Pennsylvania Affidavit of Heirship for Real Property

Description

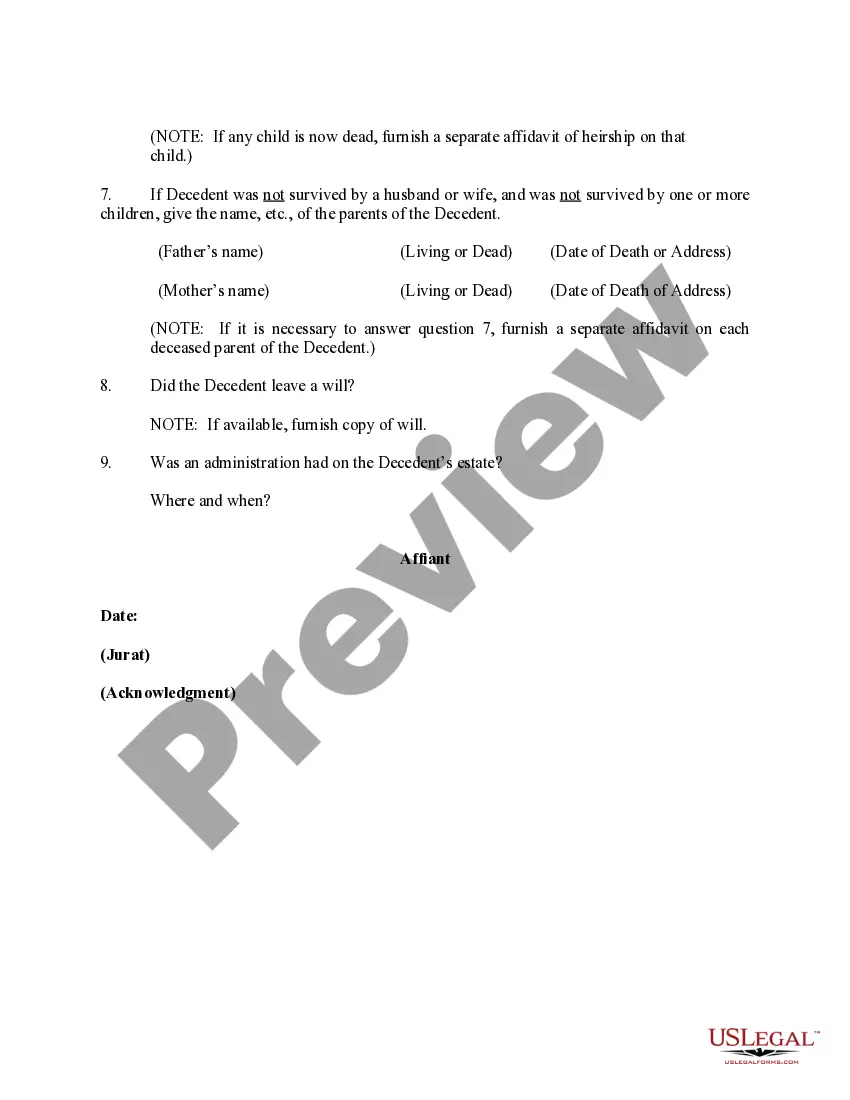

How to fill out Affidavit Of Heirship For Real Property?

US Legal Forms - one of many most significant libraries of authorized forms in the USA - provides a wide array of authorized file web templates you can download or printing. Making use of the web site, you may get a large number of forms for business and individual functions, categorized by types, claims, or keywords.You will discover the newest variations of forms just like the Pennsylvania Affidavit of Heirship for Real Property in seconds.

If you already have a subscription, log in and download Pennsylvania Affidavit of Heirship for Real Property through the US Legal Forms catalogue. The Obtain switch can look on each and every type you perspective. You get access to all in the past delivered electronically forms in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, listed below are easy guidelines to help you started out:

- Ensure you have chosen the right type for the city/state. Go through the Review switch to examine the form`s content material. Look at the type information to ensure that you have chosen the appropriate type.

- When the type does not fit your needs, use the Research area at the top of the screen to obtain the one who does.

- If you are satisfied with the shape, confirm your decision by clicking the Purchase now switch. Then, opt for the costs prepare you favor and provide your references to register to have an accounts.

- Method the deal. Make use of your credit card or PayPal accounts to finish the deal.

- Find the format and download the shape in your device.

- Make changes. Fill out, edit and printing and indication the delivered electronically Pennsylvania Affidavit of Heirship for Real Property.

Every template you added to your account does not have an expiration time and it is the one you have for a long time. So, in order to download or printing an additional backup, just go to the My Forms area and click on in the type you want.

Obtain access to the Pennsylvania Affidavit of Heirship for Real Property with US Legal Forms, probably the most extensive catalogue of authorized file web templates. Use a large number of specialist and condition-specific web templates that meet your small business or individual demands and needs.

Form popularity

FAQ

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.

An affidavit of heirship is used to transfer personal property and/or real property written by a disinterested third party who can testify to the relationship of the surviving spouse(s) and/or heir(s).

The mailing address is: Harris County Clerk, P.O. Box 1525, Houston, TX 77251-1525.

The disinterested witnesses must be someone who knew the decedent and was familiar with the decedent's family history. The disinterested witness can be a friend of the decedent, a friend of the family, or a neighbor, but it cannot be an individual who will directly benefit from the estate financially.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

How to Fill Out Affidavit of Heirship | PDFRUN - YouTube YouTube Start of suggested clip End of suggested clip Read the clause above the signature. Lines. Once you have understood this clause. And have confirmedMoreRead the clause above the signature. Lines. Once you have understood this clause. And have confirmed the information contained in this affidavit. You may sign it a fix your signature.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.