Pennsylvania Annuity as Consideration for Transfer of Securities

Description

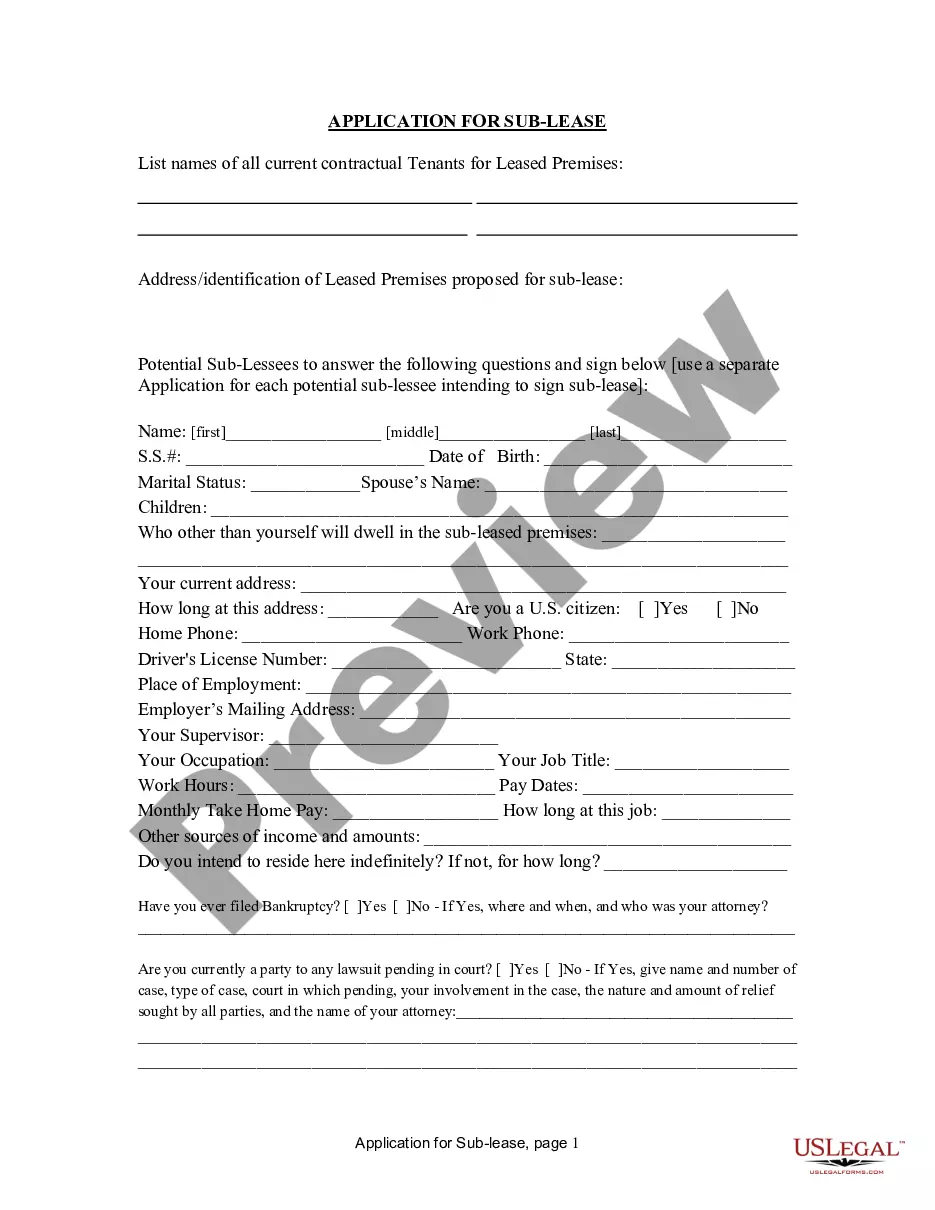

How to fill out Annuity As Consideration For Transfer Of Securities?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's user-friendly and efficient search feature to find the documents you require.

A selection of templates for business and personal purposes is organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Select your preferred pricing plan and provide your details to register for an account.

Step 5. Complete the payment process. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Pennsylvania Annuity as Consideration for Transfer of Securities in just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and select the Download option to obtain the Pennsylvania Annuity as Consideration for Transfer of Securities.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the appropriate form for your region/country.

- Step 2. Use the Preview option to review the contents of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The short answer is yes. Annuities are regulated and protected at the state level. Every state has a nonprofit guaranty organization that each insurance company operating in that state must join. In the event that a member company fails, the other companies in the guaranty association help pay the outstanding claims.

The SEC regulates only indexed annuities that are securities. 1These indexed annuities can expose investors to investment losses. If the indexed annuity is a security, generally a prospectus will be delivered to you.

In the case of annuities, you can surrender your existing contract for another annuity with a different insurance company without fear of IRS penalties or restrictions.

While some have referred to annuity sales as the wild west, devoid of oversight, all annuities are regulated by state insurance commissioners. And variable annuities are also governed at the federal level by the Securities and Exchange Commission and the Financial Industry Regulatory Authority.

Annuity income that is part of a qualified retirement plan, and the recipient has reached age 59 1/2, is not subject to Pennsylvania income tax. For nonqualified annuities, the earnings are taxable but the return of contributions would not be taxable to Pennsylvania.

Suitability Information Gathered by an InsurerAge.Annual income.Financial situation and needs, including the financial resources you're using to fund the annuity.Financial experience.Financial goals and objectives.Intended use of the annuity.Financial time horizon.More items...

Regulation. Variable annuities are securities registered with the Securities and Exchange Commission (SEC), and sales of variable insurance products are regulated by the SEC and FINRA.

An annuity consideration or premium is the money an individual pays to an insurance company to fund an annuity or receive a stream of annuity payments. An annuity consideration may be made as a lump sum or as a series of payments, often referred to as contributions.

Annuity is a contract in between the insurance company (i.e., the party granting the annuity) and the annuitant (receiver of annuity) whereby in consideration of the payment of a purchase price by the annuitant, the other party (i.e., the insurance company) undertakes to make a yearly or annual payment to the annuitant

Annuities are not FDIC insured and are not bank deposits. Although each state does have its own guaranty fund, it should not be thought of as a substitute for FDIC insurance.