Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a vast array of legal document templates that you can download or print.

By using the website, you will find thousands of documents for both business and personal purposes, organized by categories, claims, or keywords. You can access the most recent versions of documents like the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form in moments.

If you already have a subscription, Log In and retrieve the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form from your US Legal Forms library. The Download option will be available for every document you view. You can access all previously saved documents in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you need. Access the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form with US Legal Forms, the largest repository of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the correct document for your city/region.

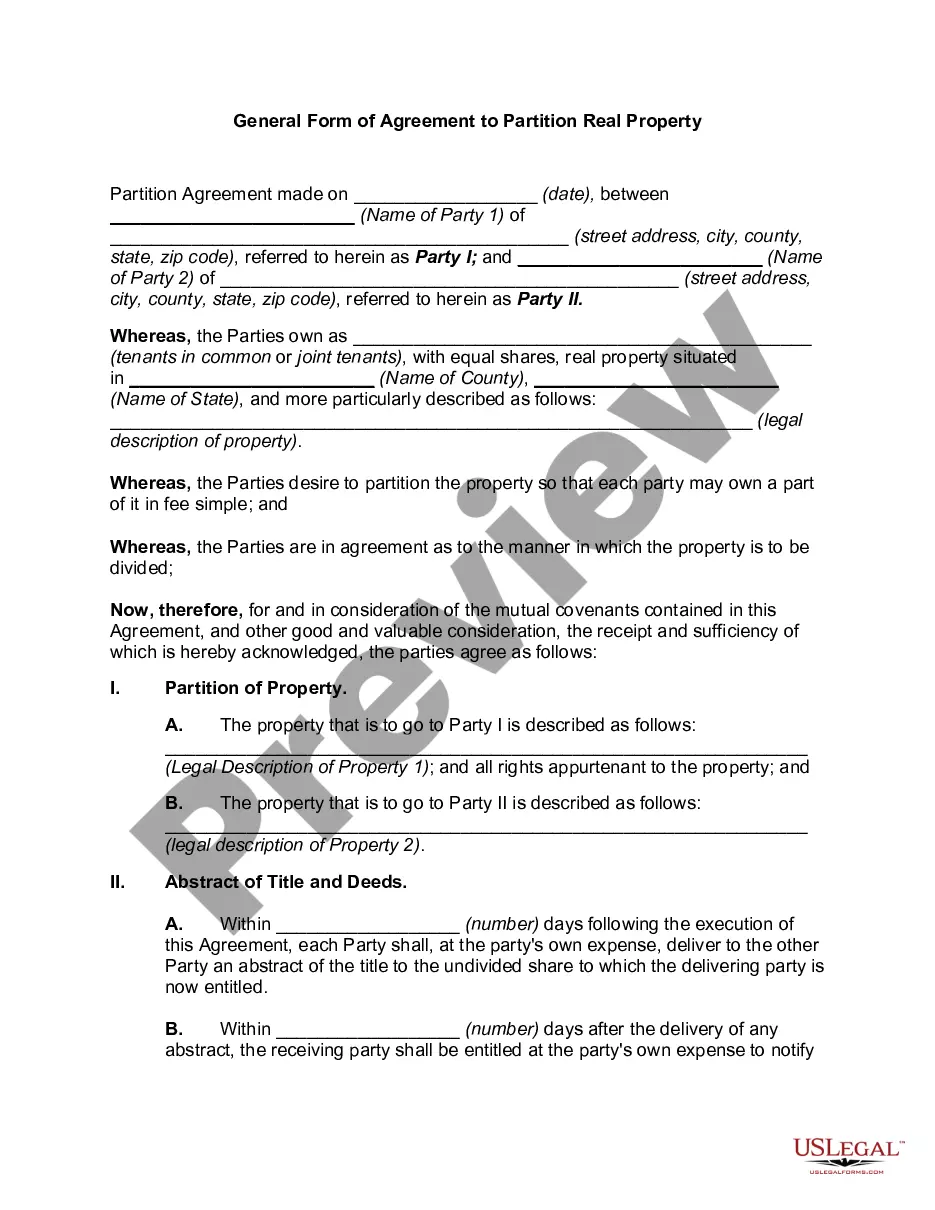

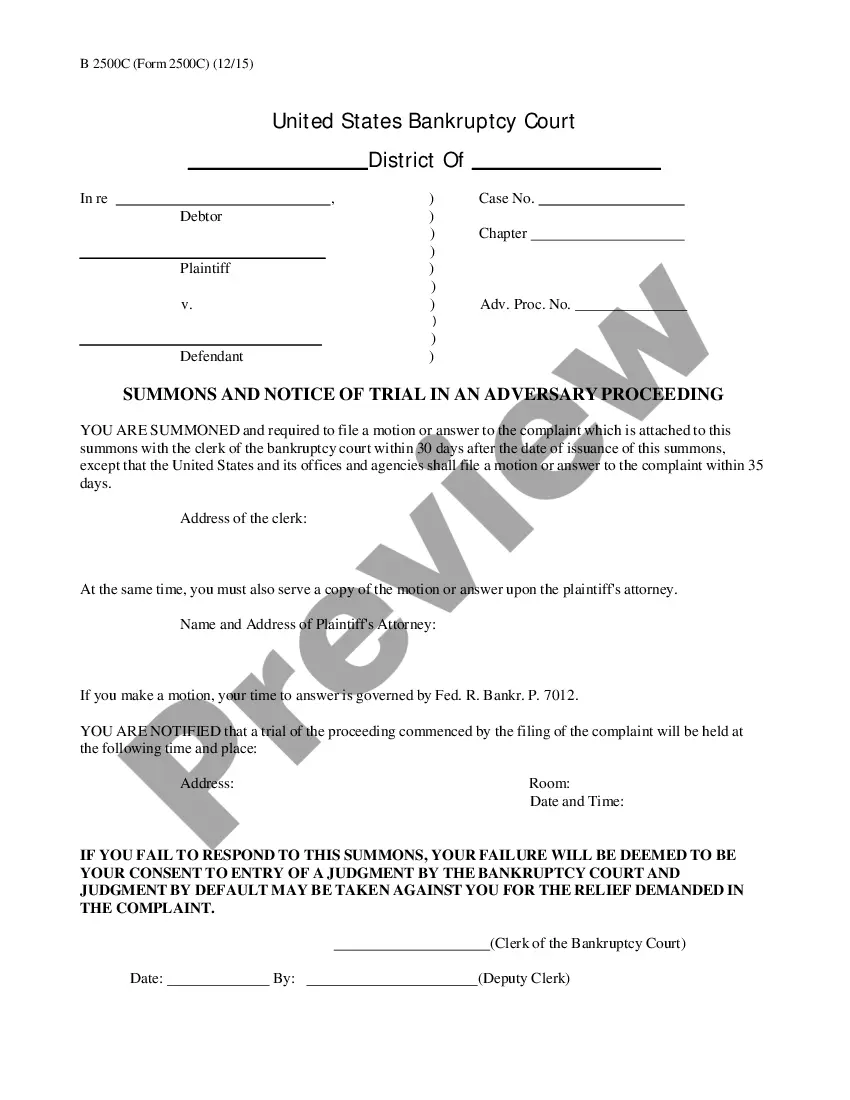

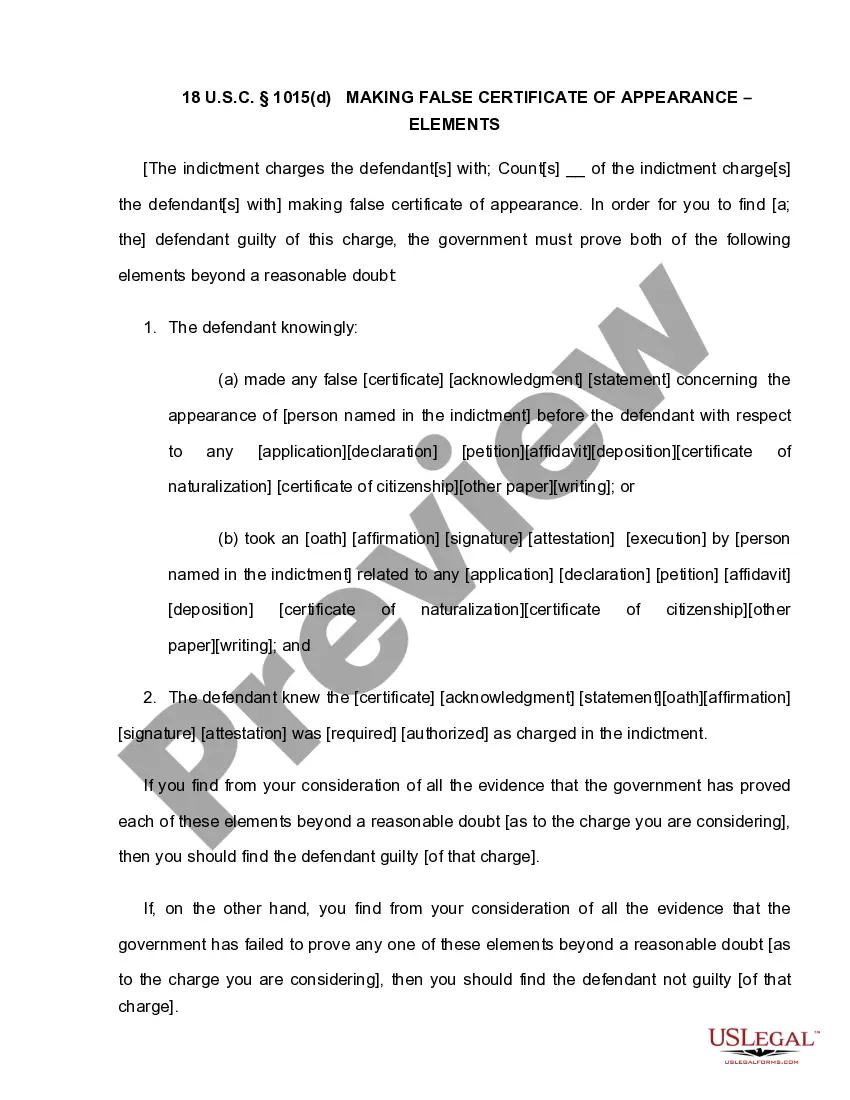

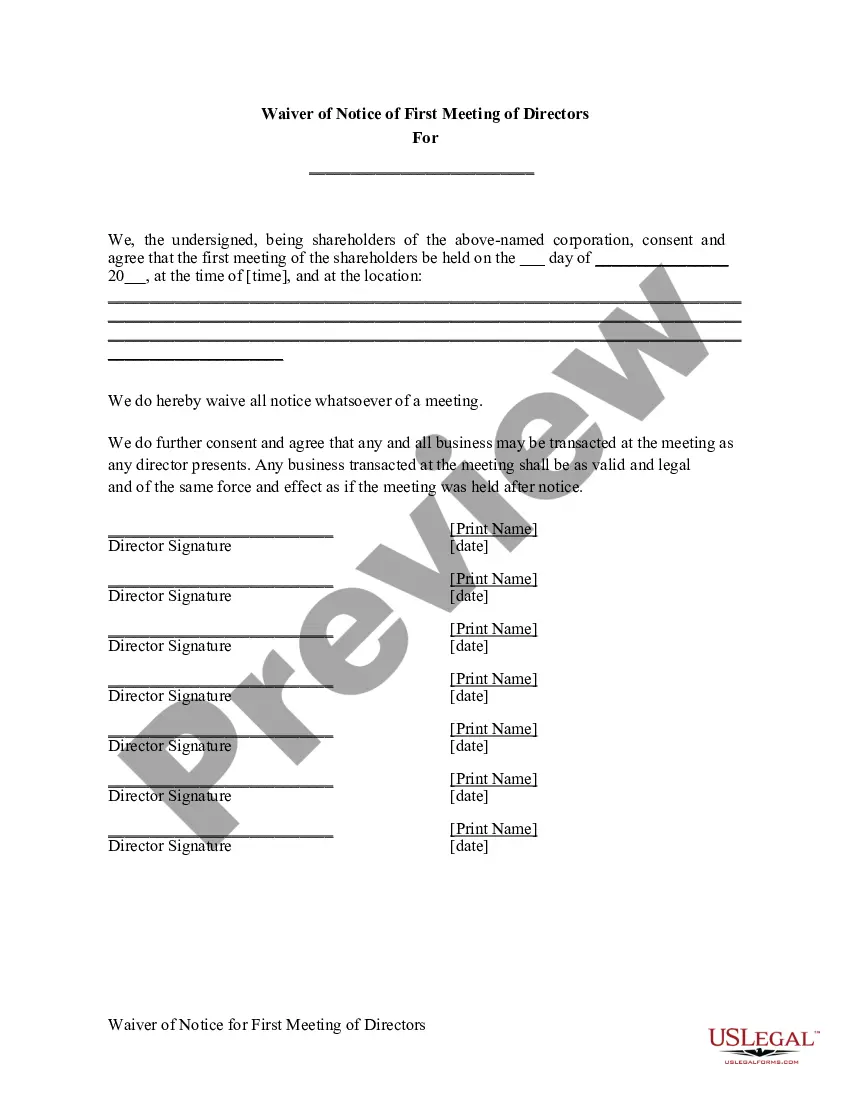

- Click on the Preview option to review the document's details.

- Check the document information to confirm you have chosen the right document.

- If the document does not meet your needs, use the Lookup field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Filling out an independent contractor form starts with providing your basic information, such as your name and contact details. Specify the services you offer and any pertinent business details. Don’t forget to refer to the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form to affirm your status, thus guiding you through the process seamlessly.

Filling out a declaration of independent contractor status form begins with your personal information, including your name and address. Next, describe the services you provide and affirm that you meet the criteria for independent contractor status. This ties into the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form, which helps clarify your non-employee status.

To create an independent contractor agreement, start by including your name, the client’s name, and the scope of work. Clearly outline payment terms, deadlines, and confidentiality clauses. You can enhance your agreement with the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form to solidify your independent status, ensuring both parties understand their responsibilities.

When starting as an independent contractor, you should complete several key forms. Primarily, you will need the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form to establish your status. Additionally, you may need a W-9 form to provide your taxpayer identification number to clients. Having these documents in order is essential for smooth business transactions.

The choice between 1099 and W-9 depends on the context; a W-9 form provides the necessary taxpayer details from the contractor while the 1099 form is for reporting payments to the IRS. If you hire an independent contractor, you'll have them complete the W-9 and then issue a 1099 at year-end if payments exceed $600. Using the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form alongside these documents streamlines the reporting process.

To hire an independent contractor, you will need a signed contract that specifies the nature of the work and payment details. Additionally, including the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form verifies their classification as an independent worker. Proper documentation fosters transparency and protects both you and the contractor throughout your working relationship.

Typically, independent contractors fill out the W-9 form and may also need specific contractual agreements related to their work. In Pennsylvania, it's also advisable for contractors to complete the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form to clarify their roles. These forms help streamline the hiring process and ensure all legal and tax obligations are met.

Yes, an independent contractor is generally considered self-employed. This status means they operate their own business and control their work processes. Understanding this distinction is crucial when utilizing the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form, as it solidifies the contractor’s independent standing under state law.

Independent contractors typically need to fill out a W-9 form to provide their taxpayer information and to report their income. However, to establish their employment status, it’s beneficial to use the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form. This form solidifies arrangements and clarifies both parties’ expectations for the work.

Independent contractors must meet specific legal criteria, including the ability to control how they complete their work and the provision of their tools for the job. In Pennsylvania, using the Pennsylvania Self-Employed Independent Contractor Consideration For Hire Form helps affirm these criteria are met. Understanding these requirements helps you properly classify your workers and avoid potential legal issues.