Pennsylvania Notice of Annual Report of Employee Benefits Plans

Description

How to fill out Notice Of Annual Report Of Employee Benefits Plans?

Have you ever been in a situation where you needed documents for either business or personal reasons every day.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of document templates, including the Pennsylvania Notice of Annual Report of Employee Benefits Plans, which are designed to comply with state and federal regulations.

Once you locate the appropriate form, click on Get now.

Select the payment plan you prefer, fill in the required details to create your account, and pay for the order using your PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Pennsylvania Notice of Annual Report of Employee Benefits Plans template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/area.

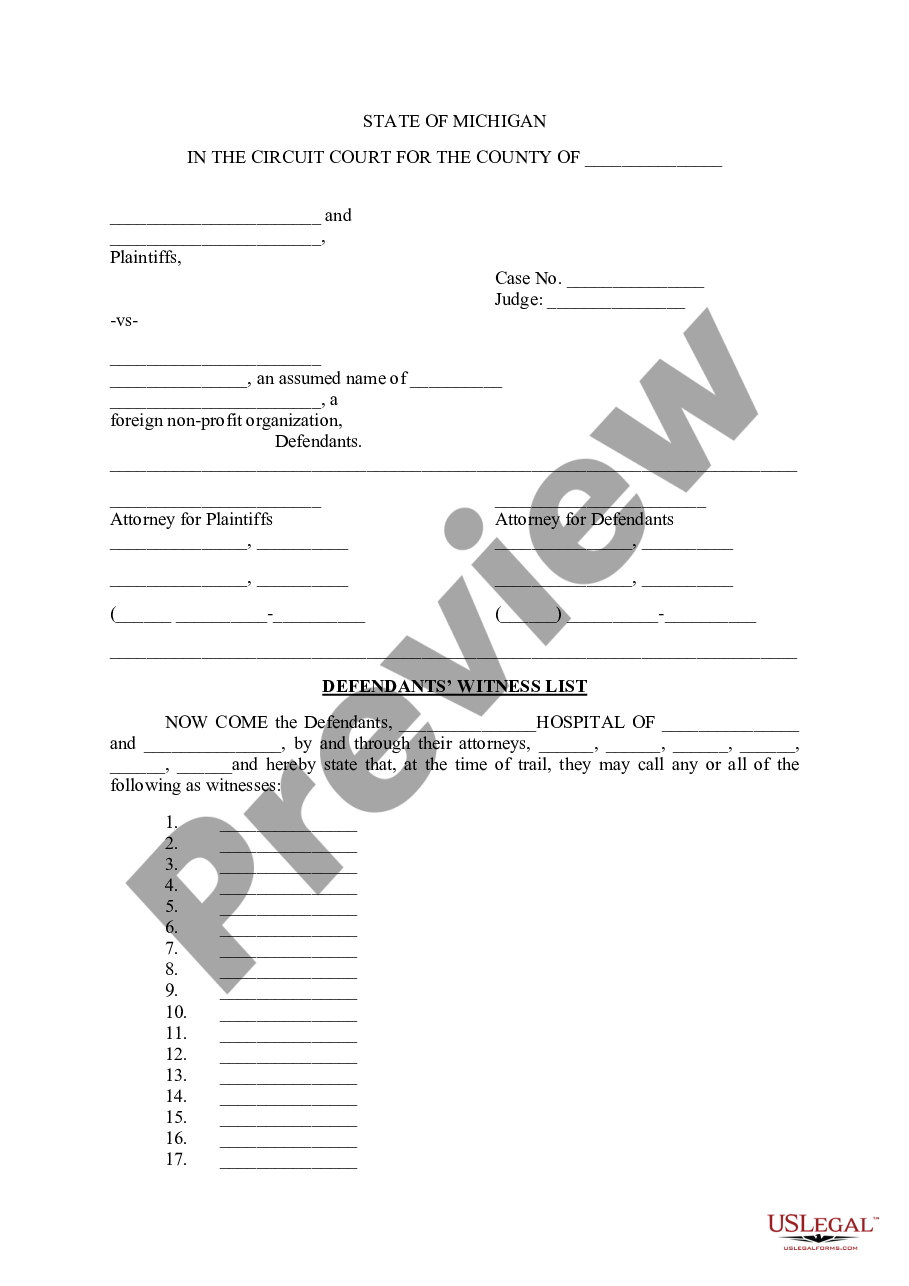

- Use the Preview feature to review the form.

- Check the description to make sure you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

Pennsylvania Employees Benefit Trust Fund (PEBTF)The PEBTF administers health care benefits for approximately 76,000 eligible commonwealth employees and their dependents. It is governed by a Board of Trustees comprised of both commonwealth and union representatives.

Which employers must distribute the SAR? Employers who sponsored health plans with 100 or more enrollees on the first day of the 2019 plan year were required to file a Form 5500 in 2020. Employers who filed a Form 5500 must also distribute the SAR, which is a summary of the Form 5500.

Share on: A new Pennsylvania law (Act 9 of 2020) requires Pennsylvania employers to provide notice to employees about unemployment compensation benefits at the time of separation from employment or when an employee's work hours are reduced.

Employees who become participants covered under the plan are entitled to receive a SAR after they have satisfied the plan's eligibility requirements, regardless of whether they elect to make deferrals, and former employees remain participants in the plan (and thus are entitled to receive an SAR) until they no longer

Defined Benefit Plan rules require that employers provide a meaningful benefit to at least 40% of nonexcludable employees. However, the requirement is capped at 50 employees. Additionally, if there are fewer than three employees, all employees must receive a meaningful benefit.

This notice is intended to provide a summary of plan information to participating employers and employee representatives of the Alaska Ironworkers Pension Plan (Plan). This notice is required to be provided by Section 104(d) of the Employee Retirement Income Security Act (ERISA).

PA Employer UC Account Number This seven-digit number is shown on the New Employer Confirmation Letter (Form UC-1408), Notice of Pennsylvania Unemployment Compensation Responsibilities (Form UC-851), and the Contribution Rate Notice (Form UC-657).

The Summary Annual Report (SAR) provides a narrative summary of the financial information contained on the Form 5500 and a statement of the right to receive an annual report.

Each year, the plan administrator of a plan that is not exempt from filing a Form 5500 must provide a summary annual report (SAR) to the participants within nine months after the end of the plan year.

UC-1609 (PDF): Employer Information Form Size=153k You must provide this completed form to separating employees and/or employees working reduced hours. It provides accurate information for use when unemployment claims are filed.