Pennsylvania Tree Surgeon Agreement - Self-Employed Independent Contractor

Description

How to fill out Tree Surgeon Agreement - Self-Employed Independent Contractor?

If you want to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Employ the site's straightforward and user-friendly search feature to locate the documents you need.

Various templates for commercial and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you find the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to locate the Pennsylvania Tree Surgeon Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to retrieve the Pennsylvania Tree Surgeon Agreement - Self-Employed Independent Contractor.

- You can also access documents you previously downloaded via the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the correct form for your specific city/state.

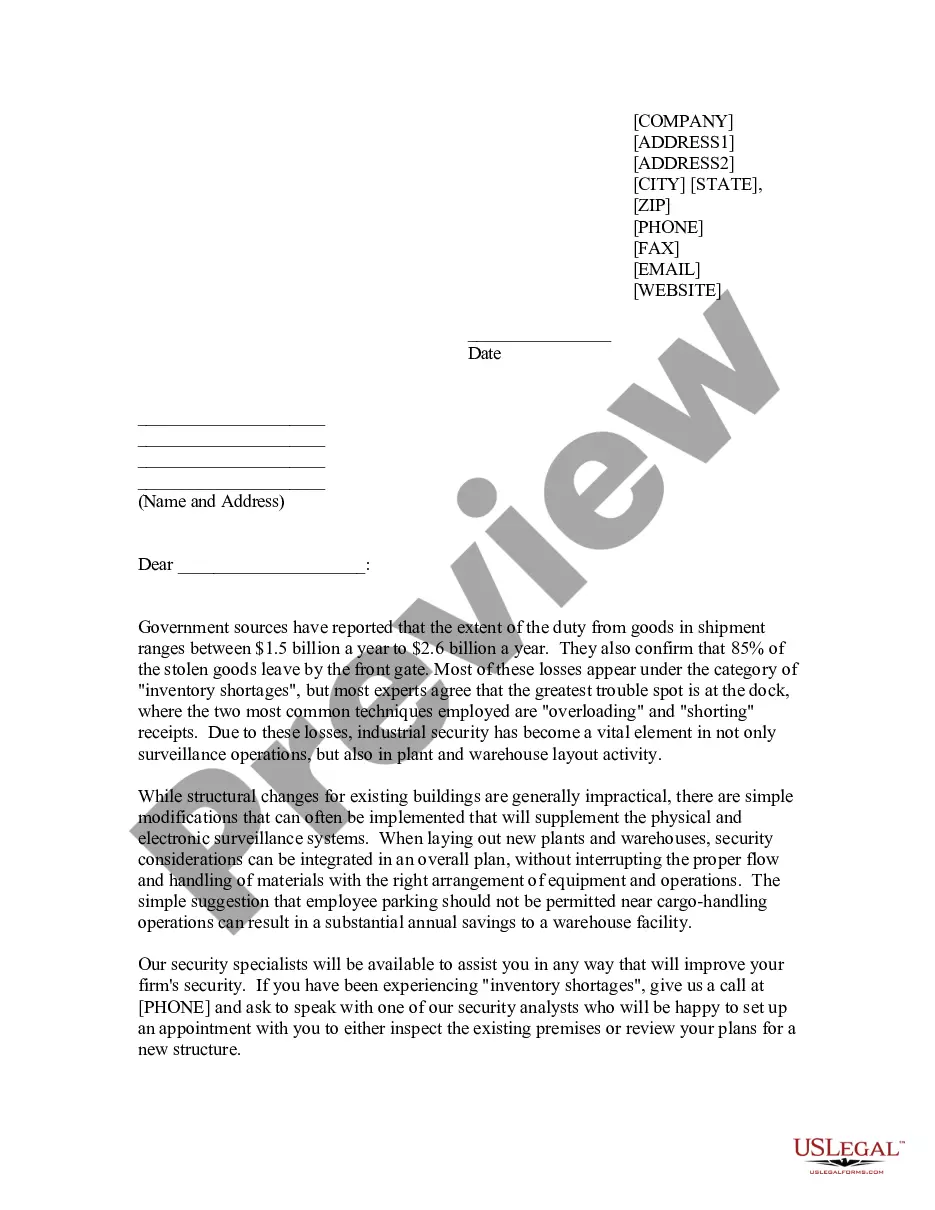

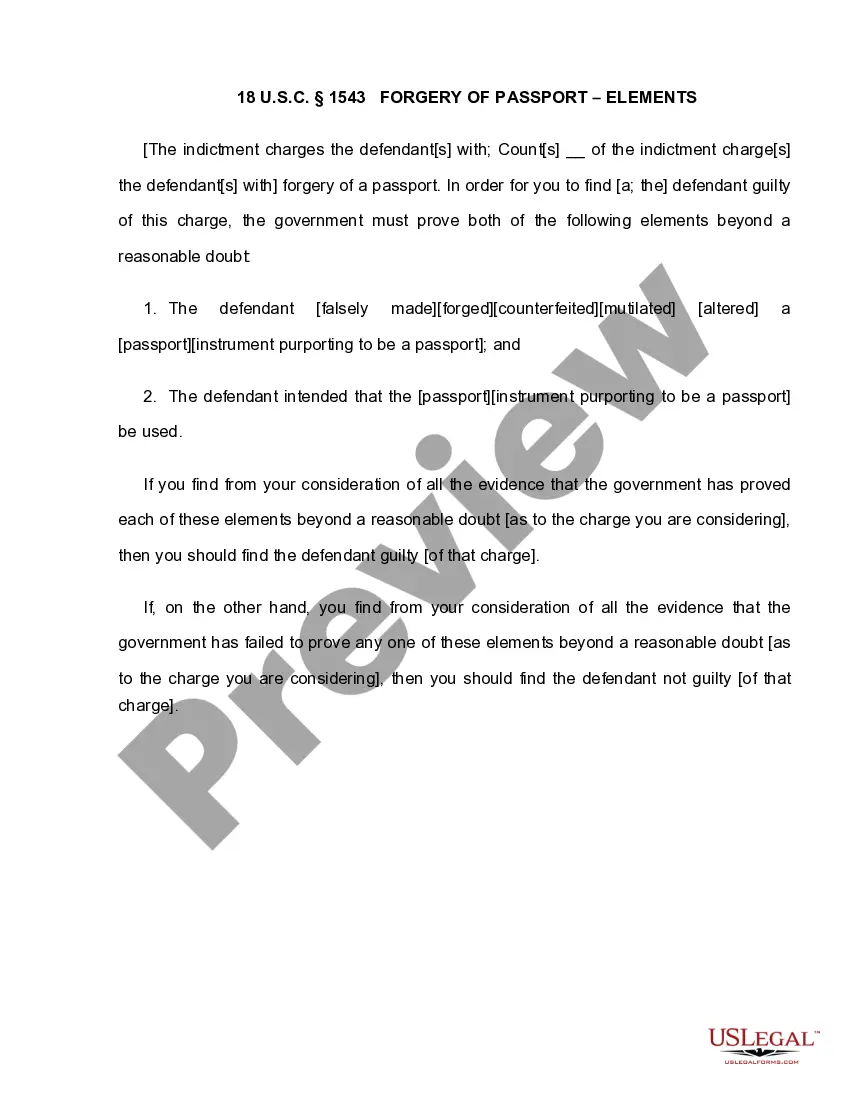

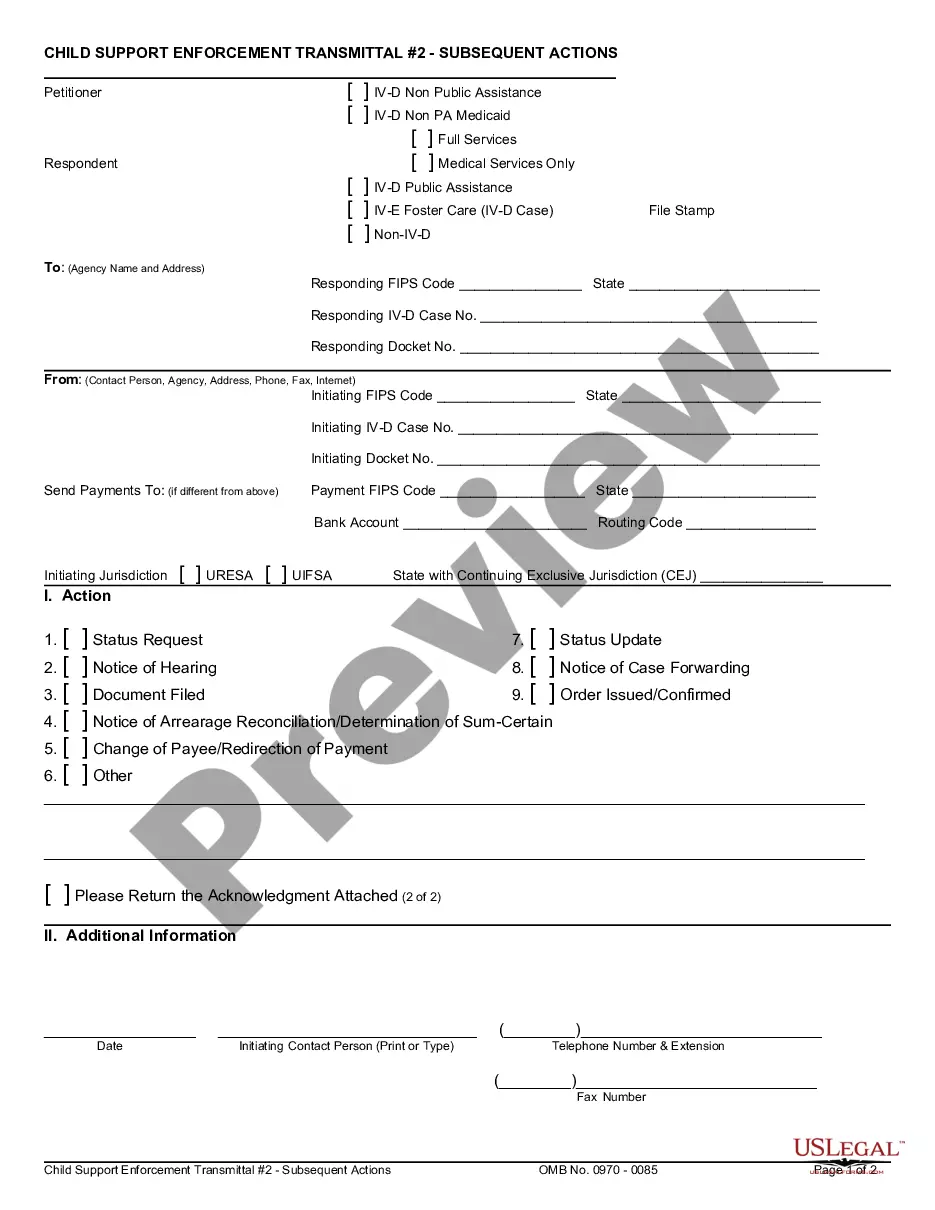

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to discover other templates in the legal form library.

Form popularity

FAQ

An independent contractor is an individual who performs or works for another individual (the principal) under an expressed or implied agreement and is one who is not under anyone's control and is independently responsible for himself and his actions unless certain cases make the person who has hired the contractor

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Indemnity Clause:Every independent contractor agreement should feature an indemnity clause. The purpose of this clause is to ensure that the independent contractor will be held liable for any damage or injury resulting from the independent contractor's work performed under the contract.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

So an employer is held vicariously liable for an independent contractor if they are negligent in performing their work, in case of strict liability, and when the employer authorizes the work to the contractor.

7 Tips for Managing Freelancers and Independent ContractorsWhat the Experts Say.Understand what they want.Set expectations.Build the relationship.Make them feel part of the team.Don't micromanage.Give feedback.Pay them well.More items...?