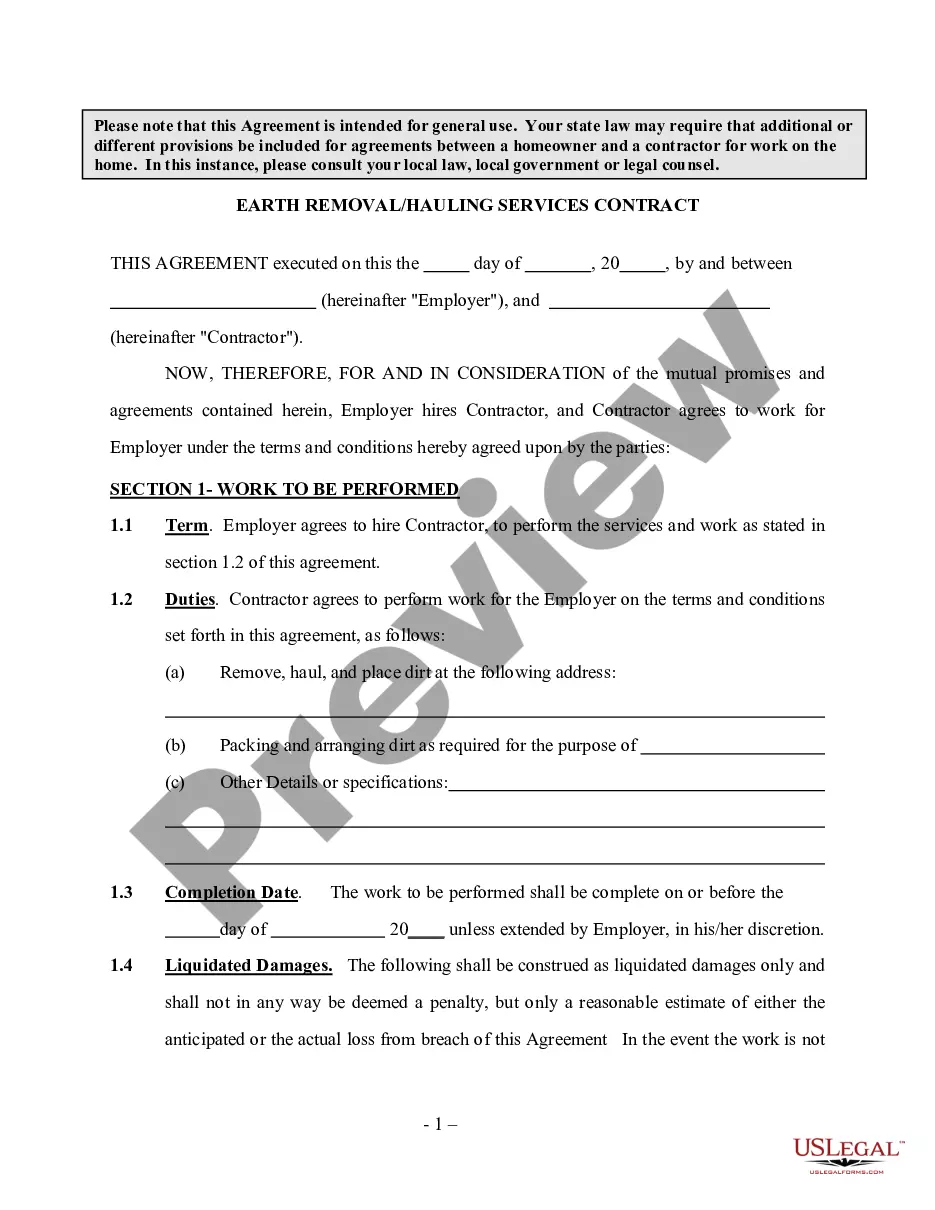

Pennsylvania Hauling Services Contract - Self-Employed

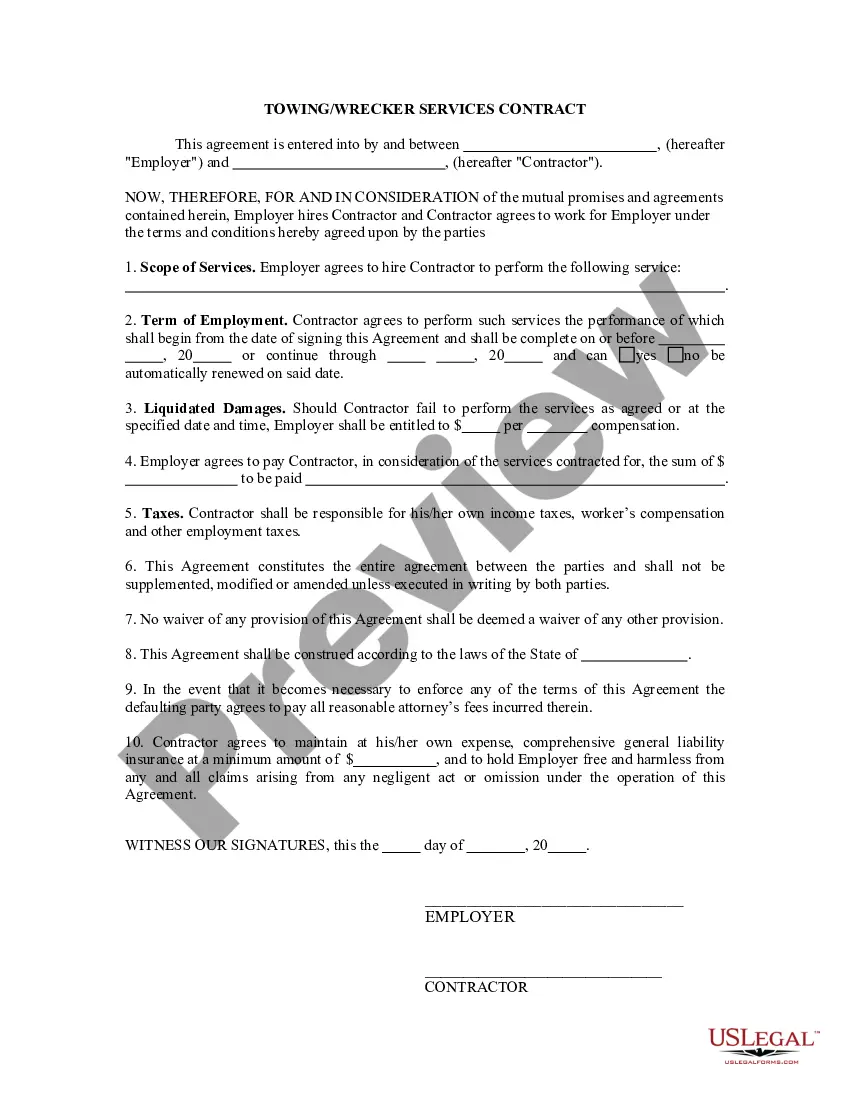

Description

How to fill out Hauling Services Contract - Self-Employed?

Are you in a situation where you require documents for occasional business or personal reasons almost every day.

There are numerous authorized document templates accessible online, but finding forms you can trust is not easy.

US Legal Forms offers thousands of template documents, like the Pennsylvania Hauling Services Contract - Self-Employed, that are designed to comply with state and federal regulations.

Select the pricing plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Pennsylvania Hauling Services Contract - Self-Employed at any time, if needed. Just click on the specific form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Pennsylvania Hauling Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

- Use the Review button to examine the document.

- Read the details to confirm that you have selected the right form.

- If the form isn’t what you are looking for, use the Lookup field to find the document that meets your needs and requirements.

- Once you find the correct form, click on Get now.

Form popularity

FAQ

Independent contractors in Pennsylvania, like those who operate under a Pennsylvania Hauling Services Contract - Self-Employed, need to be aware of various tax obligations. This includes state income tax, local taxes, and potential sales tax on services provided. It’s advisable to consult a tax professional to ensure you are meeting all necessary tax requirements and making the most of available deductions.

In Pennsylvania, service agreements can be taxable depending on the nature of the service provided. If your agreement includes services related to tangible goods, it may incur sales tax. As a self-employed individual operating under a Pennsylvania Hauling Services Contract, understanding the implications of these agreements can help you navigate your tax responsibilities.

Yes, hauling may be subject to sales tax in Pennsylvania. This typically applies when the service is for transporting goods or materials rather than just movement without any consideration of sale. Make sure you understand these tax obligations while operating under a Pennsylvania Hauling Services Contract - Self-Employed to stay compliant.

Certain types of income are not taxed in Pennsylvania, including interest from bank accounts and some types of government benefits. If you are operating under a Pennsylvania Hauling Services Contract - Self-Employed, it's essential to differentiate between taxable and non-taxable income to ensure accurate reporting. Keeping meticulous records will help you identify what qualifies as non-taxable.

In Pennsylvania, hauling services can be taxable depending on the context. If the hauling service includes transporting tangible personal property, it may incur sales tax. Therefore, if you engage in hauling under a Pennsylvania Hauling Services Contract - Self-Employed, it's vital to verify whether tax applies to your specific situation.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?