This document is a policy statement that defines the way an associate will be compensated for originating client business for the firm. It provides the percentage of fees paid to the associate, along with a "cap" amount in any given year. It also addresses carry-over amounts to the next calendar year and the issue of the associate leaving the firm.

Pennsylvania Policy Statement on Compensating Associates Originating Client Business

Description

How to fill out Policy Statement On Compensating Associates Originating Client Business?

Are you currently in a situation where you will require documents for various business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones isn’t easy.

US Legal Forms offers thousands of form templates, including the Pennsylvania Policy Statement on Compensating Associates Originating Client Business, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, the largest collection of legal forms, to save time and prevent mistakes.

The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are currently familiar with the US Legal Forms website and have your account, simply Log In.

- Afterward, you can download the Pennsylvania Policy Statement on Compensating Associates Originating Client Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/area.

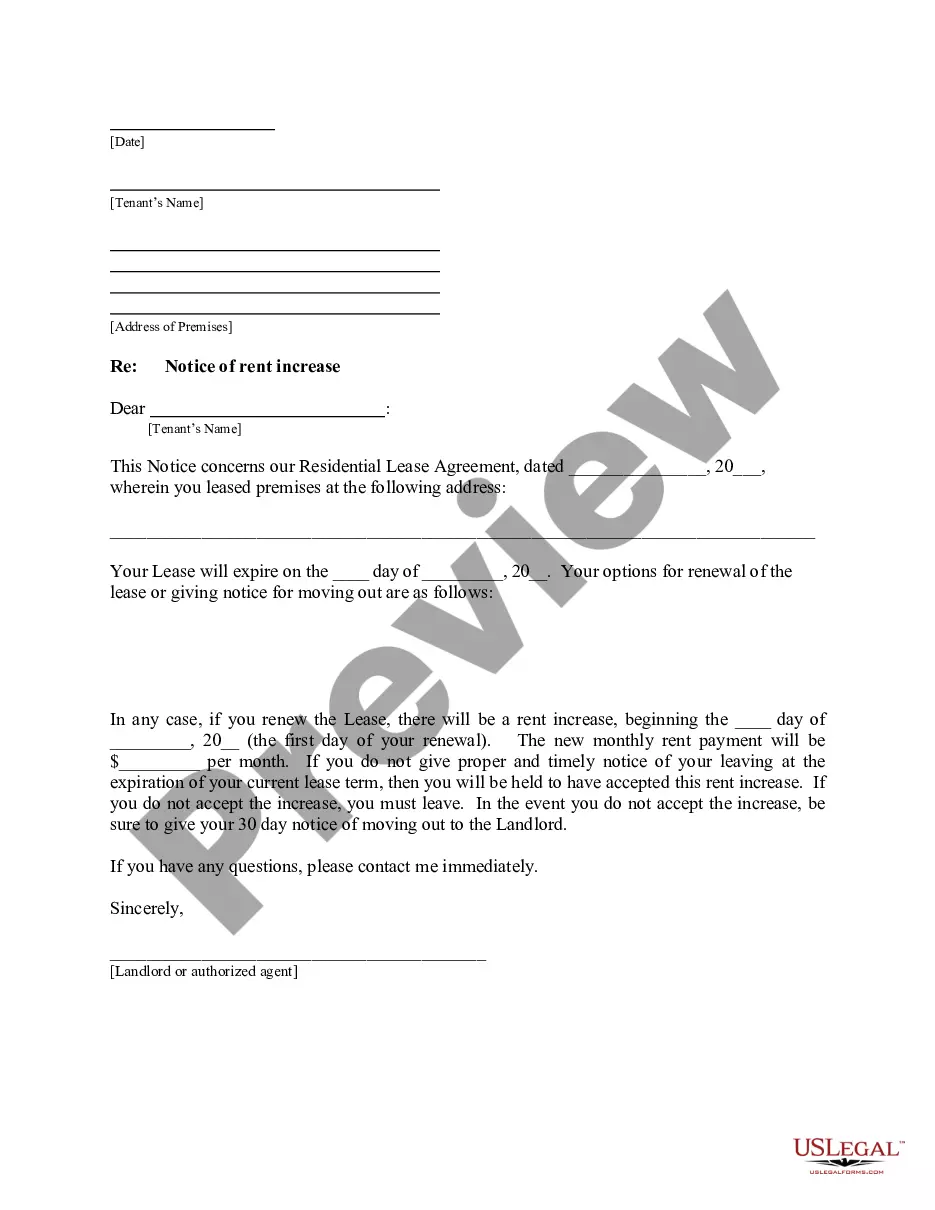

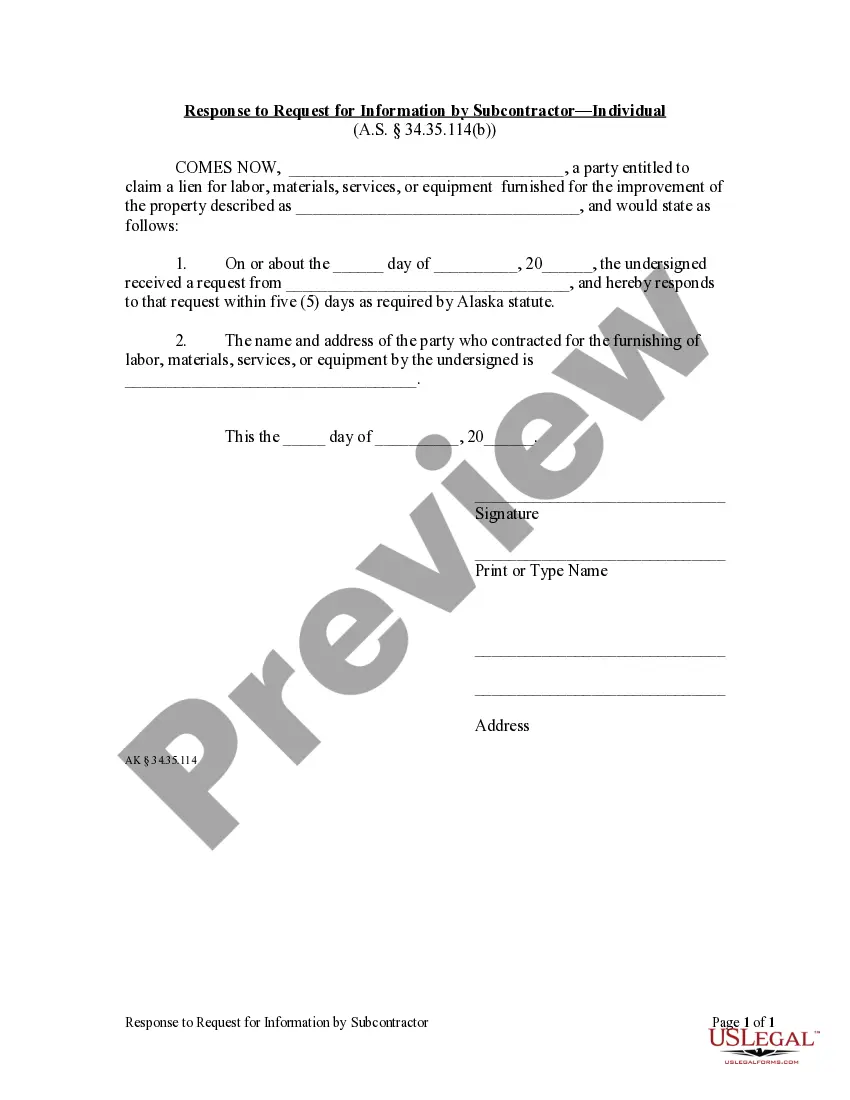

- Utilize the Preview button to examine the form.

- Check the summary to ensure that you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your needs and requirements.

- If you find the correct form, click Buy now.

- Select the pricing plan you need, complete the required information to create your account, and pay for your order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu.

- You can obtain another copy of the Pennsylvania Policy Statement on Compensating Associates Originating Client Business at any time, if needed.

- Just click on the necessary form to download or print the document template.

Form popularity

FAQ

The contract between a covered entity and a business associate is known as a Business Associate Agreement (BAA). This contract details the permitted uses and disclosures of PHI, as well as the responsibilities of the business associate to protect that information. It is a critical component of the Pennsylvania Policy Statement on Compensating Associates Originating Client Business. With uslegalforms, you can easily access templates to create a BAA that meets your specific requirements.

To do business, a business associate and covered entity must have a signed Business Associate Agreement (BAA) in place. This agreement outlines the terms under which the business associate can handle PHI and details the liabilities of both parties. It is crucial for compliance with the Pennsylvania Policy Statement on Compensating Associates Originating Client Business. Using resources like uslegalforms can help streamline the creation of this important document.

When a business associate experiences a HIPAA breach, it must notify the covered entity immediately. They are responsible for investigating the breach, mitigating damage, and reporting findings to the affected parties. This aligns with the expectations set forth in the Pennsylvania Policy Statement on Compensating Associates Originating Client Business. Ensuring you have a clear response plan in place can help manage such situations effectively.

In Pennsylvania, any business entity—including partnerships, corporations, and limited liability companies—must register to conduct business within the state. This registration ensures compliance with state laws and regulations, including those outlined in the Pennsylvania Policy Statement on Compensating Associates Originating Client Business. Engaging with uslegalforms can simplify the registration process by providing the necessary forms and guidance.

Yes, business associates are covered under HIPAA regulations. They must comply with the same privacy and security standards that apply to covered entities. This compliance ensures that sensitive health information remains protected, aligning with the Pennsylvania Policy Statement on Compensating Associates Originating Client Business. Understanding these responsibilities is crucial for any business associate working with healthcare providers.

A required document between a covered entity and a business associate is a Business Associate Agreement (BAA). This agreement outlines the responsibilities and obligations of both parties regarding the handling of protected health information (PHI). It's essential for compliance with the Pennsylvania Policy Statement on Compensating Associates Originating Client Business. Utilizing platforms like uslegalforms can help you draft a robust BAA tailored to your needs.

Certain individuals and organizations can be exempt from the Pennsylvania local services tax, including those with very low income or specific categories of government officials. Understanding these exemptions is important, especially as they relate to the Pennsylvania Policy Statement on Compensating Associates Originating Client Business, which may impact how client business income is reported. Our platform can help you explore your eligibility for exemptions and provide the necessary forms.

Pennsylvania does adhere to Section 163(j) of the Internal Revenue Code, which limits the deductibility of business interest expenses. This federal rule impacts how businesses, including those affected by the Pennsylvania Policy Statement on Compensating Associates Originating Client Business, manage their interest deductions. Staying informed about these regulations is crucial for accurate tax planning. You can find more insights on our platform to help you understand how this applies to your situation.

Whether a husband and wife need to file a partnership return depends on how they choose to structure their business. If they operate as a partnership, they are required to file a PA partnership return. It is essential to consider the implications of the Pennsylvania Policy Statement on Compensating Associates Originating Client Business in this decision. Our platform offers guidance on partnership structures and filing requirements, ensuring you address all necessary regulations.

The PA 65 Corporation tax return must be filed by corporations doing business in Pennsylvania. This includes entities that have income generated within the state, regardless of whether they are based elsewhere. Understanding your filing obligations is vital, especially in the context of the Pennsylvania Policy Statement on Compensating Associates Originating Client Business, as it may influence how you structure your business. You can rely on our platform for resources and assistance with your filings.