Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carrier Services Contract - Self-Employed Independent Contractor?

You might spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are reviewed by experts.

You can download or print the Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor from their service.

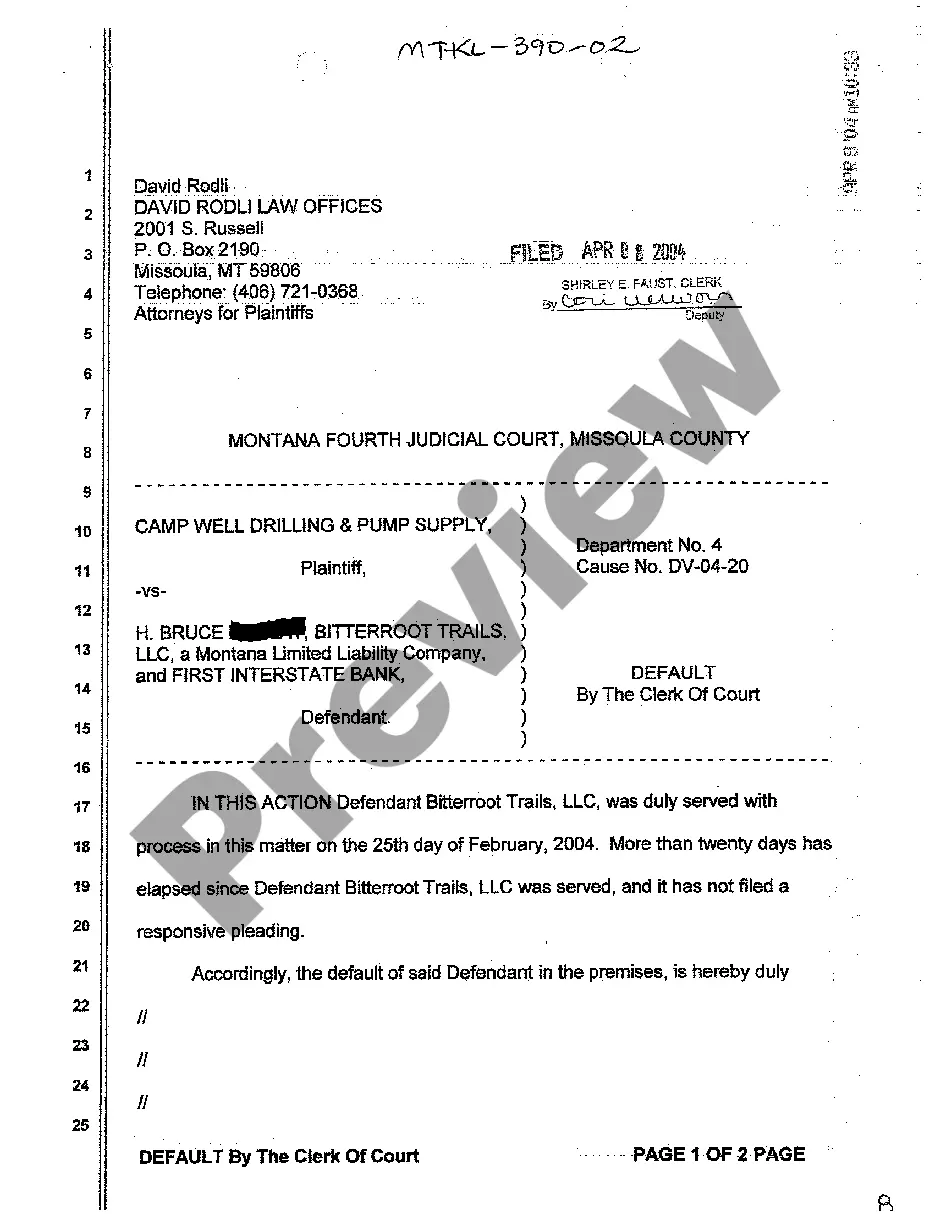

If available, utilize the Preview option to review the document template as well.

- If you have an account with US Legal Forms, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor.

- Every legal document template you purchase belongs to you permanently.

- To obtain another copy of the purchased document, navigate to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your area/city of choice.

- Review the form outline to ensure you have selected the correct form.

Form popularity

FAQ

Creating an independent contractor contract involves outlining the specific services provided, payment terms, confidentiality agreements, and timelines. You can start with a template, but be sure to customize it to reflect your circumstances accurately. Utilizing a reliable platform like uslegalforms can guide you in creating a comprehensive Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor.

Yes, having a contract is essential for self-employed individuals. A written agreement, like a Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor, helps define the scope of work, payment terms, and deadlines. This clarity not only protects your interests but also builds trust with your clients.

To get authorized as an independent contractor in the U.S., research the licensing and permit requirements specific to your profession. Every state, including Pennsylvania, has distinct regulations. Creating a Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor can aid in setting a clear framework of terms that include authorization details.

To be an independent contractor, you typically need to register your business, obtain relevant licenses, and maintain financial records. Knowledge of your industry standards is crucial, especially when drafting a Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor. Additionally, it is important to have good communication with your clients to establish mutual expectations.

Working as an independent contractor in the USA involves setting up your business structure, understanding tax obligations, and establishing a network of clients. You may want to utilize a Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor to formalize your agreements. This document serves to clarify responsibilities and protect both you and your clients.

To get authorized as an independent contractor in the U.S., you must apply for the appropriate licenses and permits for your field. Each state has specific requirements, so check Pennsylvania’s regulations as they pertain to your business. Additionally, having a Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor can help outline the necessary authorizations you may need.

Yes, independent contractors in the United States typically require work authorization to legally provide services. This authorization can vary based on the type of contract and the scope of services you offer. If you are working under a Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor, ensure you have the necessary licenses and permits for your work.

Writing an independent contractor agreement for a Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor requires you to outline key details such as the parties involved, services provided, payment structure, and any necessary legal clauses. Ensure clarity and specificity to avoid misunderstandings in the future. For an easier experience, consider using the templates offered by UsLegalForms, which provide structured guidance to help you draft a solid agreement.

To fill out an independent contractor agreement for a Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor, start by including your legal name and contact details, along with the client's information. Clearly outline the scope of work, payment terms, and duration of the agreement. Using a reliable template, such as those from UsLegalForms, can simplify this process and ensure you cover all necessary components.

Filling out an independent contractor form for a Pennsylvania Carrier Services Contract - Self-Employed Independent Contractor involves providing essential information like your name, address, and details about the services you offer. Ensure you accurately state your payment terms and any other conditions specific to your arrangement. You might find it helpful to use online resources from UsLegalForms for guidance on completing these forms effectively.