Pennsylvania Plan of Reorganization

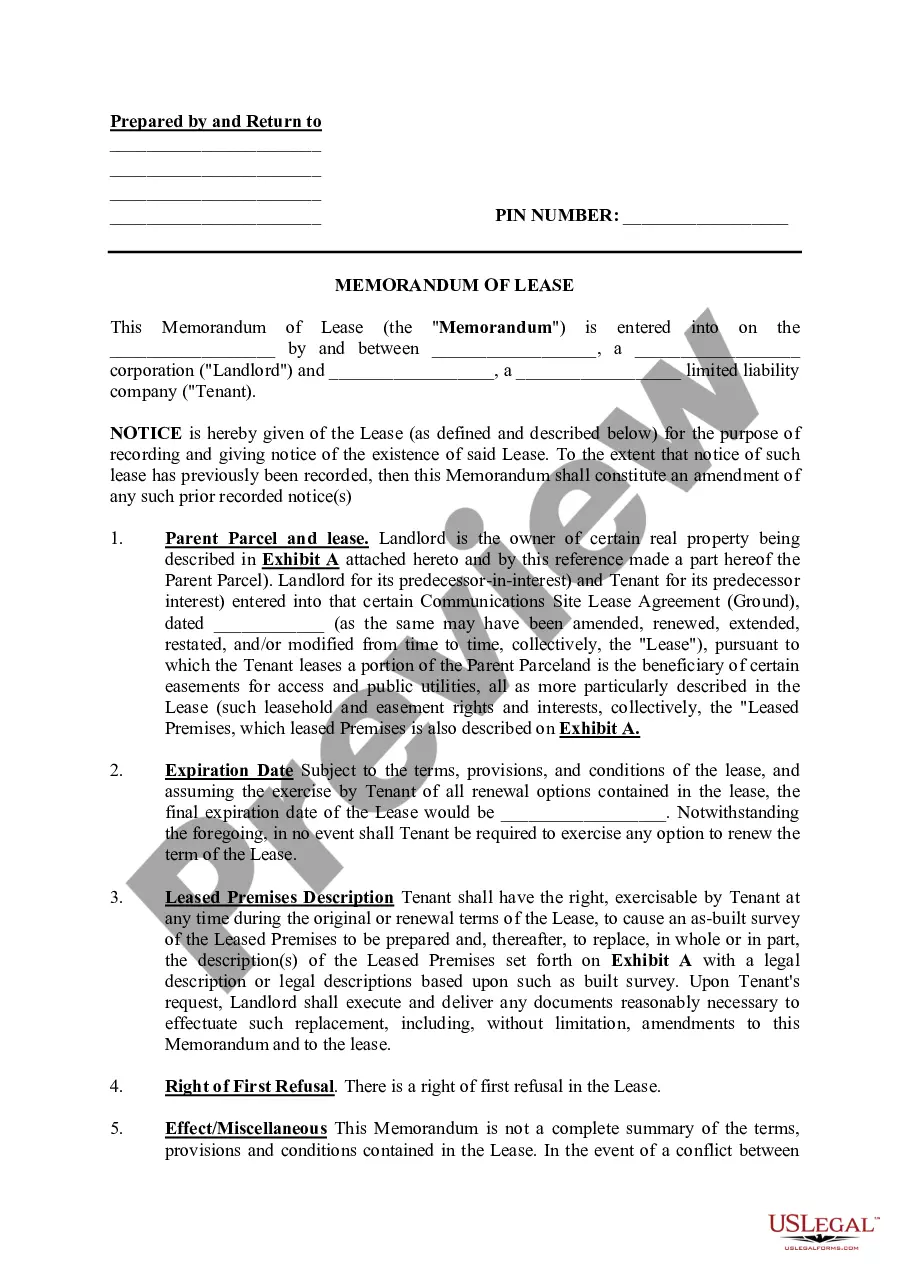

Description

How to fill out Plan Of Reorganization?

Have you been within a place the place you need to have paperwork for both business or specific functions nearly every working day? There are a lot of lawful file templates available on the net, but finding types you can rely isn`t simple. US Legal Forms offers thousands of form templates, just like the Pennsylvania Plan of Reorganization, which are composed to fulfill state and federal requirements.

Should you be already familiar with US Legal Forms site and get a free account, just log in. Next, you may acquire the Pennsylvania Plan of Reorganization web template.

Unless you offer an bank account and want to begin using US Legal Forms, adopt these measures:

- Obtain the form you need and make sure it is for your proper metropolis/county.

- Take advantage of the Preview button to analyze the form.

- Look at the explanation to actually have selected the right form.

- If the form isn`t what you are looking for, utilize the Look for industry to find the form that meets your needs and requirements.

- Once you get the proper form, click on Get now.

- Pick the pricing strategy you need, complete the desired details to generate your money, and buy an order with your PayPal or credit card.

- Decide on a hassle-free document file format and acquire your duplicate.

Find each of the file templates you might have bought in the My Forms menu. You can get a additional duplicate of Pennsylvania Plan of Reorganization anytime, if required. Just click the required form to acquire or printing the file web template.

Use US Legal Forms, the most comprehensive collection of lawful varieties, to save some time and avoid blunders. The services offers professionally created lawful file templates which you can use for a range of functions. Create a free account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

Also known as plan. A comprehensive document prepared by a debtor or another party in interest detailing how the debtor will continue to operate or liquidate, and how it plans to pay the claims of its creditors over a fixed period of time.

Unlike chapter 7, chapter 11 is not a liquidation of the debtor's assets. Rather, it is a reorganization of existing assets, principally as debt. The confirmed chapter 11 plan becomes a contract between the debtor and creditors, governing their rights and obligations; see In re Nylon Net Company.

Secured creditors like banks are going to get paid first. This is because their credit is secured by assets?typically ones that your business controls. Your plan and the courts may consider how integral the assets are that secure your loans to determine which secured creditors get paid first though.

In the Chapter 11 case filed by a corporation, limited liability company, or other nonindividual, the debtor receives a discharge when a plan is confirmed by the court. The order of the court that confirms the plan also contains the debtor's Chapter 11 discharge.

Background. A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor.

If your company owes a current employee wages when it files for Chapter 11, then the employee's paychecks should not be interrupted. The company will ask the court's permission to keep paying its employees as long as it stays in business.

You will need to work in conjunction with the lawyer or firm to prepare your petition by completing a list of all of your company's assets, debts, income, and expenses with a summary of your finances. When ready, the petition can be filed with the bankruptcy clerk's office.