Pennsylvania Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

If you wish to total, acquire, or print out legitimate document layouts, use US Legal Forms, the biggest selection of legitimate types, which can be found on-line. Utilize the site`s easy and practical search to find the files you need. A variety of layouts for organization and personal uses are categorized by categories and suggests, or search phrases. Use US Legal Forms to find the Pennsylvania Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse in just a number of clicks.

In case you are currently a US Legal Forms buyer, log in for your account and click the Obtain option to obtain the Pennsylvania Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. Also you can access types you previously downloaded inside the My Forms tab of your respective account.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for the proper area/land.

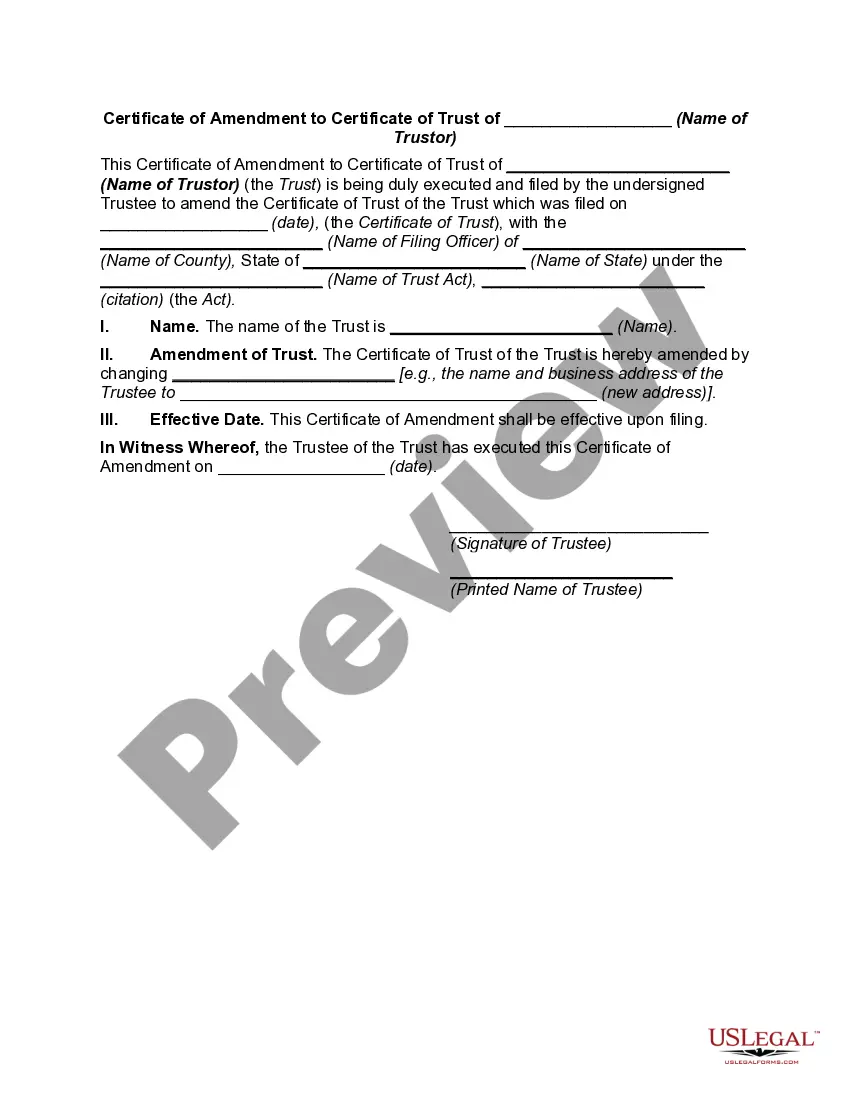

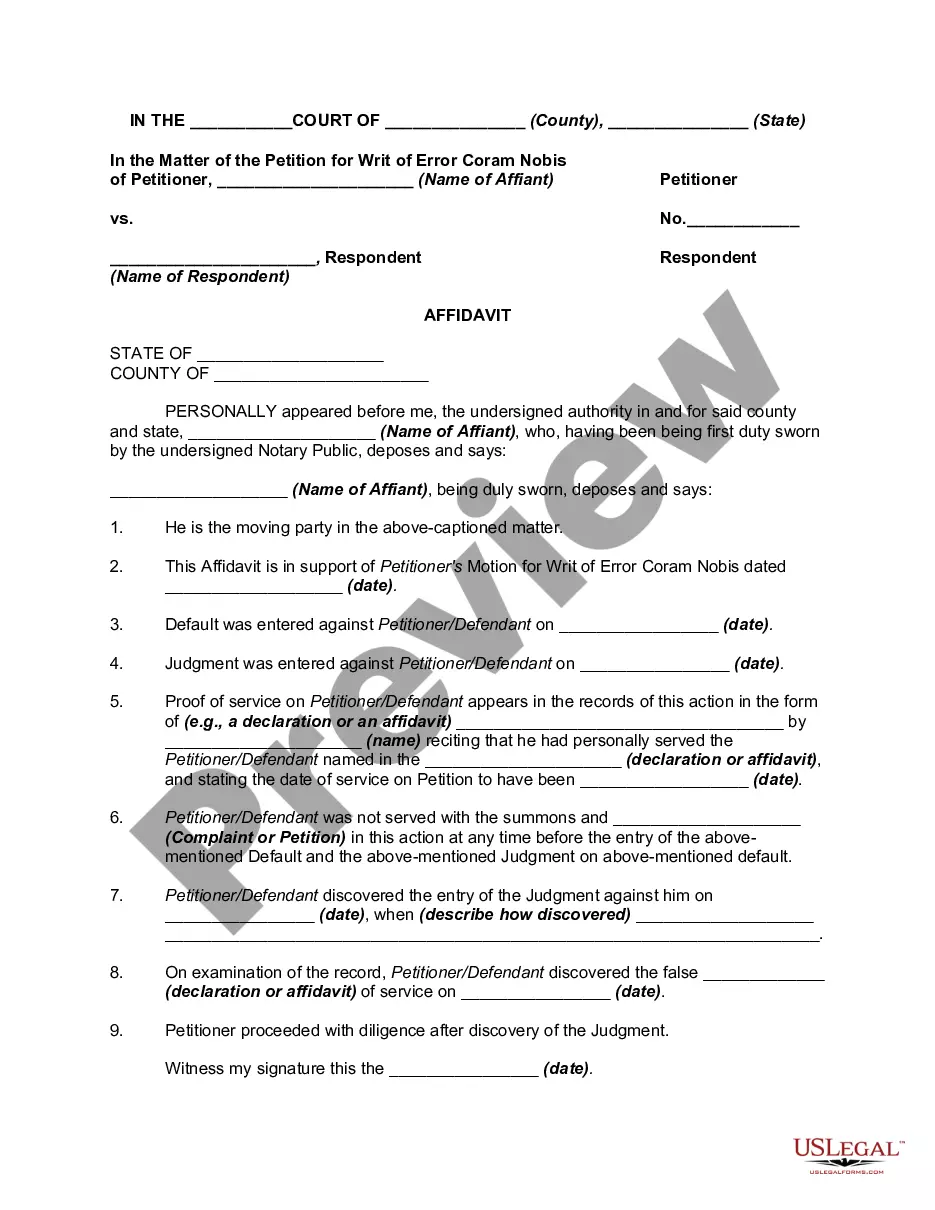

- Step 2. Use the Review option to look over the form`s content. Do not forget to see the explanation.

- Step 3. In case you are not satisfied with all the develop, use the Research field towards the top of the monitor to get other variations from the legitimate develop web template.

- Step 4. After you have discovered the form you need, select the Purchase now option. Pick the prices plan you favor and include your credentials to sign up to have an account.

- Step 5. Procedure the financial transaction. You can utilize your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Select the file format from the legitimate develop and acquire it on your system.

- Step 7. Complete, modify and print out or sign the Pennsylvania Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Each legitimate document web template you purchase is your own property eternally. You possess acces to each develop you downloaded with your acccount. Click the My Forms segment and choose a develop to print out or acquire once again.

Remain competitive and acquire, and print out the Pennsylvania Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms. There are millions of expert and status-specific types you may use for the organization or personal requires.

Form popularity

FAQ

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Pennsylvania resident beneficiaries of estates and trusts must report income received or credited from estates or trusts on their PA-40 Pennsylvania Personal Income Tax return as a separate class of income??income derived through estates or trusts??for Pennsylvania personal income tax purposes.

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants). Estate Planning - HRBK Law hrbklaw.com ? hrbk_publications ? estate-planning hrbklaw.com ? hrbk_publications ? estate-planning

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments. What Is a Marital Trust? Benefits, How It Works, and Types Investopedia ? terms ? marital-trust Investopedia ? terms ? marital-trust

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure. Marital Trust | Definition, How It Works, Advantages ... Carbon Collective Investment ? sustainable-investing Carbon Collective Investment ? sustainable-investing

While various types of trusts can be labeled as ?residuary,? broadly speaking, a residuary trust is a trust that contains the remaining property that is not specifically left to a beneficiary in pour-over will, in the trust, or through another trust. What Is a Residuary or Residual Trust? - RMO LLP rmolawyers.com ? Blog rmolawyers.com ? Blog

Assets Owned In a Revocable Trust: Generally, if someone dies owning assets in a revocable trust over which he or she had access and control those assets, those assets will be 100% taxable for Pennsylvania inheritance tax purposes.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.