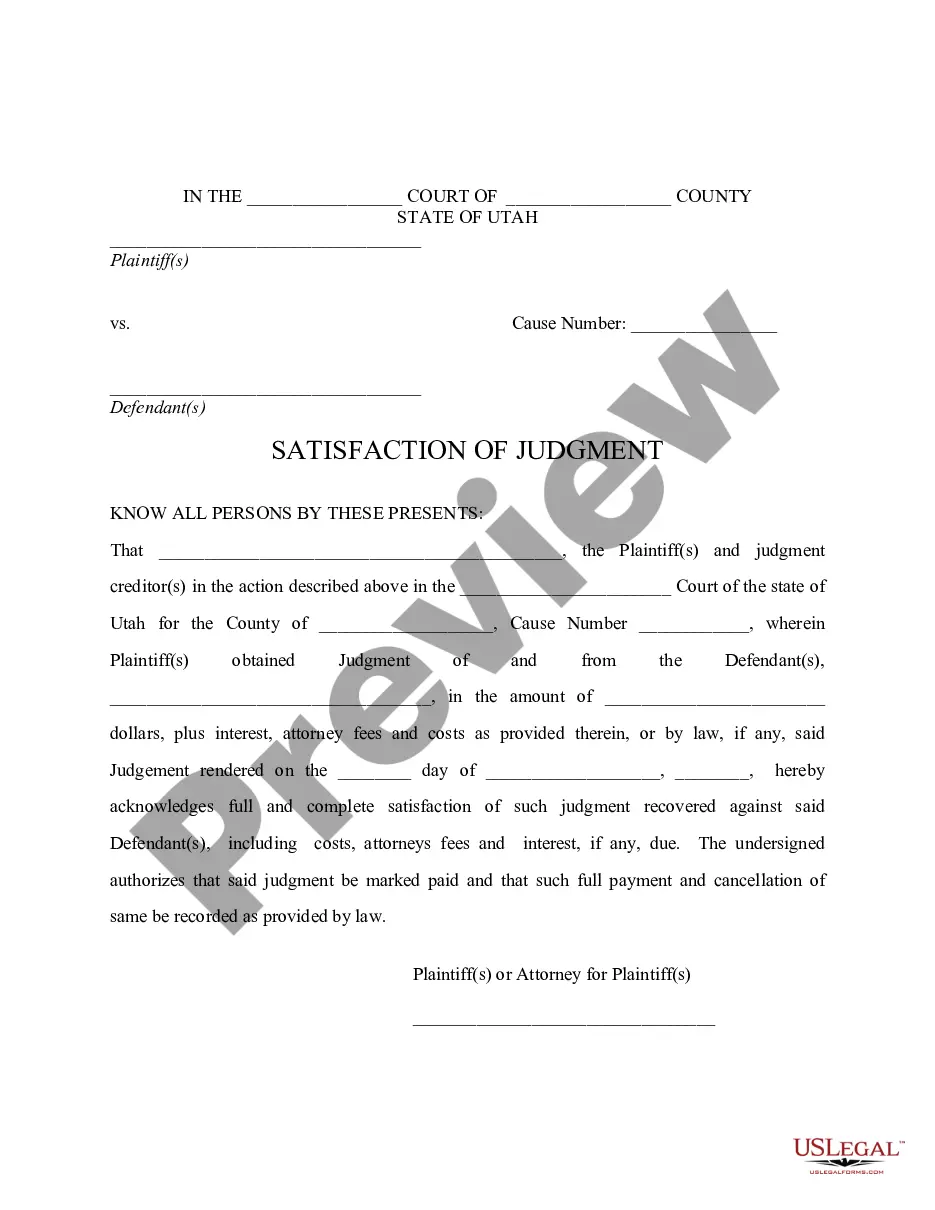

- Take advantage of the Review switch to examine the shape.

- Browse the outline to ensure that you have chosen the right type.

- In case the type is not what you are searching for, make use of the Search area to find the type that fits your needs and requirements.

- If you get the right type, just click Purchase now.

- Opt for the pricing program you desire, complete the necessary information and facts to create your account, and pay for your order making use of your PayPal or charge card.

- Select a convenient paper file format and acquire your copy.

Find all of the papers web templates you have bought in the My Forms food selection. You can aquire a further copy of Pennsylvania Correction to Mineral Deed As to Interest Conveyed any time, if required. Just select the essential type to acquire or printing the papers web template.

Use US Legal Forms, probably the most comprehensive selection of legal varieties, to save lots of some time and prevent faults. The assistance offers appropriately manufactured legal papers web templates that can be used for an array of uses. Generate an account on US Legal Forms and commence producing your way of life a little easier.

Form popularity

FAQ

How to transfer mineral rights in Pennsylvania? A copy of the deed for the site must be obtained from a local courthouse in Pennsylvania by the new owner. Verify that the deed matches the description and that the so-called mineral rights are included in the property deed.

When mineral rights are inherited, the value basis is not what the previous owner bought the land for- it is the value at the time of the inheritance. The value of the inherited mineral rights should be reassessed at the time of inheritance to reflect current market value.

After a death, assets like mineral rights often go through probate, which is a legal process to authenticate a will and distribute assets ing to it. If no will exists, probate helps determine how assets should be divided.

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

72 P.S. § 7303(a)(3). If a mineral rights estate owner sells the mineral rights, the consideration less the owner's basis in the mineral rights and other costs associated with the sale is taxable. The gain is reported on Schedule D of the PA-40.

Minerals include gold, silver, coal, oil, and gas. If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.

This can only be done by recording a new deed showing the change. Many people think they can come to our office and change the present deed on record. However, once a document or deed is recorded, it cannot be altered or changed in any way. A new deed is needed and can be prepared for you by your attorney.