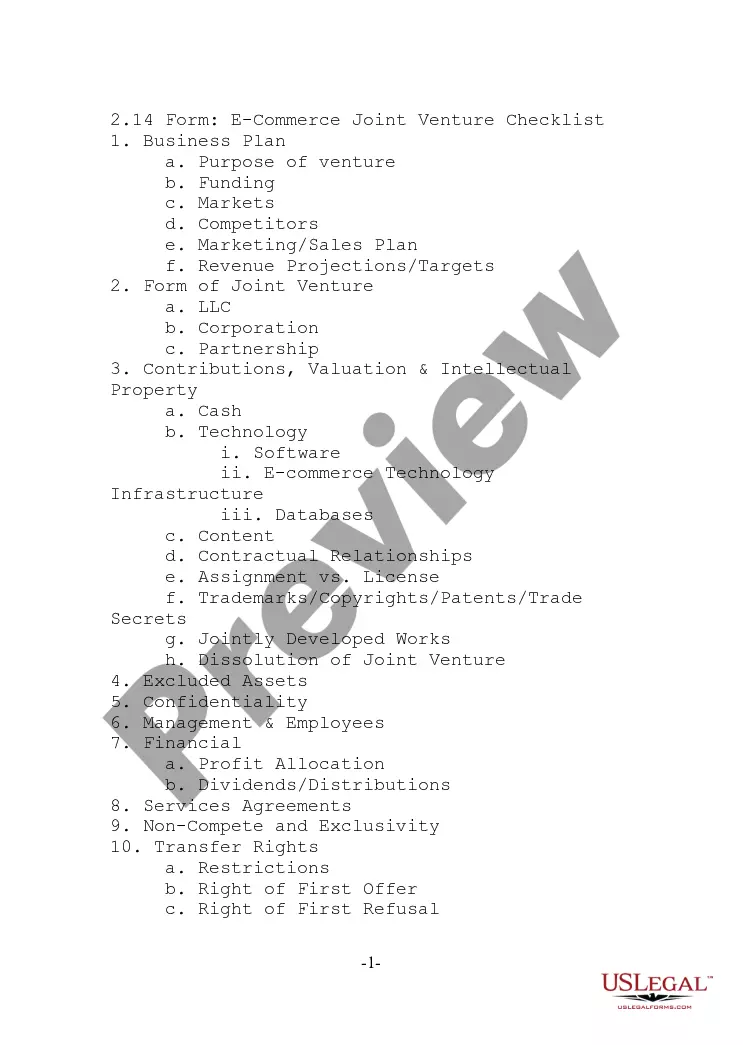

Pennsylvania Proposed Client Intake Sheet - General

Description

How to fill out Proposed Client Intake Sheet - General?

You are able to spend several hours on the Internet searching for the authorized document design that meets the state and federal specifications you need. US Legal Forms supplies a large number of authorized varieties which can be evaluated by pros. It is possible to down load or print out the Pennsylvania Proposed Client Intake Sheet - General from our services.

If you already have a US Legal Forms accounts, you may log in and then click the Download switch. Afterward, you may total, change, print out, or indication the Pennsylvania Proposed Client Intake Sheet - General. Each and every authorized document design you buy is yours permanently. To get one more duplicate of any acquired form, visit the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms internet site initially, stick to the basic guidelines under:

- Initially, make certain you have chosen the correct document design for the county/city of your liking. Browse the form description to ensure you have chosen the correct form. If accessible, utilize the Review switch to search with the document design as well.

- If you want to get one more variation of the form, utilize the Lookup field to get the design that fits your needs and specifications.

- Once you have identified the design you want, click on Buy now to carry on.

- Pick the costs plan you want, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your Visa or Mastercard or PayPal accounts to purchase the authorized form.

- Pick the file format of the document and down load it to your device.

- Make modifications to your document if needed. You are able to total, change and indication and print out Pennsylvania Proposed Client Intake Sheet - General.

Download and print out a large number of document templates while using US Legal Forms Internet site, that provides the biggest selection of authorized varieties. Use professional and status-distinct templates to take on your business or personal requirements.

Form popularity

FAQ

Pennsylvania law requires withholding at a rate of 3.07 percent on non-wage Pennsylvania source income payments made to nonresidents. Withholding of payments that are less than $5,000 during the calendar year are optional and at the discretion of the payor.

Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial sit- uation changes.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Certain types of sellers use this return to report premier resort area tax on taxable sales that take place in (i.e., are sourced to) a premier resort area.

The Local Tax Enabling Act requires businesses with employees working in Pennsylvania to withhold the appropriate local earned income tax and local services tax from payroll.

Pennsylvania Withholding Tax Account Number and Filing Frequency. If you are a new business, register online with the PA Department of Revenue to retrieve your account number and filing frequency. You can also contact the agency at 1-888-PATAXES (1-888-728-2937).

For each payroll period, an employer must calculate the tax to be withheld from an employee's compensation by multiplying such compensation subject to withholding by the current per- centage rate, 3.07%, which can be found by visiting the department's Online Customer Service Center at .revenue.pa.gov.

Definition of an Employer Employers are required to withhold PA personal income tax at a flat rate of 3.07 percent of compensation from resident and nonresident employees earning income in Pennsylvania. This rate remains in effect unless you receive notice of a change from the Department of Revenue.