Michigan Model Notice of Blackout Periods under Individual Account Plans

Description

How to fill out Model Notice Of Blackout Periods Under Individual Account Plans?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a selection of legal document templates that you can download or print.

By utilizing the website, you can find thousands of templates for business and personal use, organized by type, state, or keywords. You can locate the latest templates, such as the Michigan Model Notice of Blackout Periods under Individual Account Plans, in just a few minutes.

If you already have an account, Log In to download the Michigan Model Notice of Blackout Periods under Individual Account Plans from the US Legal Forms library. The Download option will appear on every template you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the template to your device. Edit. Fill out, modify, print, and sign the downloaded Michigan Model Notice of Blackout Periods under Individual Account Plans. Every template you add to your account has no expiration date and is yours permanently. So, if you need to download or print another copy, simply go to the My documents section and click on the template you need. Access the Michigan Model Notice of Blackout Periods under Individual Account Plans with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct template for your city/state. Click on the Review option to examine the template’s details.

- Read the template description to confirm you have chosen the appropriate one.

- If the template does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the template, confirm your selection by clicking the Download now button.

- Then, select your preferred payment plan and provide your information to register for your account.

Form popularity

FAQ

Employers must distribute the SAR to each plan participant covered under the plan during the applicable plan year, including COBRA participants and terminated employees who were covered under the plan. For instance, the Form 5500 (and the associated SAR) filed in 2020 pertain the to the plan that was offered in 2019.

These include Summaries of Material Modifications (SMMs), Summary Annual Reports (SARs), and notices regarding changes to investment funds and certain other information in the Annual Fee Disclosure.

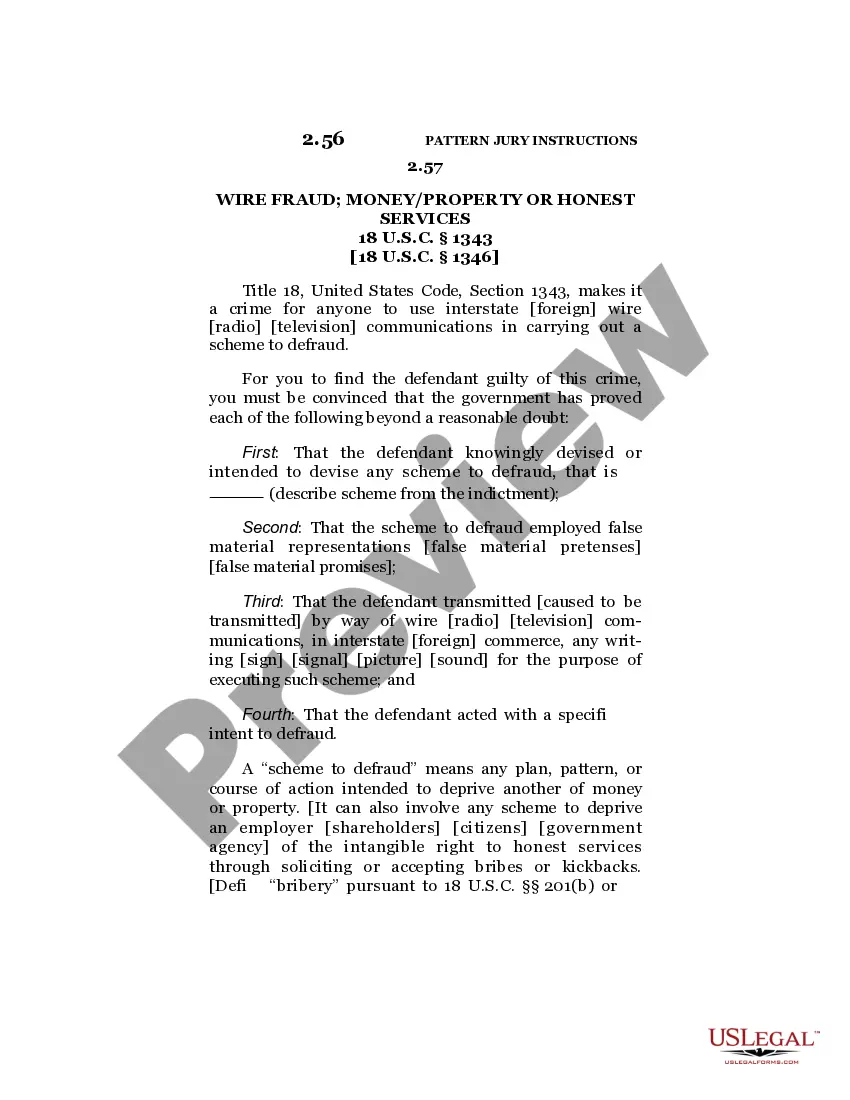

A blackout notice should contain information on the expected beginning and end date of the blackout. The notice should also provide the reason for the blackout and what rights will be restricted as a result. The notice must specify a plan contact for answering any questions about the blackout period.

The new law says that written notice must be given to participants and beneficiaries at least 30 days before the blackout period begins and not more than 60 days before. Failure to issue notification of a blackout period may result in severe penalties.

A blackout period is a time when participants are not able to access their 401(k) accounts because a major plan change is being made. During this time, they are not allowed to direct their investments, change their contribution rate or amount, make transfers, or take loans or distributions.

There is a mandatory 2 week blackout period for all employees of the Company prior to the release of quarterly and annual financial statements which shall continue until two trading days after the time such information has been released to the public.

A blackout period in financial markets is a period of time when certain peopleeither executives, employees, or bothare prohibited from buying or selling shares in their company or making changes to their pension plan investments. With company stock, a blackout period usually comes before earnings announcements.

Black-out periods. occur when the ability of plan participants to take certain actions is temporarily. suspended. Sarbanes-Oxley requires that participants receive advance written. notice of certain black-out periods, and restricts the ability of insiders to trade in.

A blackout period is a temporary interval during which access to certain actions is limited or denied. The primary purpose of blackout periods in publicly traded companies is to prevent insider trading. A blackout period for an employee retirement plan temporarily prevents participants from modifying their plans.