This form is an outline of issues that the due diligence team should consider when determining the feasibility of the proposed transaction.

Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors

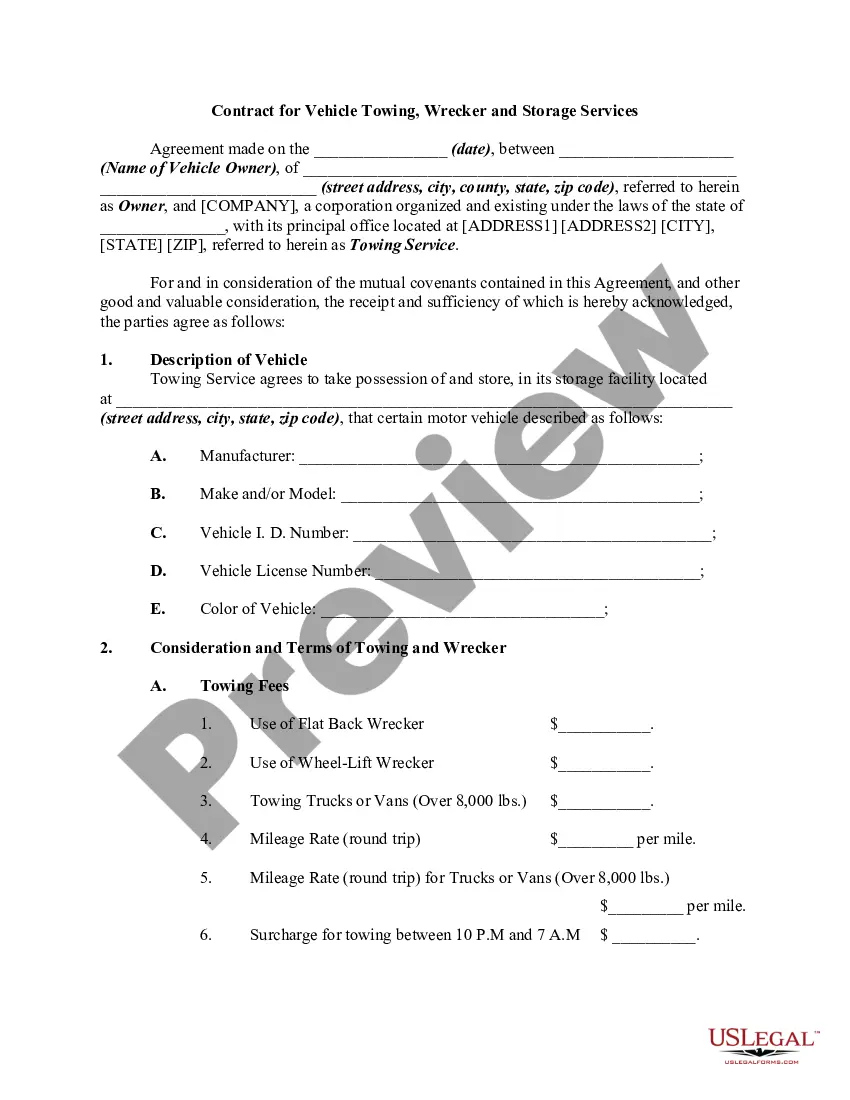

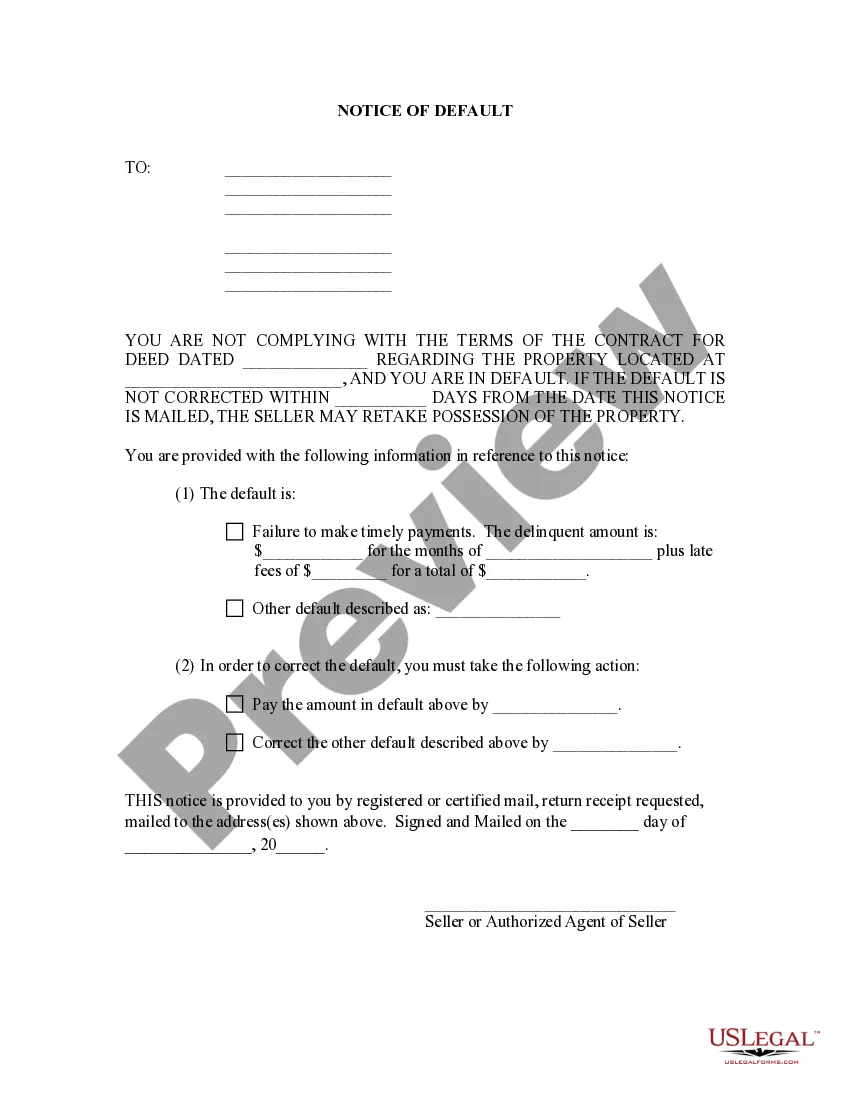

Description

How to fill out Outline Of Considerations For Transactions Involving Foreign Investors?

If you need to compile, retrieve, or generate authentic document templates, utilize US Legal Forms, the largest repository of authentic forms available online.

Leverage the website's straightforward and user-friendly search function to obtain the documents you require.

Various templates for business and personal purposes are organized by categories and regions or keywords.

Step 4. Once you have found the form you wish to use, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to create an account.

Step 6. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase. Step 7. Access the format of your legal document and download it to your device. Step 8. Fill out, modify, and print or sign the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors.

- Employ US Legal Forms to acquire the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and select the Download option to retrieve the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors.

- You can also view forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form’s content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of your legal document template.

Form popularity

FAQ

The PA Securities Act of 1972 is a law that regulates the sale of securities within Pennsylvania. This act aims to protect investors and ensure fair practices in the investment market. It plays a crucial role in the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors, as foreign investors must comply with these regulations when entering the state. Understanding this act is essential for any foreign investor looking to navigate Pennsylvania's legal landscape.

Yes, a Delaware LLC can operate in Pennsylvania. However, it must register as a foreign entity to conduct business legally in the state. This registration is essential to ensure compliance with the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors. By following the proper channels, Delaware LLCs can benefit from Pennsylvania's market while adhering to state regulations.

In Pennsylvania, nonresident partners have specific withholding requirements when it comes to partnerships. Typically, partnerships must withhold a percentage of the distributive share owned by nonresident partners to cover state tax obligations. This is essential for compliance under the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors. For clarity and assistance, using platforms like US Legal Forms can help simplify the complexities of these legal requirements.

The rules for Blue Sky Laws vary by state but generally include requirements for registration and disclosure of securities offerings. In Pennsylvania, these rules aim to protect investors by ensuring transparency and accountability. Understanding these rules is vital when engaging in transactions, as outlined in the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors.

Certain entities and transactions may be exempt from Blue Sky Laws in Pennsylvania, such as federal covered securities and some private placements. However, each exemption comes with specific criteria that must be met. Familiarizing yourself with these exemptions is an integral part of the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors, ensuring you make informed decisions.

Yes, Pennsylvania does have a Pass-Through Entity tax (PTE). This tax applies to certain business entities like partnerships and S corporations, affecting how foreign investors report income. Knowing about PTE is essential for effective planning and falls within the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors, providing clarity on tax obligations.

Blue Sky Laws in Pennsylvania refer to state regulations designed to protect investors from fraud in securities transactions. These laws require certain disclosures and registrations before securities can be sold in the state. For foreign investors, understanding the implications of the Blue Sky Laws is crucial as outlined in the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors.

Yes, foreign income is generally taxable in Pennsylvania. This means if you are a foreign investor earning income from sources within the state, you are responsible for state taxes on that income. Understanding how this impacts your investment strategy is part of the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors. Consulting with an expert can help clarify your obligations.

Proof of financial responsibility in Pennsylvania demonstrates that a party can cover potential financial liabilities, especially in transactions. This is particularly important for foreign investors considering various investments. As you navigate the Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors, having this proof helps ensure compliance and builds trust with stakeholders.

Yes, a foreign corporation must register in Pennsylvania before conducting business within the state. This registration process ensures compliance with local laws and taxes applicable to foreign entities. The Pennsylvania Outline of Considerations for Transactions Involving Foreign Investors offers a comprehensive view of these requirements, helping foreign investors understand their obligations. For support in the registration process, uslegalforms is a valuable resource.