Pennsylvania Self-Employed Seamstress Services Contract

Description

How to fill out Self-Employed Seamstress Services Contract?

If you wish to finalize, download, or create authentic document formats, utilize US Legal Forms, the largest collection of authentic templates available online.

Employ the site's simple and convenient search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to access the Pennsylvania Self-Employed Seamstress Services Agreement in just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Pennsylvania Self-Employed Seamstress Services Agreement. Each legal document template you purchase is yours forever. You will have access to every form you saved in your account. Choose the My documents section and select a form to print or download again. Finalize and download, and print the Pennsylvania Self-Employed Seamstress Services Agreement with US Legal Forms. There are numerous professional and state-specific templates you can utilize for your personal or business needs.

- If you are an existing US Legal Forms user, sign in to your account and click the Acquire button to obtain the Pennsylvania Self-Employed Seamstress Services Agreement.

- You can also access forms you have previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

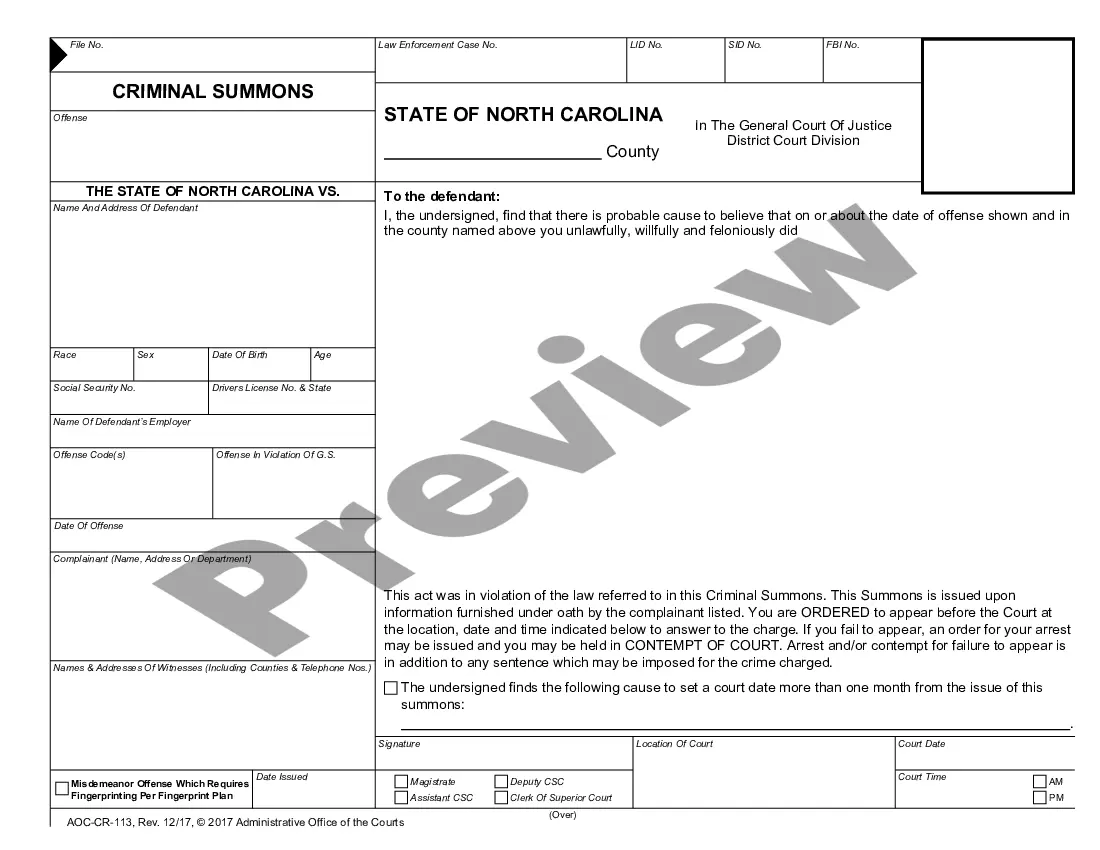

- Step 2. Use the Preview option to review the form's content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

You can certainly write your own service agreement by detailing the services to be provided, payment terms, and responsibilities of both parties. Make sure the agreement is clear and concise, reflecting the specifics of your arrangement. Using a Pennsylvania Self-Employed Seamstress Services Contract template can provide a solid framework for creating your agreement.

Yes, you can write your own legally binding contract, provided you include essential elements such as clear terms, mutual consent, and signatures from both parties. It's vital to ensure the contract adheres to local laws, such as those governing a Pennsylvania Self-Employed Seamstress Services Contract. Seeking templates online can be a helpful starting point.

Writing a self-employed contract requires outlining the specific services you will provide and the terms of compensation. Be sure to include timeframes, responsibilities, and any other relevant details. A Pennsylvania Self-Employed Seamstress Services Contract can simplify this process and ensure compliance with local regulations.

To write a simple employment contract, begin with basic information about both parties, followed by the job description and payment details. Include any necessary clauses regarding confidentiality and dispute resolution. A Pennsylvania Self-Employed Seamstress Services Contract can serve as a straightforward model for this type of agreement.

Writing a self-employment contract involves defining the services you will provide and the terms of payment. Specify the duration of the contract and any conditions for termination. Utilizing a Pennsylvania Self-Employed Seamstress Services Contract template can help streamline this process and ensure all key elements are included.

To write a contract for a 1099 employee, start by clearly outlining the scope of work and the payment terms. Include details such as deadlines, deliverables, and responsibilities. It's essential to specify that this is a Pennsylvania Self-Employed Seamstress Services Contract to ensure both parties understand the nature of the work arrangement.

Absolutely, a self-employed person can and should have a contract. This document helps define the expectations and responsibilities between you and your clients. A Pennsylvania Self-Employed Seamstress Services Contract is an excellent tool to ensure both parties understand their rights and obligations in the working relationship.

Self-employed individuals operate their own businesses, while contracted workers are typically hired to complete specific projects for clients. Self-employed workers manage their business operations, whereas contracted workers usually have less control over the work process. A Pennsylvania Self-Employed Seamstress Services Contract can clarify your role and responsibilities, regardless of which designation applies.

A contract in Pennsylvania is legally binding when it includes an offer, acceptance, consideration, and the intention to create a legal obligation. Both parties must have the capacity to enter into a contract and the terms must be clear. A Pennsylvania Self-Employed Seamstress Services Contract should meet these criteria to ensure it holds up in court.

Yes, contract work is generally considered self-employment. When you take on contracts, you operate your own business and are responsible for your taxes and insurance. Establishing a Pennsylvania Self-Employed Seamstress Services Contract can provide you with the structure and protection necessary for your independent work.