Pennsylvania Approval of deferred compensation investment account plan

Description

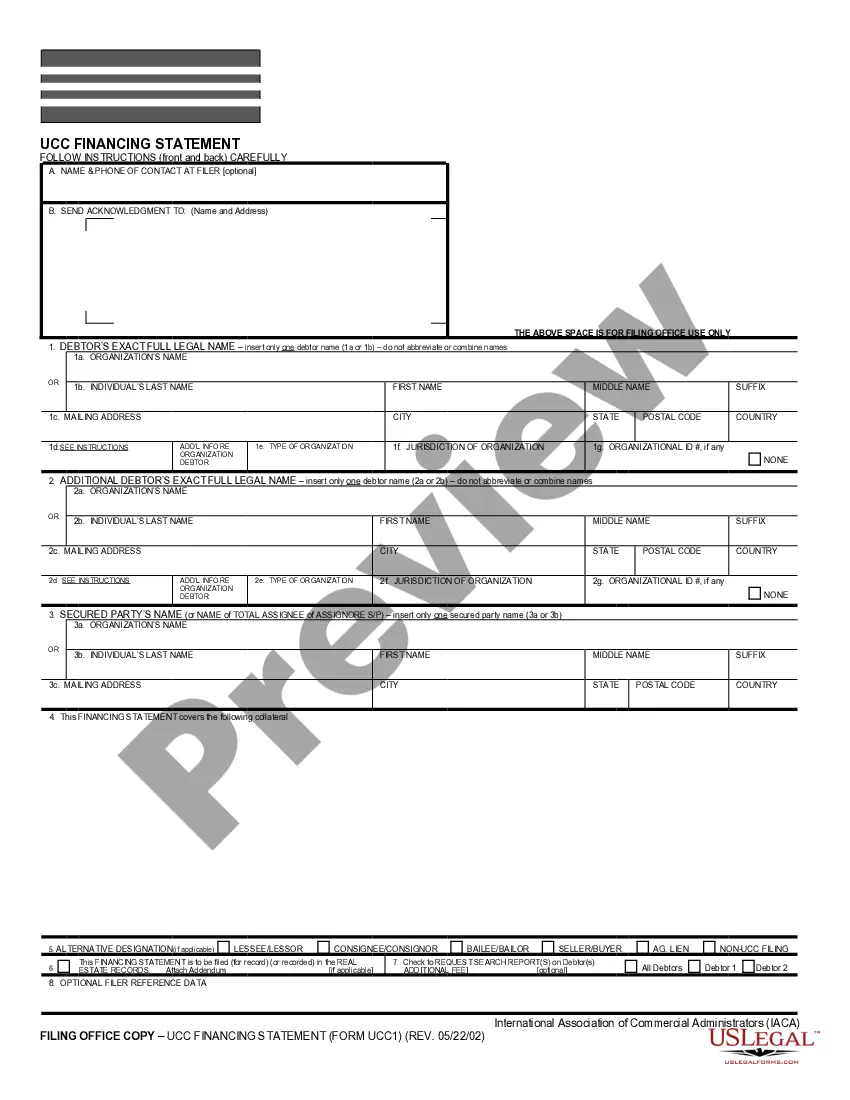

How to fill out Approval Of Deferred Compensation Investment Account Plan?

US Legal Forms - one of the biggest libraries of authorized forms in America - offers a variety of authorized document web templates you are able to acquire or printing. While using internet site, you can find 1000s of forms for enterprise and person functions, sorted by classes, suggests, or search phrases.You can get the newest models of forms like the Pennsylvania Approval of deferred compensation investment account plan in seconds.

If you currently have a membership, log in and acquire Pennsylvania Approval of deferred compensation investment account plan from the US Legal Forms library. The Down load option can look on every kind you look at. You gain access to all previously delivered electronically forms within the My Forms tab of your respective account.

If you wish to use US Legal Forms the very first time, listed below are simple instructions to obtain began:

- Make sure you have picked out the best kind for your town/region. Select the Preview option to analyze the form`s articles. Browse the kind description to actually have selected the right kind.

- If the kind does not match your demands, use the Research area near the top of the monitor to get the one that does.

- If you are satisfied with the shape, validate your option by clicking on the Buy now option. Then, select the costs strategy you want and give your qualifications to sign up on an account.

- Method the purchase. Use your bank card or PayPal account to accomplish the purchase.

- Choose the structure and acquire the shape in your gadget.

- Make changes. Fill up, edit and printing and signal the delivered electronically Pennsylvania Approval of deferred compensation investment account plan.

Each design you added to your money lacks an expiry particular date which is yours for a long time. So, if you would like acquire or printing yet another version, just proceed to the My Forms section and click on on the kind you will need.

Obtain access to the Pennsylvania Approval of deferred compensation investment account plan with US Legal Forms, one of the most extensive library of authorized document web templates. Use 1000s of specialist and status-distinct web templates that fulfill your organization or person requires and demands.

Form popularity

FAQ

Deferred Compensation 457 Plan Your 457 Plan offers a simple, flexible way for you to save for retirement. With it's powerful pretax and Roth saving features, investment options and planning resources, you can work toward replacing your working income in retirement - for life.

Retirement plans and employee pensions are examples of deferred compensation. Employers usually withhold a fraction of employees' compensation every month, accumulate it over time, and pay the lump sum amount on a date previously agreed upon in the employment contract.

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

If you take your deferred compensation payments over a period of 10 years or more, those payments will be taxed in the state where you reside, rather than in the state in which you earned the compensation, possibly reducing your state income taxes.

(f) All amounts deferred under a deferred compensation plan shall constitute taxable income for purposes of the act of March 4, 1971 (P.L. 6, No. 2), known as the "Tax Reform Code of 1971," and shall constitute taxable income for State and local earned income taxes.

If you are a state employee not in education, the SERS manages your pension. If you work in public education, PSERS manages your retirement savings.

?Deferred comp? makes it easy to set aside more money for retirement by allowing you to have some of your pay automatically deducted on a pre-tax basis and invested. You select the amount you want to invest, from as little as $5 per pay to no more than $22,500 per year, which is the IRS limit for 2023.