Pennsylvania Self-Employed Independent Contractor Construction Worker Contract

Description

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

Are you presently in a situation where you need documentation for either business or personal reasons almost every time.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms provides thousands of form templates, such as the Pennsylvania Self-Employed Independent Contractor Construction Worker Contract, which can be tailored to meet state and federal requirements.

Select the pricing plan you want, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can access the Pennsylvania Self-Employed Independent Contractor Construction Worker Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/region.

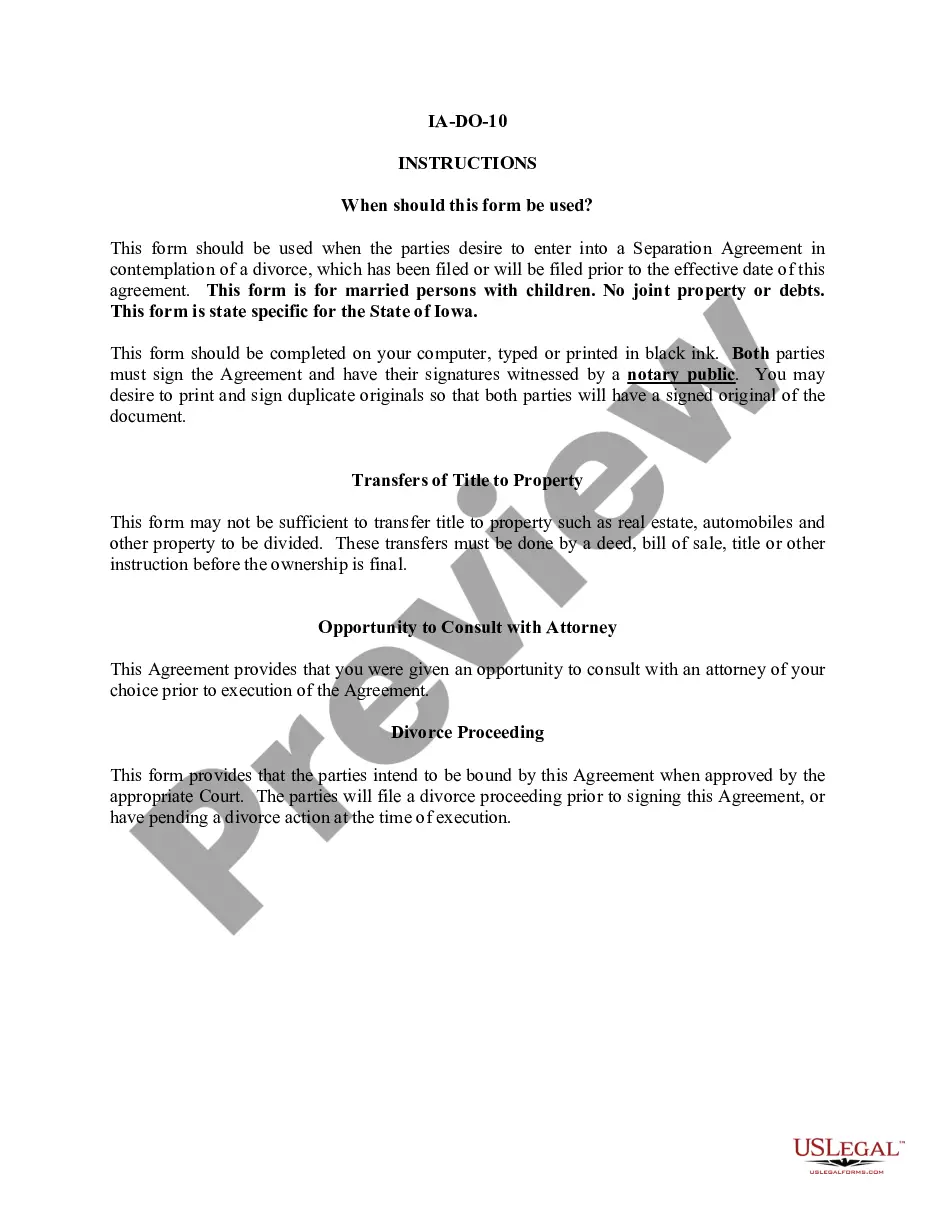

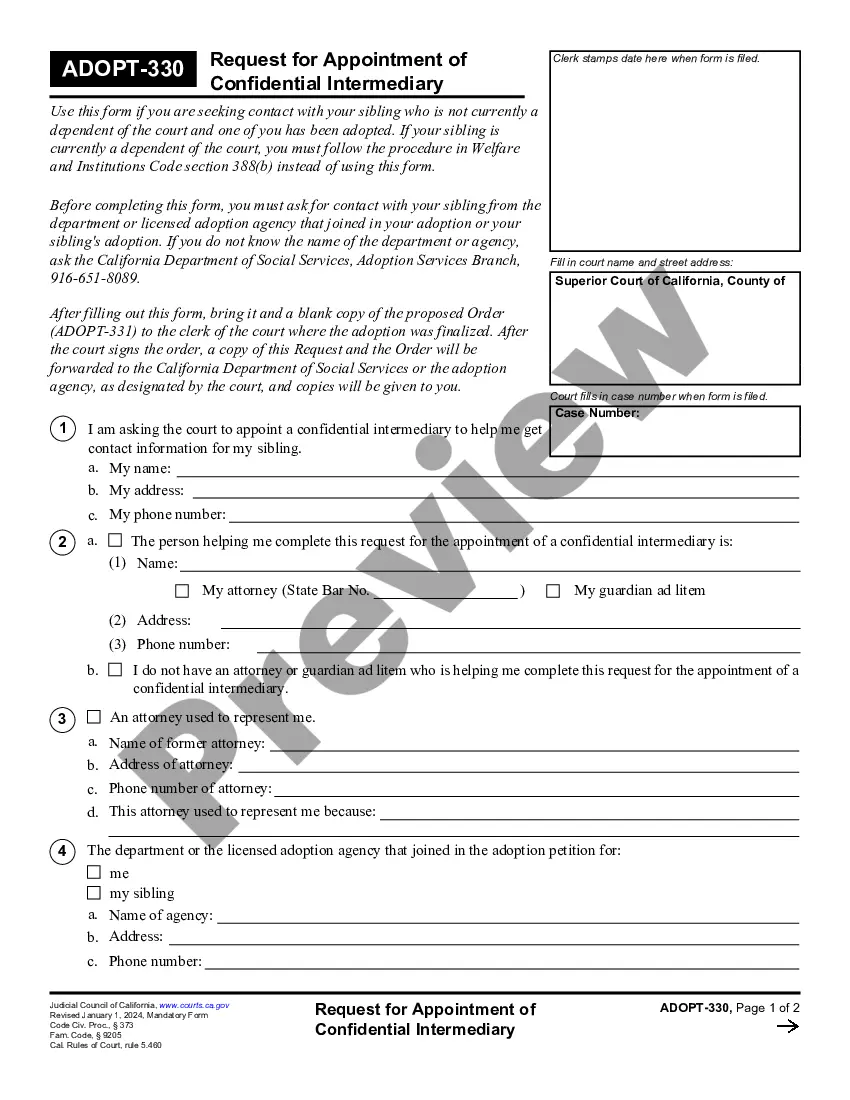

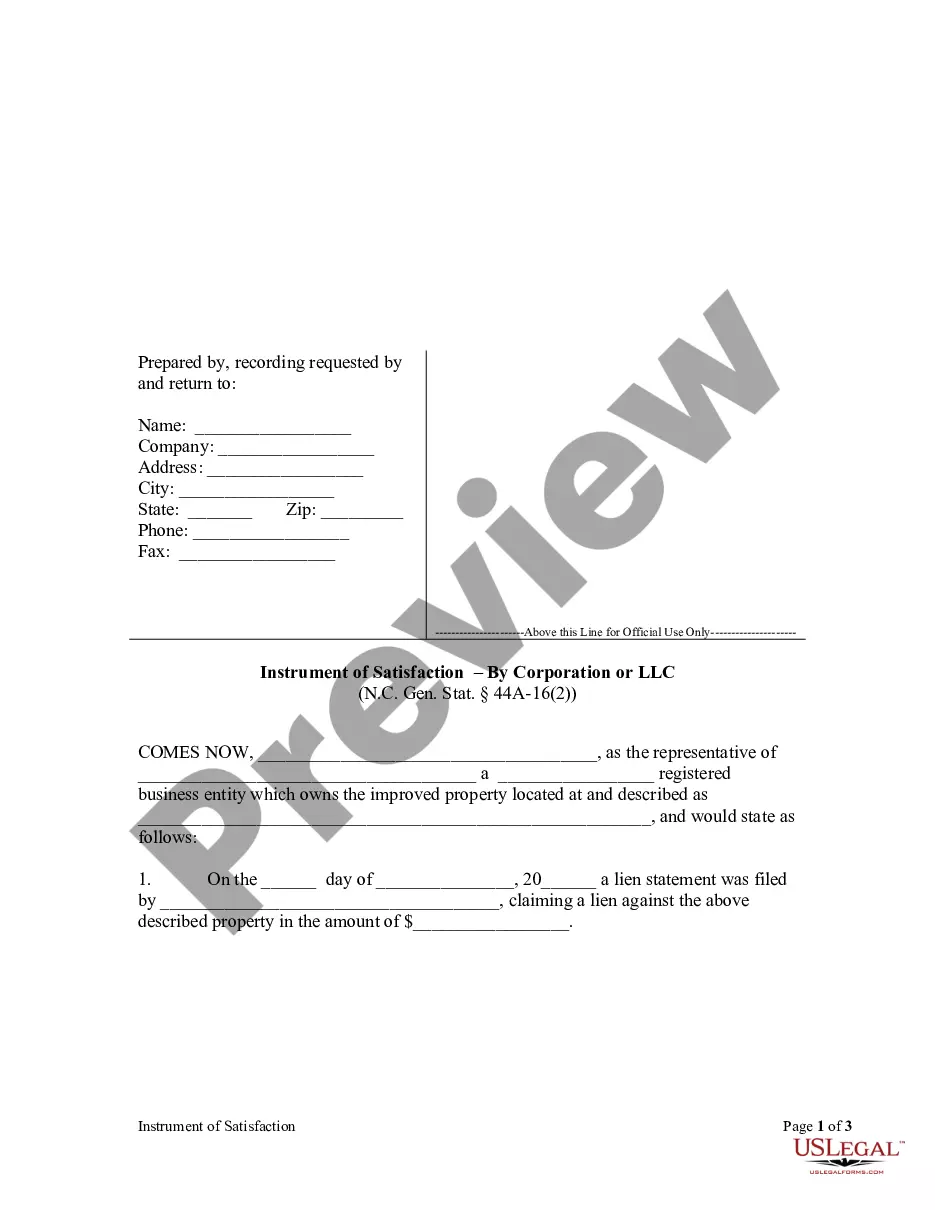

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your requirements.

- Once you find the appropriate form, click Purchase now.

Form popularity

FAQ

Yes, having a written contract is highly advisable for independent contractors. A clear contract outlines the scope of work, payment terms, and responsibilities, reducing misunderstandings. As a Pennsylvania Self-Employed Independent Contractor Construction Worker Contract, a well-drafted agreement can also protect your rights and ensure you and your client maintain a professional relationship. You can utilize platforms like uslegalforms to create effective contracts easily.

Many 1099 workers in Pennsylvania may be classified as independent contractors, which means they usually do not need workers' compensation insurance. However, if the nature of their work suggests an employer-employee relationship, they might be subject to workers' comp requirements. Therefore, reviewing your classification as a Pennsylvania Self-Employed Independent Contractor Construction Worker Contract can provide clarity about your insurance obligations.

In Pennsylvania, independent contractors typically do not need to carry workers' compensation insurance if they have no employees. However, it’s essential to note that if your work relationship resembles that of a typical employee, you may be required to obtain coverage. Therefore, as a Pennsylvania Self-Employed Independent Contractor Construction Worker Contract, assessing your work relationships and risks is crucial for compliance.

Independent contractors often need various types of insurance to protect themselves. Commonly required insurance includes liability insurance and commercial auto insurance if applicable. As a Pennsylvania Self-Employed Independent Contractor Construction Worker Contract, having appropriate insurance can safeguard your assets and ensure you comply with state regulations. Always consider your specific business risks when choosing your coverage.

In Pennsylvania, certain individuals may be exempt from workers' compensation laws. Generally, sole proprietors and partners in a business are not required to obtain workers' comp coverage for themselves. Additionally, certain independent contractors, depending on their relationship with the hiring entity, may also be exempt. Understanding your status as a Pennsylvania Self-Employed Independent Contractor Construction Worker Contract can help clarify your insurance needs.

Filling out an independent contractor agreement requires clear input on both parties’ names, roles, and specific project details. It's essential to define payment schedules, including any retainers or deposits. Additionally, clarify the duration of the contract and outline termination conditions. A Pennsylvania Self-Employed Independent Contractor Construction Worker Contract can be particularly helpful for this task.

To write an effective independent contractor agreement, start with the names of both parties and the date. Then, clearly outline the job responsibilities, payment terms, and project deadlines. Also, include confidentiality and termination clauses. Crafting a Pennsylvania Self-Employed Independent Contractor Construction Worker Contract ensures thoroughness and helps mitigate potential disputes.

Filling out an independent contractor form involves providing accurate information about your role, scope of work, and payment details. Make sure to include your name, address, and the nature of the services provided. Double-check your information to avoid mistakes that could disrupt your agreement. Using a Pennsylvania Self-Employed Independent Contractor Construction Worker Contract can streamline this process.

In Pennsylvania, an independent contractor agreement outlines the relationship between a business and a self-employed contractor. This contract specifies the terms of work, payment structure, and both parties' responsibilities. It's crucial for legally protecting both the contractor and the business, particularly in fields like construction. Utilizing a comprehensive Pennsylvania Self-Employed Independent Contractor Construction Worker Contract can ensure clarity and compliance with local regulations.