Pennsylvania Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

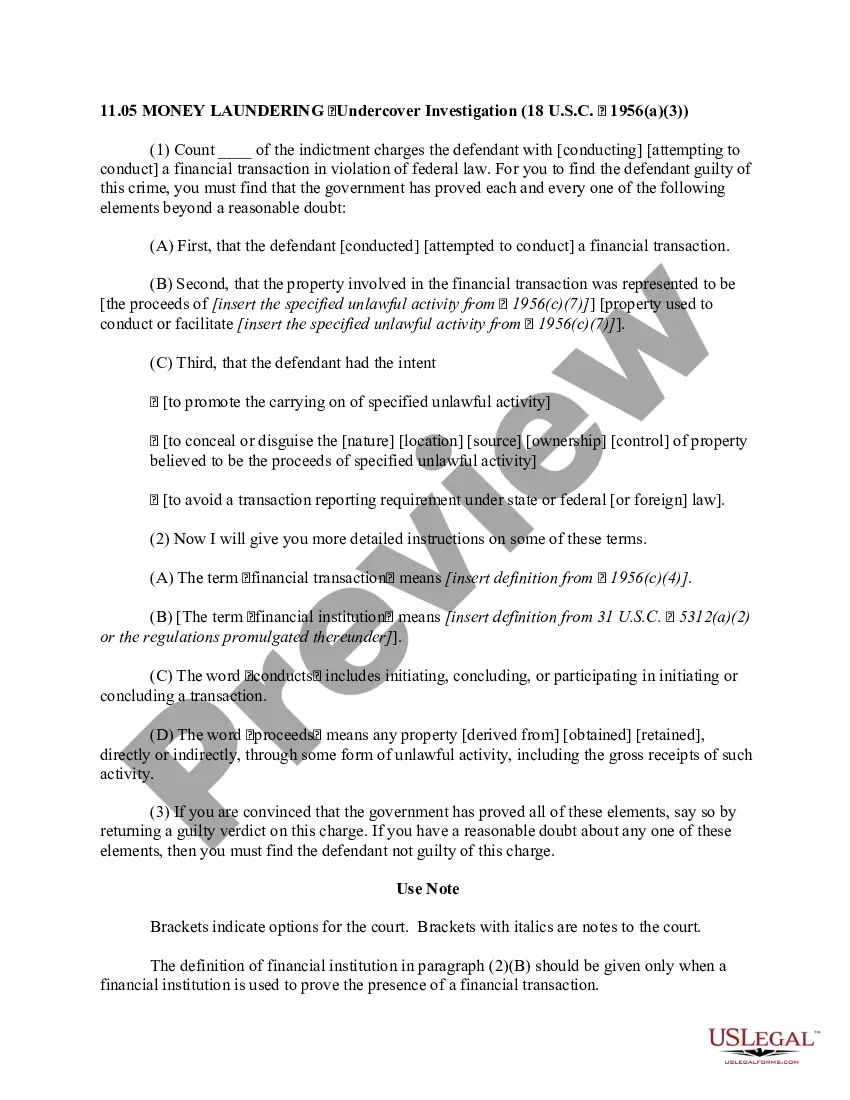

How to fill out Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

You may commit several hours on the Internet looking for the legitimate record template which fits the state and federal requirements you want. US Legal Forms provides a large number of legitimate forms that happen to be reviewed by specialists. It is simple to down load or print the Pennsylvania Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes from the services.

If you already possess a US Legal Forms profile, you are able to log in and click the Download option. Next, you are able to complete, edit, print, or signal the Pennsylvania Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes. Each legitimate record template you purchase is the one you have forever. To get yet another backup for any obtained form, proceed to the My Forms tab and click the corresponding option.

If you use the US Legal Forms internet site the very first time, follow the simple directions listed below:

- Very first, make sure that you have selected the right record template to the state/town that you pick. See the form description to make sure you have chosen the appropriate form. If accessible, use the Review option to check through the record template also.

- If you wish to find yet another variation from the form, use the Search discipline to find the template that meets your needs and requirements.

- Upon having found the template you want, click on Get now to carry on.

- Find the costs plan you want, enter your accreditations, and sign up for your account on US Legal Forms.

- Complete the purchase. You should use your credit card or PayPal profile to fund the legitimate form.

- Find the formatting from the record and down load it to your device.

- Make changes to your record if required. You may complete, edit and signal and print Pennsylvania Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes.

Download and print a large number of record layouts while using US Legal Forms Internet site, that offers the biggest collection of legitimate forms. Use skilled and express-specific layouts to take on your organization or personal needs.

Form popularity

FAQ

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

In general, beneficiaries do have the proper to request data about the estate, inclusive of financial institution statements.

At the end, the Executor can end the estate in two ways: (1) an informal settlement providing the beneficiaries an ?accounting? of the estate finances as well as a comprehensive release of the Executor; or, (2) a court filing of a formal ?Account? which provides a comprehensive overview of finances, which is ultimately ...

Beneficiaries have a right to be notified that they are entitled to an inheritance from the estate. It is up to the executor to decide when is an appropriate time to inform the beneficiaries. Often executors will inform beneficiaries at the beginning of the administration of the estate.

What is probate? Probate is when the court supervises the processes that transfer legal title of property from the estate of the person who has died (the "decedent") to his or her beneficiaries.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.