Pennsylvania Service Bureau Form

Description

How to fill out Service Bureau Form?

Locating the appropriate legitimate document template may pose a challenge.

Certainly, there are numerous formats accessible online, but how do you obtain the authentic document you require.

Utilize the US Legal Forms website. The service offers thousands of formats, including the Pennsylvania Service Bureau Form, which can be utilized for both business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate document.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Pennsylvania Service Bureau Form.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

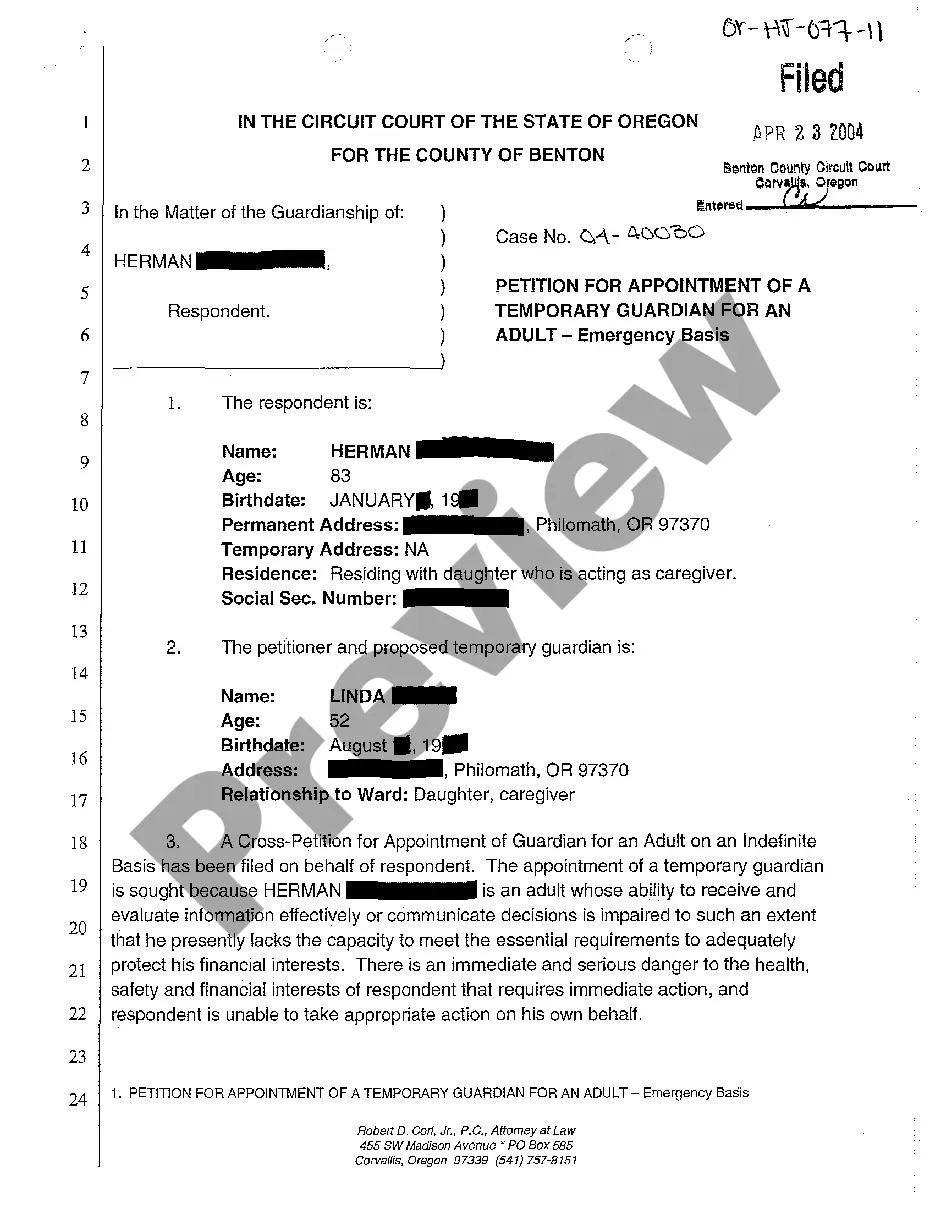

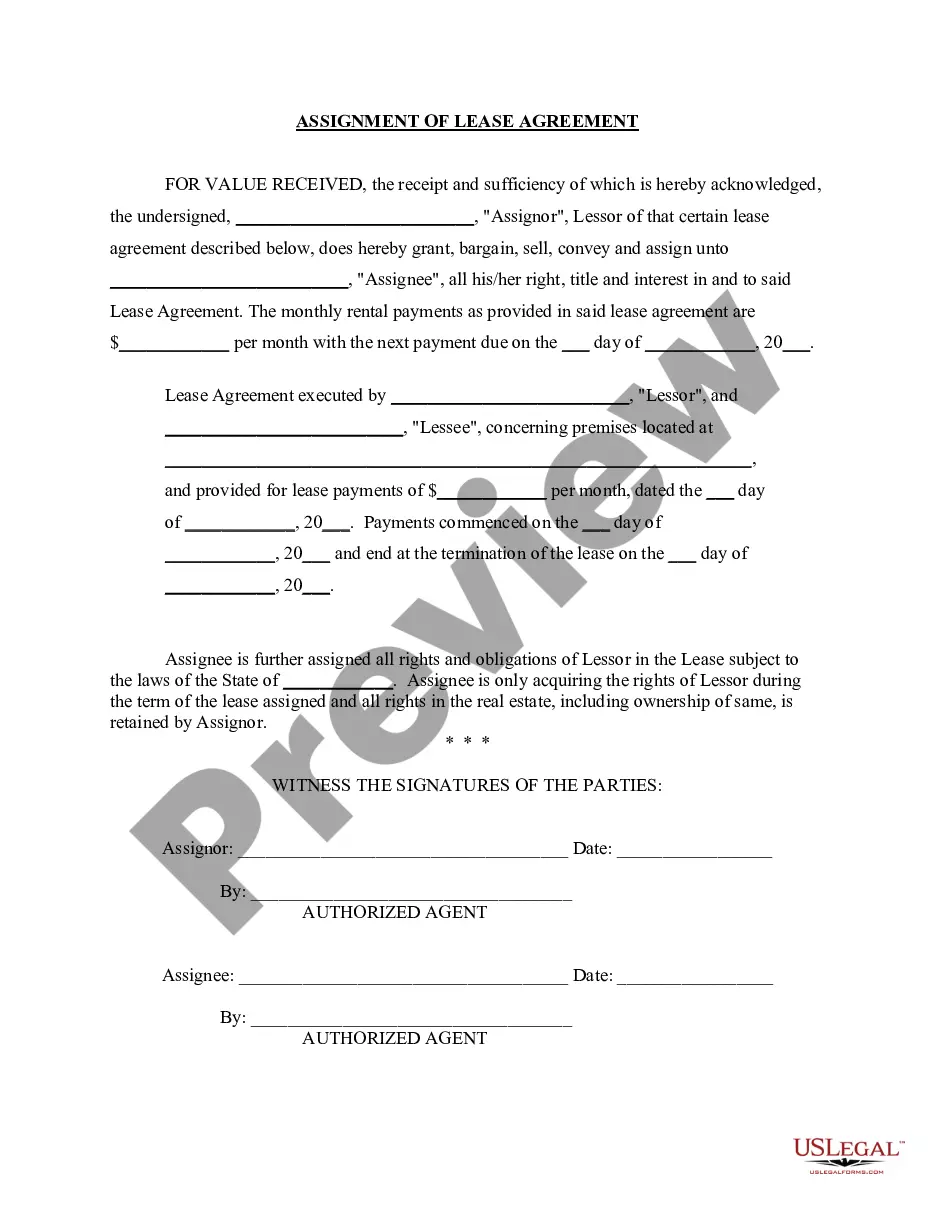

- First, ensure you have selected the correct form for your city/county. You can view the form using the Preview button and read the form details to confirm this is suitable for you.

Form popularity

FAQ

Dissolving an LLC in Pennsylvania costs $149 per person. You'll have to file certain documents and pay any outstanding taxes before you can dissolve your LLC. These documents, called Articles of Dissolution, must be filed with the Pennsylvania Department of State.

To withdraw or cancel your foreign corporation in Pennsylvania, you provide the completed Application for Termination of Authority Foreign Corporation (DSCB: 15-4129/6129) form to the Department of State by mail, in person, or online, along with the filing fee.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

A docketing statement PA is a supplemental form that is used to create a new business entity in the state of Pennsylvania. The docketing statement will be included with the submission for your new business and certificate of organization when you file it with the Pennsylvania Department of State.

Your filing usually will be processed within about one week. The DOS has a certificate of dissolution form available for download.

Business Corporation (§ 1902) Nonprofit Corporation (A§ 5902) In compliance with the requirements of the applicable provisions of 15 Pa.C.S. A§ 1902 or A§ 5902 (relating to. Statement of termination), the undersigned, desiring to terminate an amendment that has not yet become effective, hereby.

What Is Form DSCB:15-134A? Form DSCB:15-134A, Docketing Statement - New Entity, is a one-page form to register your new Pennsylvania LLC for tax purposes. This PA Docketing Statement is submitted to the Pennsylvania Department of Revenue for the purpose of assigning your LLC a Pennsylvania Tax ID number.

Docketing statement is a statement that is filed at the beginning of the appeal. The docketing statement facilitates efficient processing of appeals by allowing the court of appeal to quickly identify jurisdictional problems, and appropriate settlement cases.

To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company (DCSB: 15-8975/8978) form to the Department of State by mail, in person, or online.

How to Dissolve an LLCConfirm the Company Is in Good Standing.Hold a Vote to Dissolve the Business.File LLC Articles of Dissolution.Notify the Company's Stakeholders.Cancel Business Licenses and Permits.File the LLC's Final Payroll Taxes.Pay Final Sales Tax.File Final Income Tax Returns.More items...?