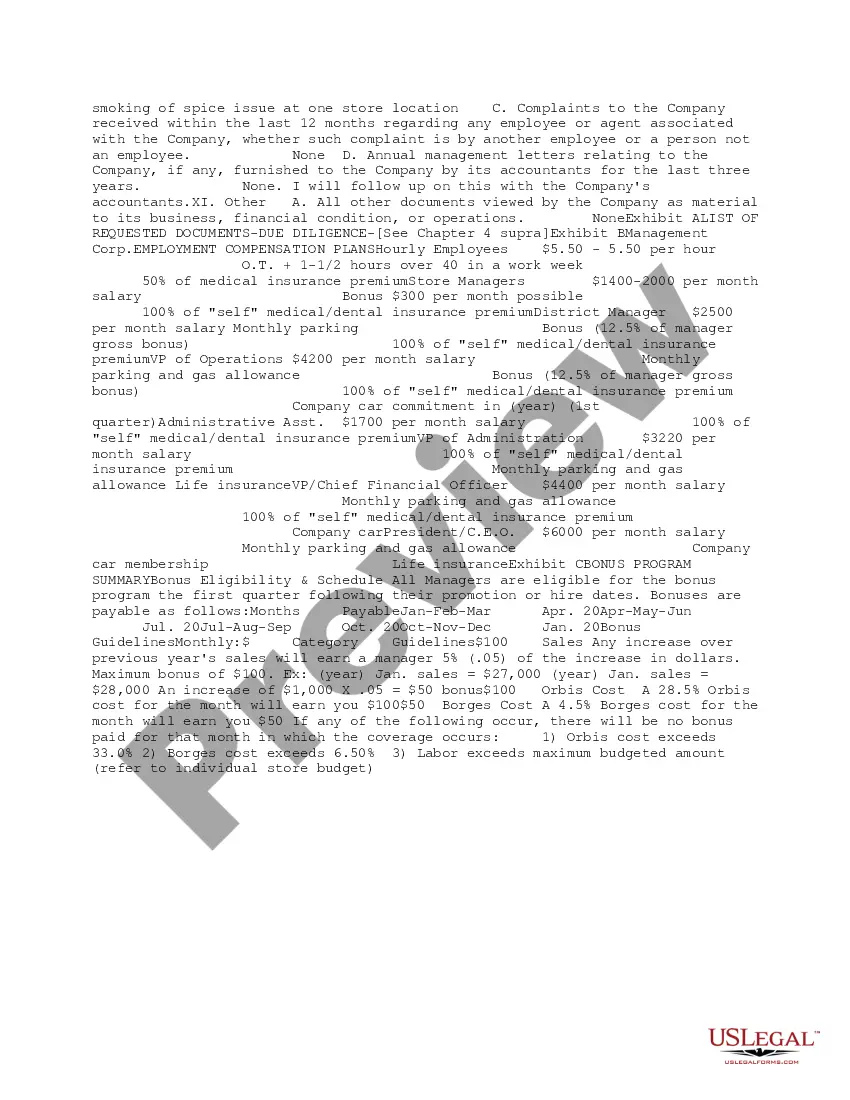

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Pennsylvania Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Summary Initial Review Of Response To Due Diligence Request?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates for you to download or print.

By using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the latest versions of forms such as the Pennsylvania Summary Initial Review of Response to Due Diligence Request within moments.

If you possess a subscription, Log In and retrieve Pennsylvania Summary Initial Review of Response to Due Diligence Request from the US Legal Forms repository. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Pennsylvania Summary Initial Review of Response to Due Diligence Request.

- Make sure to select the appropriate form for your specific city/state.

- Click on the Review button to examine the form's information.

- Read the form description to ensure you have selected the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking on the Purchase now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Rule 4003.2 outlines the scope and limitations of discovery in civil cases, focusing on the relevance and proportionality of the information being requested. This rule facilitates a fair exchange of information while preventing unnecessary costs and delays. Understanding Rule 4003.2 is integral to performing an effective Pennsylvania Summary Initial Review of Response to Due Diligence Request.

Rule 4003.7 governs the disclosure of expert testimony within legal proceedings in Pennsylvania. This rule requires that parties provide advance notice when relying on expert testimony to ensure that all parties are adequately prepared. This knowledge contributes to a smoother Pennsylvania Summary Initial Review of Response to Due Diligence Request.

Rule 4007.4 essentially emphasizes the requirement for attorneys to provide a complete and comprehensive response to due diligence requests. This rule serves to streamline the legal process by ensuring all necessary documentation is presented accordingly. Familiarity with Rule 4007.4 enhances your understanding of the Pennsylvania Summary Initial Review of Response to Due Diligence Request.

Rule 1.9 addresses conflict of interest concerning former clients. Attorneys must not represent a client in a matter that is substantially related to a previous representation unless they obtain the prior informed consent of the former client. This rule ensures that confidentiality is maintained while giving guidance on matters involved in a Pennsylvania Summary Initial Review of Response to Due Diligence Request.

In Pennsylvania, certain types of property are exempt from judgment under various circumstances, including personal property and certain incomes. This includes items such as necessary clothing, household goods, and certain tools of the trade. Knowing what is exempt can help you navigate the process effectively during a Pennsylvania Summary Initial Review of Response to Due Diligence Request.

Rule 4007.4 in Pennsylvania provides important guidance regarding the initial review of responses to due diligence requests. This rule outlines the process for parties to submit their responses and ensures that these documents meet the necessary standards for a valid claim. Understanding Rule 4007.4 is crucial for a successful Pennsylvania Summary Initial Review of Response to Due Diligence Request.

The due diligence process typically involves several critical steps, including document collection, data analysis, and comprehensive reporting. Initially, you will gather relevant documents related to the transaction, followed by a thorough evaluation. A Pennsylvania Summary Initial Review of Response to Due Diligence Request is initiated to give you quick insights, and the process culminates in presenting findings that enable informed decisions.

The initial due diligence report is a preliminary document that outlines key findings and insights from the due diligence review process. This report serves as an essential tool for buyers, offering a Pennsylvania Summary Initial Review of Response to Due Diligence Request, and helps in evaluating whether to proceed with the transaction. This initial analysis forms the foundation for more detailed investigations as needed.

To obtain a due diligence report, you generally need to engage a qualified professional or firm specializing in due diligence services. These experts can conduct a detailed assessment and provide you with a Pennsylvania Summary Initial Review of Response to Due Diligence Request. Using a platform like uslegalforms can streamline this process, offering resources and templates to assist you.

The due diligence review process involves several key steps to gather and analyze information about a target investment. Initially, you identify critical documents and data, followed by organizing the findings in a comprehensive report. A Pennsylvania Summary Initial Review of Response to Due Diligence Request is typically conducted to ensure all aspects are evaluated, allowing for informed decision-making.