Pennsylvania Child Care or Day Care Services Contract - Self-Employed

Description

How to fill out Child Care Or Day Care Services Contract - Self-Employed?

Are you in a circumstance where you frequently require documents for potential business or specific purposes almost every day.

There are numerous legitimate document templates accessible online, but finding formats you can trust isn’t simple.

US Legal Forms provides thousands of form templates, such as the Pennsylvania Child Care or Day Care Services Agreement - Self-Employed, which are crafted to meet federal and state regulations.

Once you locate the appropriate form, click Get now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Pennsylvania Child Care or Day Care Services Agreement - Self-Employed template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

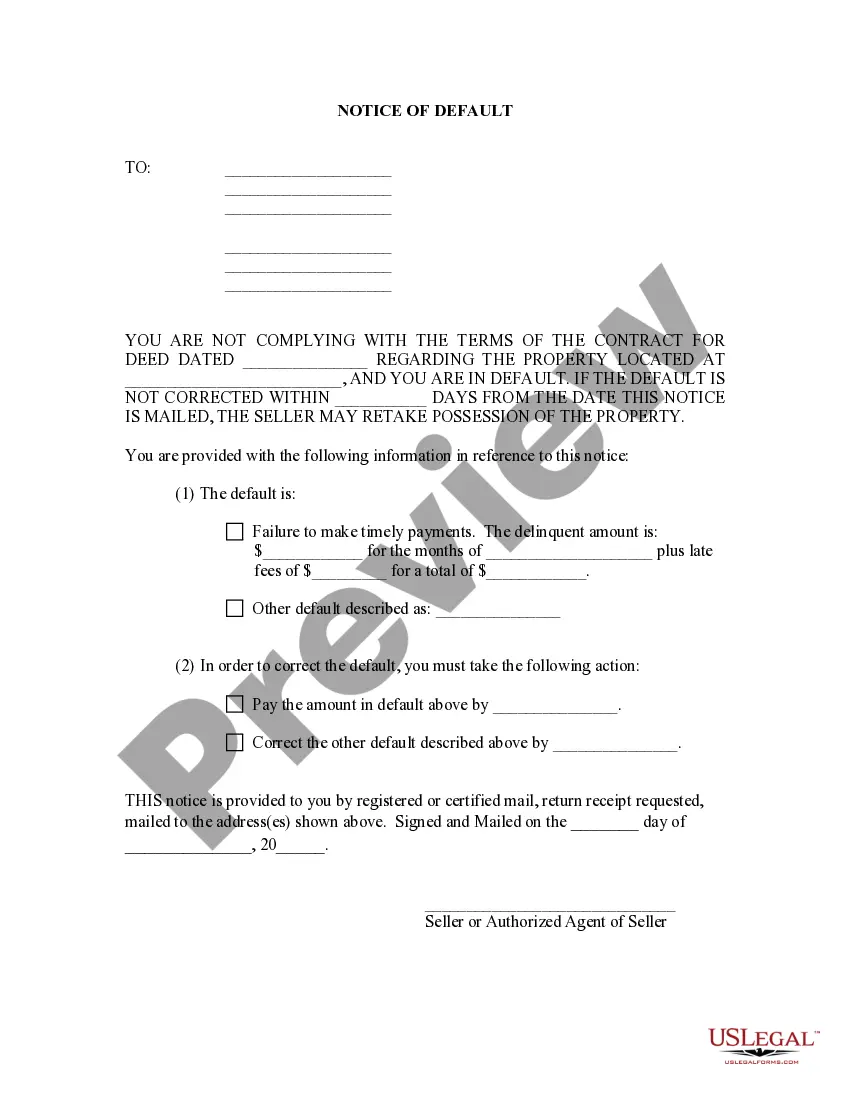

- Utilize the Preview button to look over the document.

- Review the description to ensure you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The amount you can write off for child care expenses varies based on your income and the number of qualifying children. Typically, the IRS allows you to claim a percentage of your child care costs, which can be a financial relief. Utilize the Pennsylvania Child Care or Day Care Services Contract - Self-Employed to gain further insights into these deductions.

Opening a daycare in Pennsylvania involves several steps, including obtaining the necessary licenses and permits. Familiarizing yourself with the Pennsylvania Child Care or Day Care Services Contract - Self-Employed will provide essential resources to navigate the regulatory landscape. Additionally, create a solid business plan that outlines your goals and target market.

Childcare expenses can be tax-deductible for self-employed parents, allowing you to alleviate some financial burdens. This deduction is particularly relevant under the Pennsylvania Child Care or Day Care Services Contract - Self-Employed. Be sure to consult a tax professional for accurate information tailored to your situation.

Yes, self-employed individuals can claim the child tax credit. This credit can significantly reduce your overall tax liability. To ensure you meet all requirements, refer to the Pennsylvania Child Care or Day Care Services Contract - Self-Employed for guidance on claiming this valuable benefit.

Self-employed parents may qualify for child care subsidies in Pennsylvania. The criteria can vary, but you’ll need to provide proof of your income and employment status. Exploring the Pennsylvania Child Care or Day Care Services Contract - Self-Employed will help you understand your eligibility for these programs.

Yes, self-employed individuals can write off a portion of their child care expenses. This falls under the Pennsylvania Child Care or Day Care Services Contract - Self-Employed. However, you must keep accurate records and be mindful of the guidelines provided by the IRS to ensure you maximize your deductions legally.

In Pennsylvania, the number of kids you can babysit at home typically aligns with the family daycare limits, allowing for up to six children under the age of 18, including your own. It is essential to be aware of your local regulations, as they can differ based on community guidelines. Using a Pennsylvania Child Care or Day Care Services Contract - Self-Employed can facilitate a clear understanding of your capacity and responsibilities among parents.

The Pennsylvania child care tax credit offers financial relief to families paying for childcare services. This credit can help offset some of the costs associated with care for children under 13. Ensuring your daycare service is compliant with the qualifying conditions can help families receive this benefit. By implementing a Pennsylvania Child Care or Day Care Services Contract - Self-Employed, you can inform clients about this credit while providing professional arrangements.

The number of children you can look after in your Pennsylvania home largely depends on the type of license you hold. Typically, family child care homes allow for up to six children under 18, while larger facilities have different regulations. Always check with your local licensing authority for the most accurate information. Using a Pennsylvania Child Care or Day Care Services Contract - Self-Employed can clarify provider responsibilities and improve communication with parents.

As a self-employed individual in Pennsylvania, you are subject to self-employment tax, which currently includes Social Security and Medicare taxes. This tax is calculated at 15.3% on your net earnings. It's vital to keep accurate records of your income and expenses to properly calculate your tax obligation. A Pennsylvania Child Care or Day Care Services Contract - Self-Employed can help ensure you are compliant with taxes and minimizes misunderstandings with clients.