Pennsylvania Agreement between Co-lessees as to Payment of Rent and Taxes

Description

How to fill out Agreement Between Co-lessees As To Payment Of Rent And Taxes?

If you have to complete, down load, or print out lawful record themes, use US Legal Forms, the largest collection of lawful forms, which can be found on the web. Make use of the site`s basic and convenient search to find the paperwork you want. A variety of themes for organization and personal reasons are sorted by classes and states, or keywords. Use US Legal Forms to find the Pennsylvania Agreement between Co-lessees as to Payment of Rent and Taxes in just a handful of mouse clicks.

If you are presently a US Legal Forms customer, log in to the profile and click the Down load key to get the Pennsylvania Agreement between Co-lessees as to Payment of Rent and Taxes. Also you can accessibility forms you formerly downloaded inside the My Forms tab of your profile.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for your correct town/land.

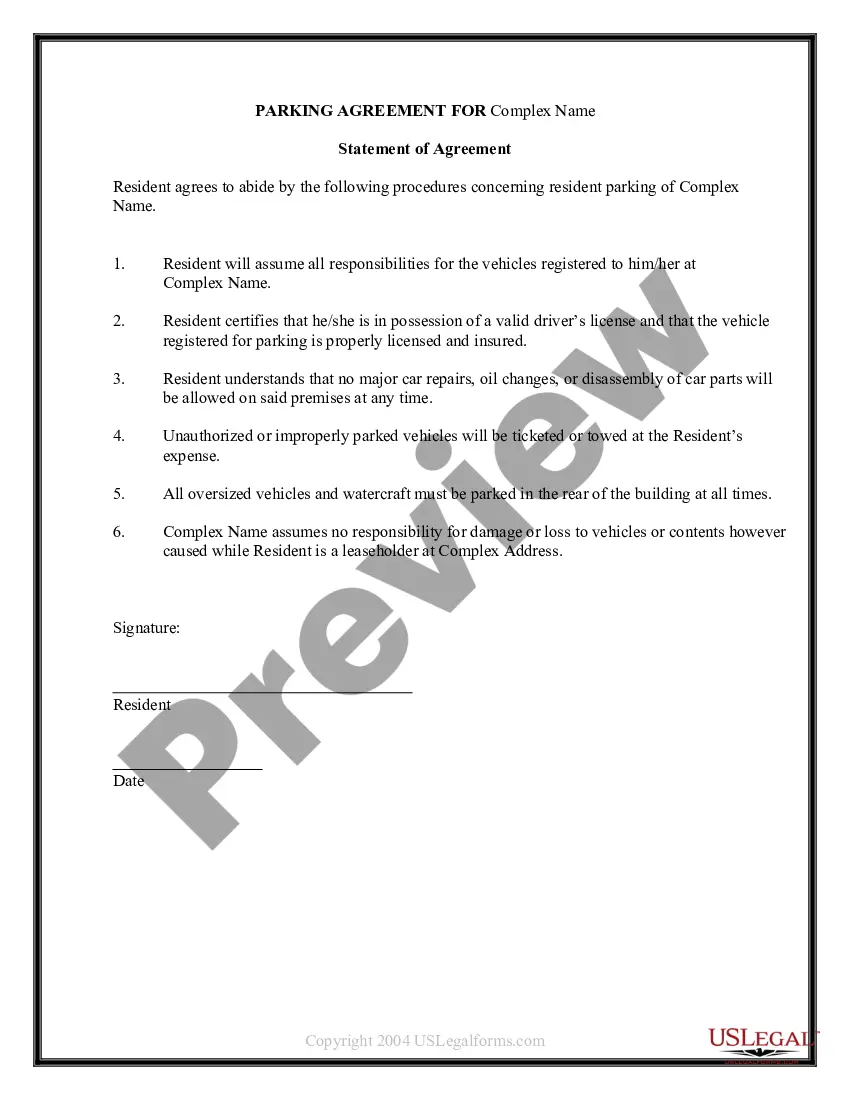

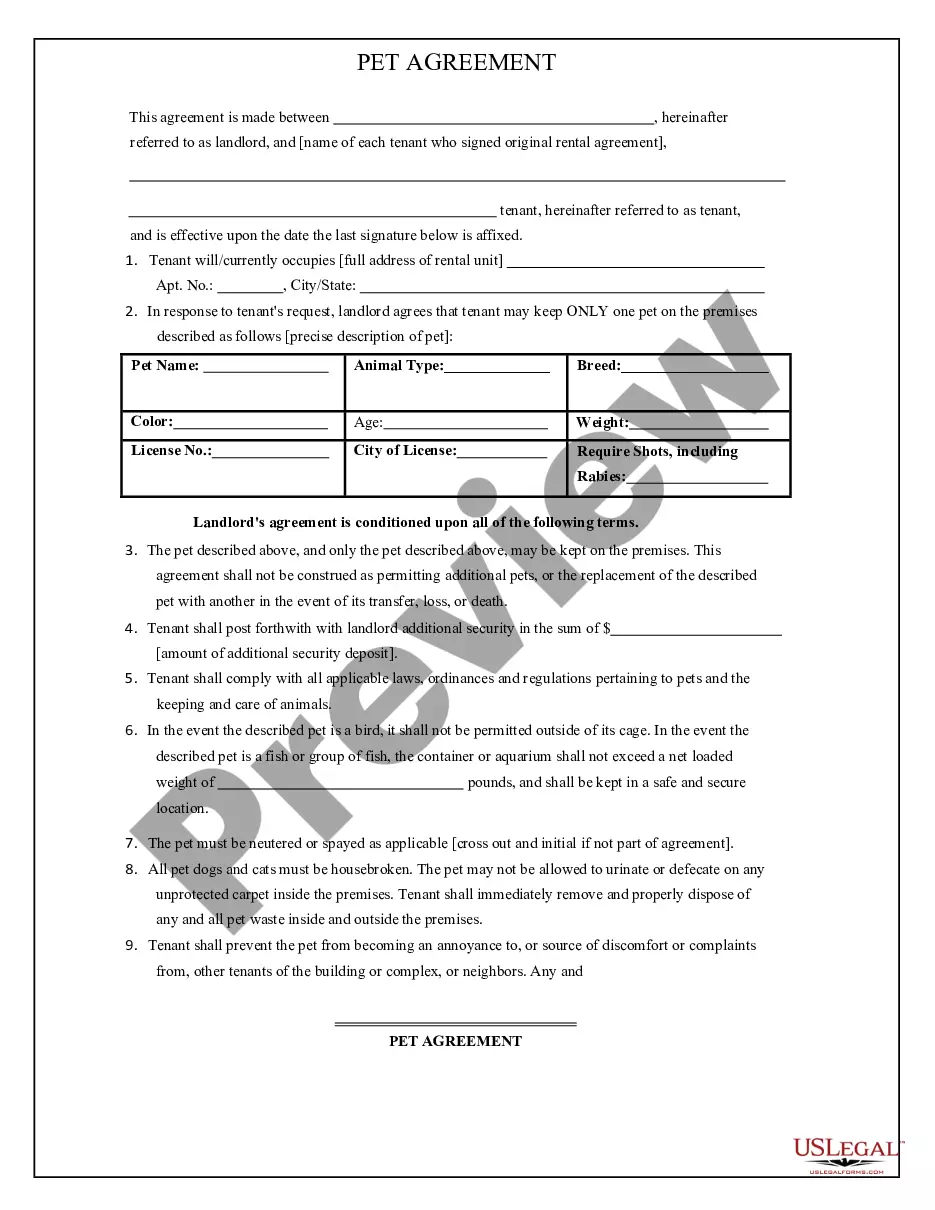

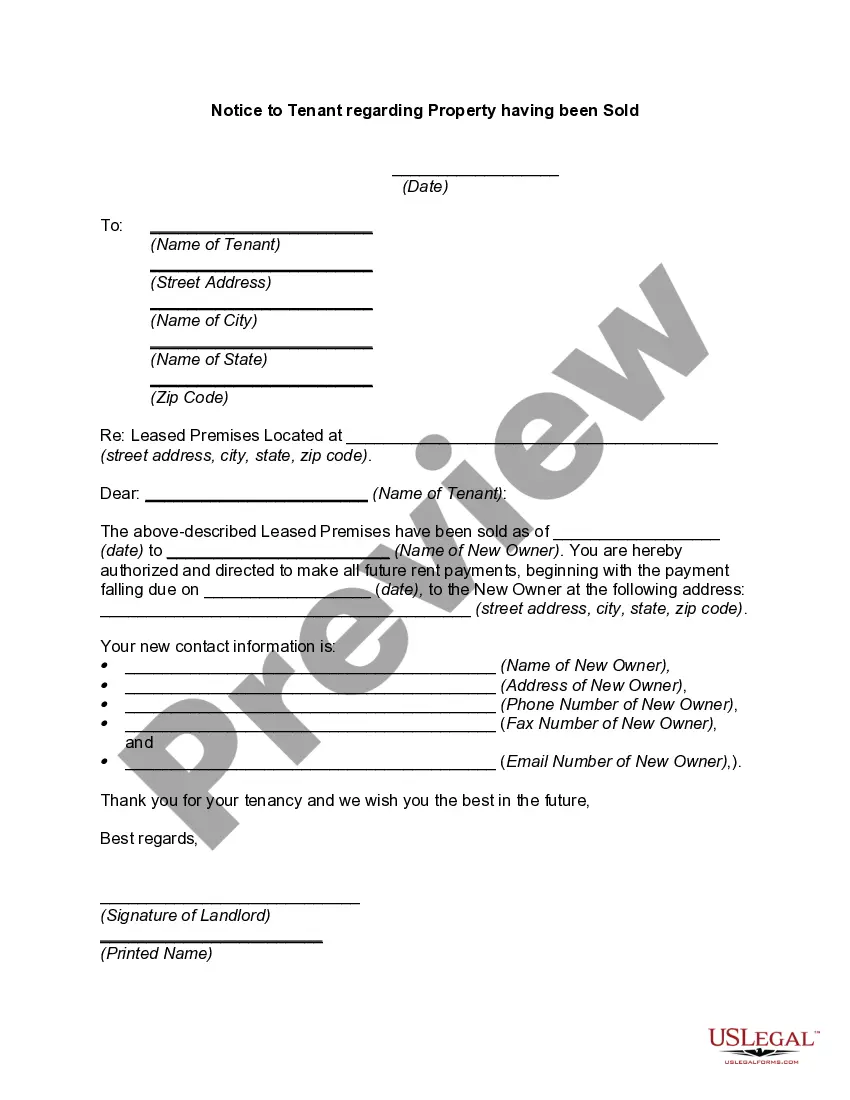

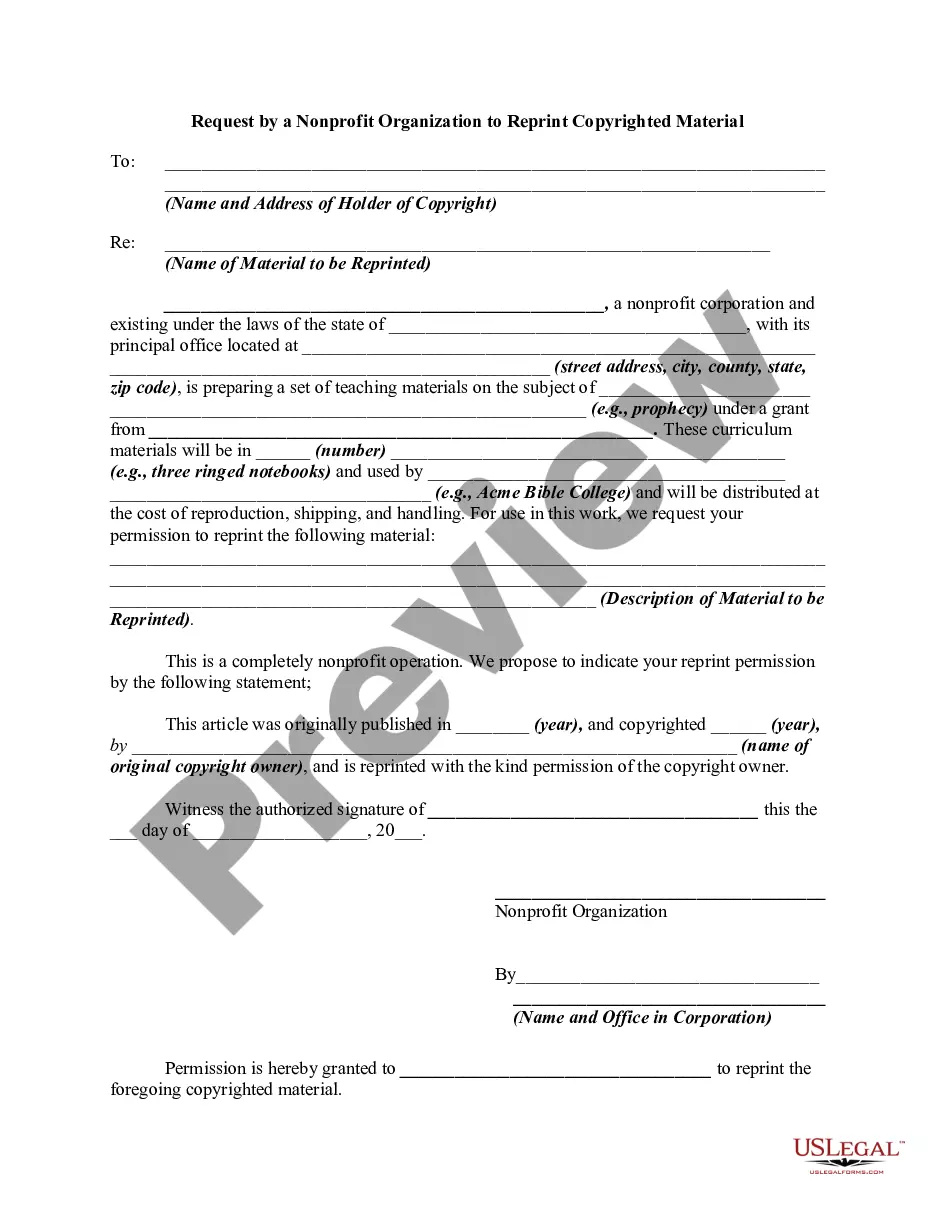

- Step 2. Utilize the Preview solution to look over the form`s content. Don`t forget about to learn the outline.

- Step 3. If you are not happy together with the type, take advantage of the Lookup discipline near the top of the display to find other variations in the lawful type design.

- Step 4. Once you have discovered the shape you want, go through the Purchase now key. Opt for the prices program you choose and put your accreditations to sign up on an profile.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal profile to complete the purchase.

- Step 6. Find the formatting in the lawful type and down load it on your own device.

- Step 7. Complete, modify and print out or sign the Pennsylvania Agreement between Co-lessees as to Payment of Rent and Taxes.

Each and every lawful record design you acquire is your own property eternally. You may have acces to each and every type you downloaded inside your acccount. Go through the My Forms section and pick a type to print out or down load again.

Contend and down load, and print out the Pennsylvania Agreement between Co-lessees as to Payment of Rent and Taxes with US Legal Forms. There are many professional and condition-specific forms you can utilize for your personal organization or personal needs.

Form popularity

FAQ

Under the right to a safe and habitable home, a landlord cannot force a tenant to move into a home or unit ?as-is? and cannot demand that the tenant be responsible for repairs. To be safe, and habitable, a unit or home should have: Working smoke alarms. Working hot water.

Schedule E is used to report income for individual partners in a partnership and for owners of S corporations. The income of the business for the year is calculated and the profits or losses are distributed to the owners in the form of a Schedule K-1.

PERSONAL INCOME TAX (PA-40 ES) Use the 2023 Form PA-40 ES-I to make your quarterly estimated payment of tax owed.

In Pennsylvania, rental income is taxed as personal income. Personal income in Pennsylvania is taxed at the rate of 3.07%. However, you can offset this cost to be even less by deducting operating expenses from your rental income.

Schedule E vs Schedule C Explained Well, Schedule C is the form taxpayers have to fill out for active income businesses, while Schedule E is the one investors usually fill out for their passive income businesses.

The tenant may be responsible for electric and gas while the landlord is responsible for water and sewer. If your lease is in writing, make sure that the lease outlines who is responsible to pay for utilities.

Use PA-40 Schedule E to report the amount of net income (loss) from rents royalties, patents and copyrights for indi- vidual or fiduciary (estate or trust) taxpayers. Refer to the PA Personal Income Tax Guide ? Net Income (Loss) from Rents, Royalties, Copyrights and Patents sec- tion for additional information.

If you earn rental income on a home or building you own, receive royalties or have income reported on a Schedule K-1 from a partnership or S corporation, then you must prepare a Schedule E with your tax return.