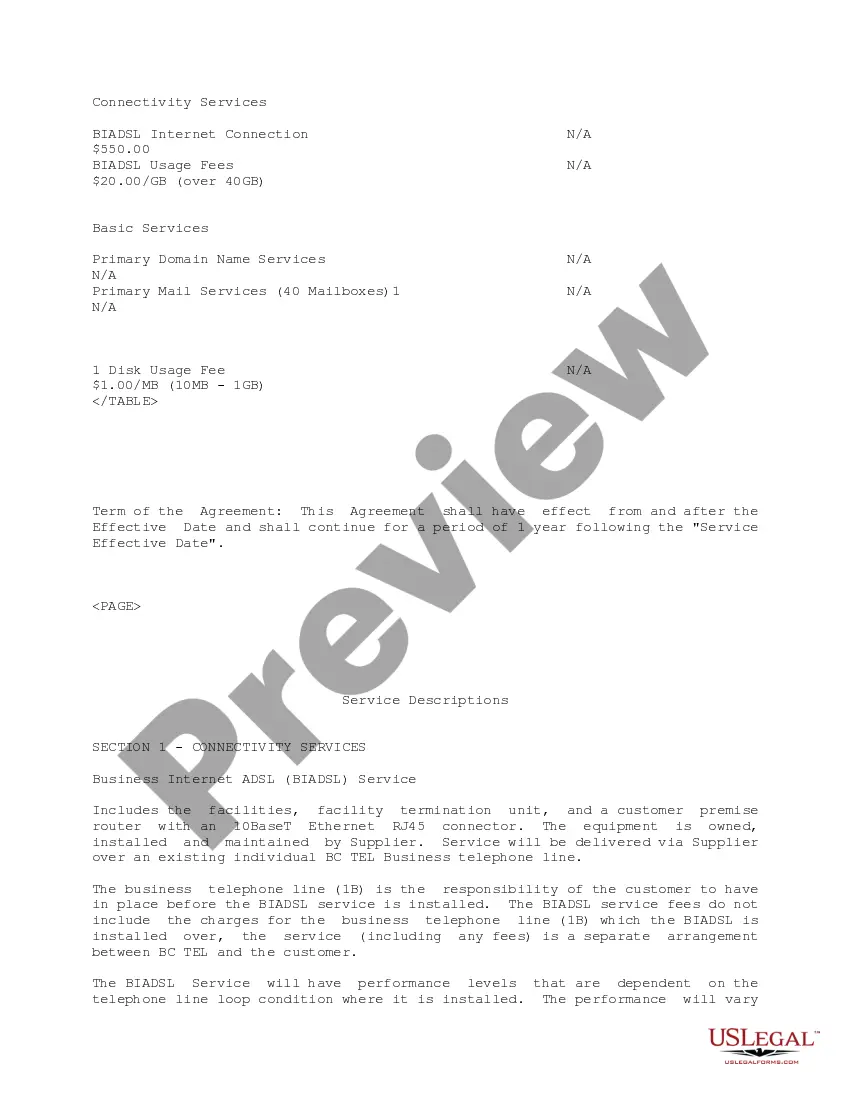

Pennsylvania Internet Business Services Agreement

Description

How to fill out Internet Business Services Agreement?

If you wish to full, obtain, or print authorized document layouts, use US Legal Forms, the largest assortment of authorized types, which can be found on-line. Utilize the site`s simple and easy practical look for to obtain the files you need. Numerous layouts for company and specific uses are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the Pennsylvania Internet Business Services Agreement with a handful of mouse clicks.

When you are already a US Legal Forms client, log in in your profile and click the Down load key to have the Pennsylvania Internet Business Services Agreement. You may also accessibility types you formerly downloaded within the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape to the right city/nation.

- Step 2. Utilize the Review method to look over the form`s content. Don`t forget to read the explanation.

- Step 3. When you are not happy together with the develop, take advantage of the Research field on top of the display screen to discover other variations from the authorized develop format.

- Step 4. Upon having discovered the shape you need, go through the Buy now key. Choose the costs prepare you choose and add your credentials to register on an profile.

- Step 5. Process the financial transaction. You should use your charge card or PayPal profile to finish the financial transaction.

- Step 6. Select the format from the authorized develop and obtain it on your product.

- Step 7. Comprehensive, revise and print or signal the Pennsylvania Internet Business Services Agreement.

Every single authorized document format you purchase is your own for a long time. You have acces to each and every develop you downloaded inside your acccount. Click on the My Forms section and select a develop to print or obtain once again.

Remain competitive and obtain, and print the Pennsylvania Internet Business Services Agreement with US Legal Forms. There are millions of professional and state-certain types you can utilize for your personal company or specific requires.

Form popularity

FAQ

($14.00 fee) complete history of the driver on file in Pennsylvania.

Yes, foreign LLCs in Pennsylvania need to file the Decennial Report. It needs to be filed every 10 years at a cost of $70. The Pennsylvania Decennial Report is due by December 31st in every year ending with the number ?1? (2031, 2041, 2051?).

To terminate or withdraw from doing business, an LLC should file an affidavit with PA's Corporation Tax Bureau because the LLC was either formed in PA (domestic LLC) or is doing business in PA... How do I dissolve a business entity in Pennsylvania?

State Business Licenses The Commonwealth of Pennsylvania requires you to obtain a license that enables you to remit the taxes you've collected to the Department of Revenue. You only need to get one license for all of the taxes you collect during the operation of your business.

How to Dissolve an LLC in Pennsylvania in 7 Steps Review Your LLC's Operating Agreement. ... Vote to Dissolve an LLC. ... Notify Tax Agencies and Pay the Remaining Taxes. ... File Articles of Dissolution. ... Inform Creditors and Settle Existing Debt. ... Wind Up Other Business Affairs. ... Distribute Remaining Assets.

Starting a business in PA in 8 steps Step 1: Choose a name and business entity. ... Step 2: Create a business plan. ... Step 3: Register your business. ... Step 4: Register for tax and employer accounts. ... Step 5: Registration for local taxes, zoning requirements, licenses, or permits. ... Step 6: Open a business bank account.

To withdraw or cancel your foreign LLC in Pennsylvania, you provide the completed Certificate of Cancellation of Registration-Foreign (DSCB: 15-8586) form to the Department of State by mail, in person, or online, along with the filing fee. A Department of Revenue Tax Clearance Certificate must be attached also.

Pennsylvania doesn't administratively dissolve LLCs. However, if you fail to file your decennial report, your LLC's name will no longer be reserved for your use. To reinstate your LLC's name, you can file your late decennial report.