Pennsylvania Affidavit of Heirship for House

Description

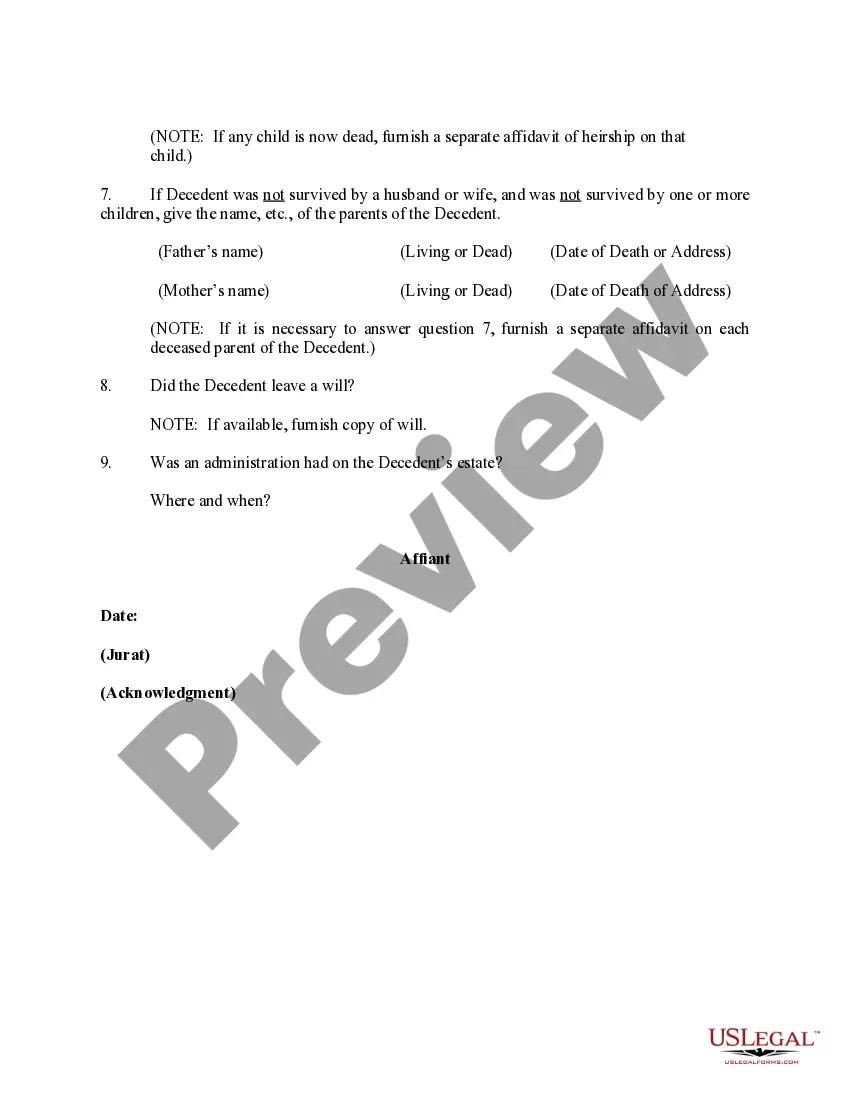

How to fill out Affidavit Of Heirship For House?

US Legal Forms - one of many most significant libraries of lawful varieties in the United States - offers an array of lawful document web templates you can acquire or printing. Utilizing the site, you can find a large number of varieties for company and person uses, categorized by groups, suggests, or key phrases.You will discover the newest versions of varieties such as the Pennsylvania Affidavit of Heirship for House within minutes.

If you already possess a subscription, log in and acquire Pennsylvania Affidavit of Heirship for House from your US Legal Forms local library. The Obtain button will show up on each and every type you view. You gain access to all in the past acquired varieties within the My Forms tab of the account.

In order to use US Legal Forms the very first time, here are easy directions to obtain started:

- Make sure you have picked the correct type for your personal town/region. Select the Review button to check the form`s content. Look at the type explanation to ensure that you have selected the correct type.

- In the event the type doesn`t fit your demands, take advantage of the Search area at the top of the display to discover the one which does.

- If you are content with the form, affirm your choice by clicking on the Acquire now button. Then, pick the pricing program you like and give your references to register to have an account.

- Process the purchase. Utilize your bank card or PayPal account to complete the purchase.

- Pick the structure and acquire the form on your system.

- Make modifications. Fill up, edit and printing and signal the acquired Pennsylvania Affidavit of Heirship for House.

Every single web template you added to your bank account does not have an expiration day and is your own for a long time. So, if you wish to acquire or printing yet another version, just go to the My Forms area and then click on the type you need.

Obtain access to the Pennsylvania Affidavit of Heirship for House with US Legal Forms, probably the most substantial local library of lawful document web templates. Use a large number of skilled and status-particular web templates that fulfill your business or person requirements and demands.

Form popularity

FAQ

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

What is an heir property owner? You are considered to be an heir property owner if you inherited your primary residence (also called a ?residence homestead?) by (1) will, (2) transfer on death deed, or (3) intestacy ? regardless of whether your ownership interest is recorded in the county's real property records.

Each county in Texas has a different filing fee, but the cost of filing an affidavit of heirship runs from $50 to $75. You will likely also need to pay a notary public to witness the document signing.

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

All beneficiaries must agree to the terms of the sale, and the purchase must be made at fair market value.

An affidavit of heirship is used to transfer personal property and/or real property written by a disinterested third party who can testify to the relationship of the surviving spouse(s) and/or heir(s).

An affidavit of heirship is a document used to give property to the heirs of a person who has died. It may be needed if the person did not have a will, or if the will was not approved within four years of their death.