Pennsylvania Nursing Agreement - Self-Employed Independent Contractor

Description

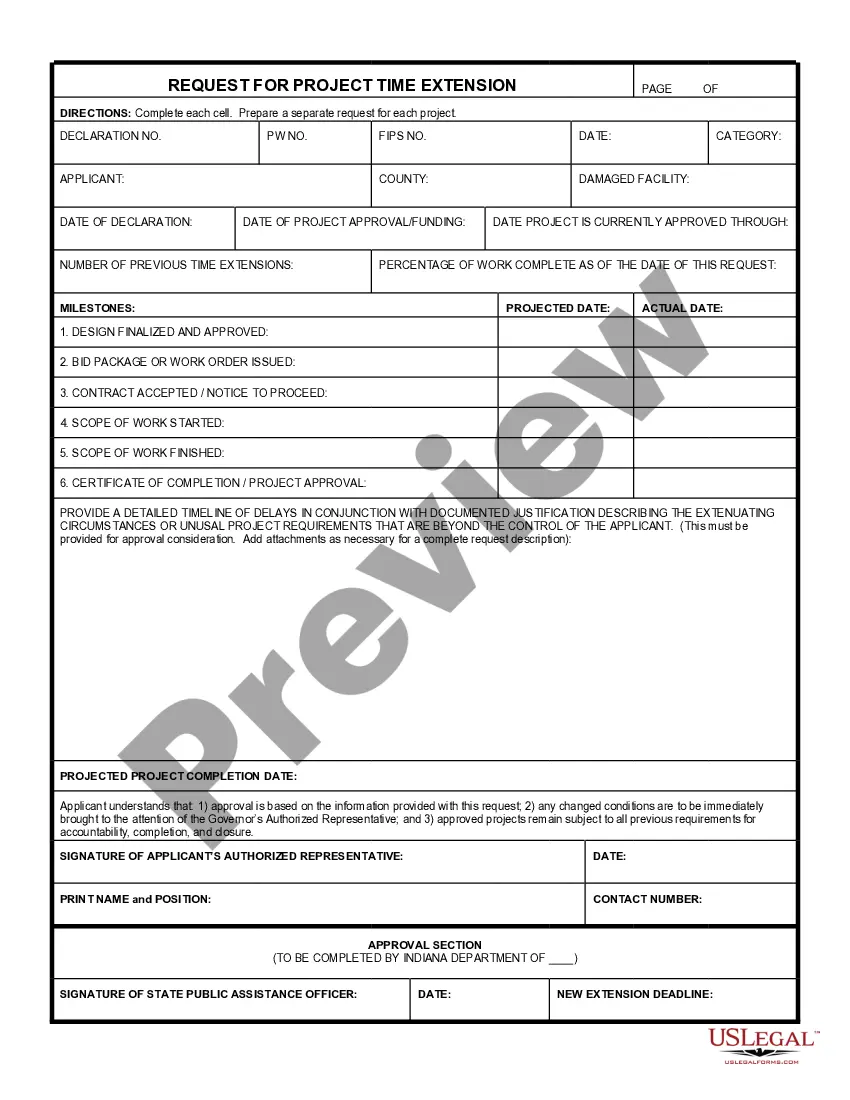

How to fill out Nursing Agreement - Self-Employed Independent Contractor?

If you desire to total, obtain, or create valid document templates, utilize US Legal Forms, the leading collection of legal forms, accessible online. Use the website's simple and efficient search to find the documents you need. Various templates for commercial and personal use are organized by categories and states, or keywords. Employ US Legal Forms to acquire the Pennsylvania Nursing Agreement - Self-Employed Independent Contractor in just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and click on the Download button to obtain the Pennsylvania Nursing Agreement - Self-Employed Independent Contractor. You can also access forms you previously obtained in the My documents section of your account.

If you are using US Legal Forms for the first time, refer to the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form's content. Remember to check the description. Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form format. Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for the account. Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finish the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Pennsylvania Nursing Agreement - Self-Employed Independent Contractor.

- Each legal document format you acquire is yours indefinitely.

- You will have access to every form you obtained in your account.

- Click the My documents section and select a form to print or download again.

- Compete and acquire, and print the Pennsylvania Nursing Agreement - Self-Employed Independent Contractor with US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

Yes, an RN can absolutely be self-employed. By creating a Pennsylvania Nursing Agreement - Self-Employed Independent Contractor, you can set your own hours, choose your clients, and manage your practice. This path offers the potential for increased earnings and job satisfaction. Additionally, you can access resources from platforms like uslegalforms to help you navigate the legal aspects of being self-employed.

Yes, nurses can be classified as 1099 workers when they operate as independent contractors. This classification allows nurses to work on a contractual basis without being tied to a single employer. By establishing a Pennsylvania Nursing Agreement - Self-Employed Independent Contractor, you can benefit from flexibility in choosing your assignments while managing your own tax responsibilities. This option is ideal for nurses seeking more control over their careers.

Nurses typically receive either a W-2 or a 1099 form, depending on their employment status. If you work as an employee, you will get a W-2, which reflects your earnings and taxes withheld. However, if you are an independent contractor operating under a Pennsylvania Nursing Agreement - Self-Employed Independent Contractor, you will receive a 1099 form, indicating your earnings without tax deductions. Understanding which form applies to you is essential for accurate tax reporting.

Yes, an independent contractor is considered self-employed. This classification means you operate your own business and are responsible for your own taxes and benefits. When working under a Pennsylvania Nursing Agreement - Self-Employed Independent Contractor, you manage your schedule and clients, providing you with more flexibility. However, you must also handle your own expenses and insurance.

To work as an independent contractor as a nurse, you need to establish a Pennsylvania Nursing Agreement - Self-Employed Independent Contractor. This agreement outlines your responsibilities, payment terms, and work conditions. You will also need to obtain any required licenses and certifications specific to your nursing specialty. Finally, ensure that you are familiar with tax obligations related to independent contracting.

To become a 1099 nurse contractor, you need to establish yourself as an independent contractor in Pennsylvania. Start by obtaining the necessary licenses and certifications required for nursing practice. Then, seek opportunities with healthcare facilities that hire independent contractors. Finally, ensure you have a Pennsylvania Nursing Agreement - Self-Employed Independent Contractor in place to protect your rights and outline your work terms. This will provide clarity and security as you navigate your new role.

Creating an independent contractor agreement involves several key steps. First, clearly define the services to be provided, along with payment terms and deadlines. Next, include clauses that address confidentiality, liability, and termination. For an efficient process, consider using platforms like uslegalforms, which offer templates specifically designed for Pennsylvania Nursing Agreements - Self-Employed Independent Contractors. This can streamline the documentation process and ensure compliance with state laws.

An independent contractor agreement in Pennsylvania outlines the terms between a client and a self-employed individual. This document clarifies the work scope, payment terms, and responsibilities of each party. Specifically, for nurses, a Pennsylvania Nursing Agreement - Self-Employed Independent Contractor ensures that both the nurse and the healthcare facility understand their roles and obligations. This agreement protects both parties while fostering a professional working relationship.

To fill out an independent contractor agreement, start by clearly identifying the contracting parties and the scope of work. Specify payment terms, including rate and method of payment, and include any relevant timelines. It is beneficial to reference the Pennsylvania Nursing Agreement - Self-Employed Independent Contractor to guide you through the specific requirements, ensuring you create a legally sound document.

Yes, a nurse can work as a 1099 employee, often referred to as an independent contractor. This arrangement allows nurses to have more flexibility in their work schedules and the ability to choose their clients. However, it is essential to have a solid understanding of the Pennsylvania Nursing Agreement - Self-Employed Independent Contractor to ensure compliance with regulations and to protect your rights.