Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor

Description

How to fill out Tutoring Agreement - Self-Employed Independent Contractor?

If you want to accumulate, download, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to each form you downloaded in your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

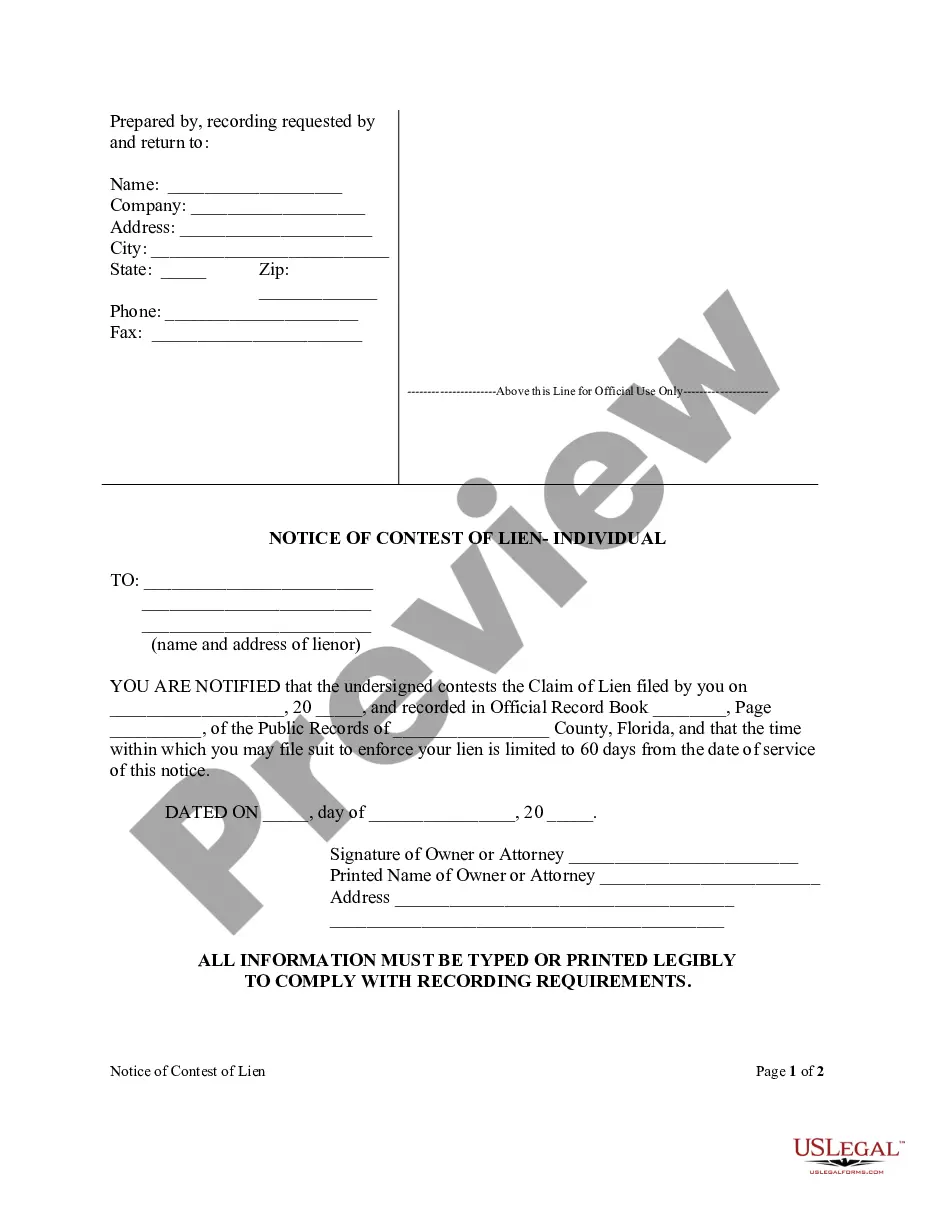

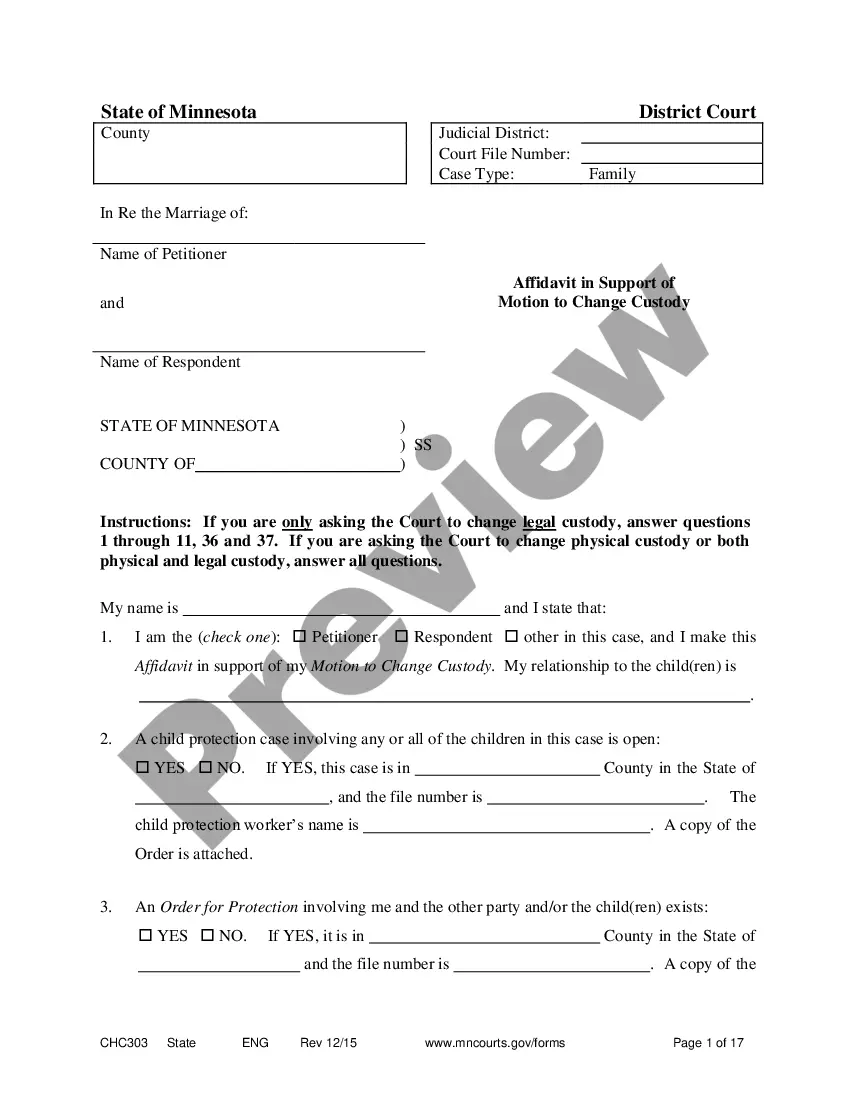

- Step 2. Use the Preview option to review the form's content. Be sure to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you desire, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Filling out an independent contractor form involves providing specific information about the contractor and the work they will perform. Begin with the contractor's name, address, and social security or tax identification number. Next, include the terms of the agreement, such as payment methods and project timelines. You can streamline this process by using a Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor template from Uslegalforms, which guides you step-by-step.

To write an independent contractor agreement, start by clearly defining the relationship between you and the contractor. Include key details such as the scope of work, compensation structure, and any deadlines. Be sure to incorporate essential clauses, such as confidentiality and termination. For a seamless experience, consider using a Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor template available on platforms like Uslegalforms.

Filling out an independent contractor agreement requires attention to detail. First, include the names and contact information of both parties involved. Then, specify the services provided, payment terms, and deadlines. Utilizing a Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor template can simplify this process, ensuring that you cover all necessary elements.

Yes, an independent contractor is regarded as self-employed. This classification allows you to operate your own business, set your prices, and determine your work schedule. A Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor can help define your status and responsibilities, making it essential for embedding clarity in your business relationship. Understanding this status is crucial for taxation and legal purposes.

Yes, private tutoring is considered self-employment when you offer your services independently. This arrangement allows you to operate without being classified as an employee of a school or organization. A Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor can help formalize your status and outline your working terms, providing clarity for both you and your clients.

A tutor generally falls into the category of a self-employed independent contractor. This means you operate your own tutoring business, set your rates, and manage your schedule without a company dictating your work environment. A Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor helps define your responsibilities and rights as you establish your practice. Make sure you understand your role clearly to protect yourself.

Filing taxes as an independent tutor involves reporting your income through a Schedule C form. You will need to track all income received and document your business expenses. Using a Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor can help you gather essential information, ensuring that you have everything you need for accurate tax filing. Consulting a tax professional can also guide you through the process.

In Pennsylvania, private tutoring does not generally require a specific license. However, you should check local regulations and any potential educational requirements for your subject area. Obtaining a Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor can help clarify any compliance needs and ensure you operate within the law. Always be sure to remain informed on any changes in local licensing requirements.

Tutors are not typically classified as 1099 employees; rather, they are independent contractors receiving a 1099 form for tax purposes. This classification indicates they are self-employed and responsible for managing their taxes. Using a Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor helps clarify this employment status and outlines the financial responsibilities involved. By understanding these distinctions, tutors can better manage their business operations.

Yes, a private tutor is generally considered self-employed, as they usually determine their own working hours and client base. They operate without direct supervision from an employer, allowing them to set their rates and teaching techniques. By utilizing a Pennsylvania Tutoring Agreement - Self-Employed Independent Contractor, tutors can formally establish their status and protect their rights. This agreement plays a crucial role in defining the self-employment relationship.