Pennsylvania Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

Have you been in a situation where you require documents for either organizations or individual tasks almost daily.

There are numerous authorized document templates accessible online, but finding reliable ones isn't easy.

US Legal Forms offers thousands of template documents, such as the Pennsylvania Private Annuity Agreement, specifically designed to meet state and federal regulations.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Choose a convenient file format and download your copy. You can access all the document templates you have acquired in the My documents section. You can obtain an additional copy of the Pennsylvania Private Annuity Agreement anytime; just click on the required document to download or print it.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Pennsylvania Private Annuity Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/area.

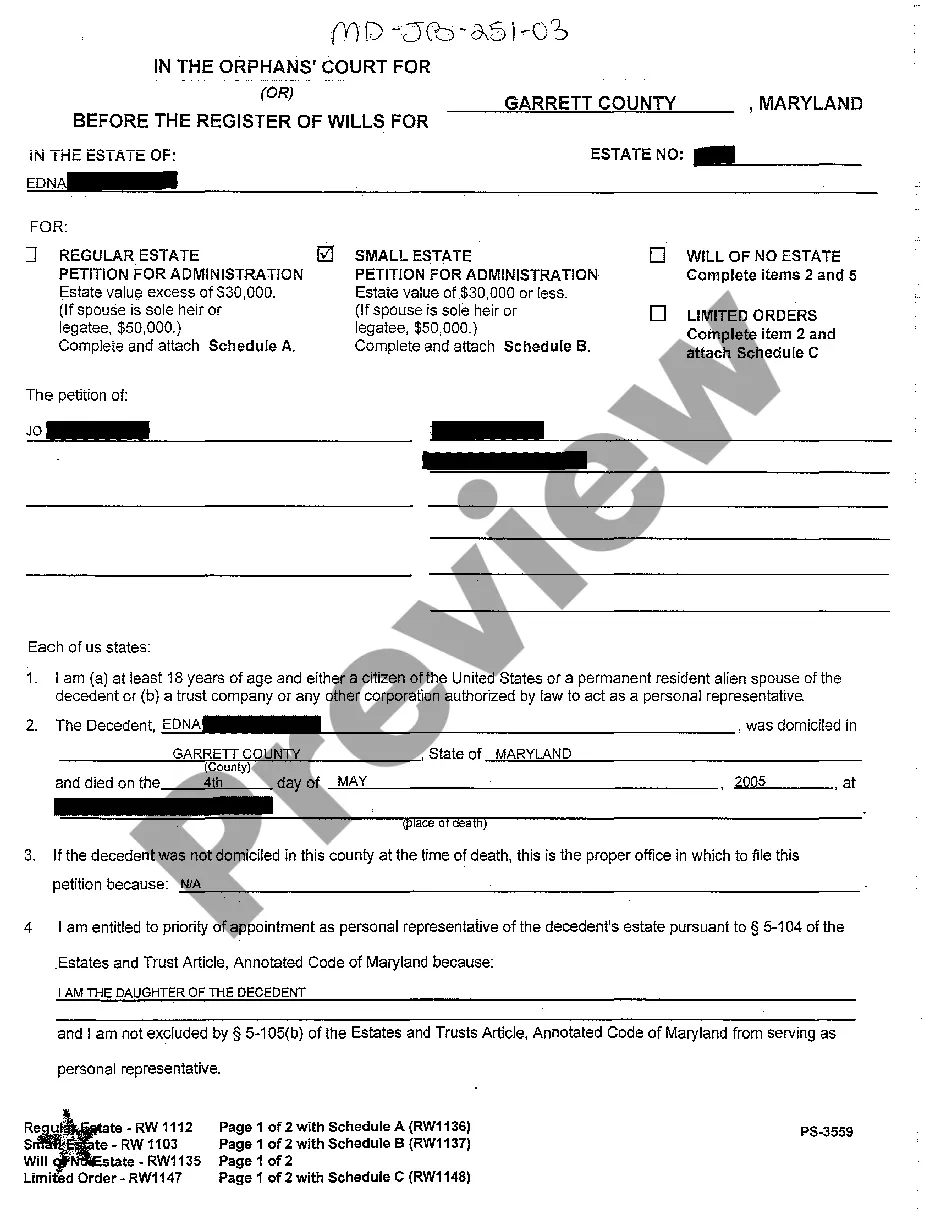

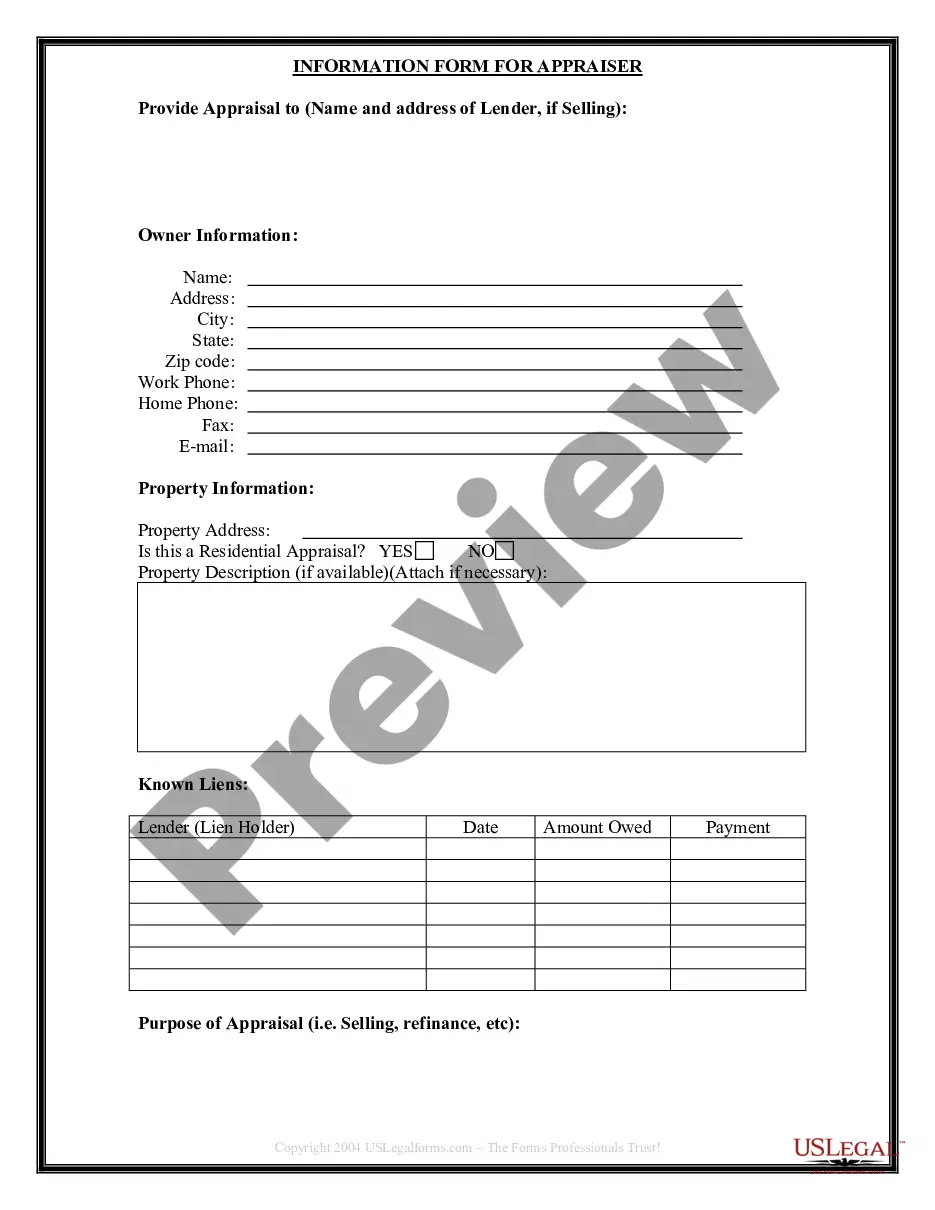

- Click the Review button to examine the form.

- Read the description to verify you have selected the appropriate document.

- If the document is not what you are seeking, use the Search field to find the document that meets your requirements.

- Once you find the correct document, click Purchase now.

Form popularity

FAQ

Setting up an annuity involves choosing the right type, determining the funding source, and selecting a trusted provider. It's crucial to review your financial goals and how a Pennsylvania Private Annuity Agreement aligns with them. Consulting with a knowledgeable advisor can further ensure that your annuity setup is both effective and aligned with your long-term financial strategy.

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

Neither public nor private pension income is taxed in Pennsylvania, which offers an advantage over nearby states such as New Jersey, New York and Maryland, which tax pensions.

Insuring the life of the transferee is an available option; however, any connection of the life insurance policy to the private annuity will be deemed as a secured transaction.

Annuity income that is part of a qualified retirement plan, and the recipient has reached age 59 1/2, is not subject to Pennsylvania income tax. For nonqualified annuities, the earnings are taxable but the return of contributions would not be taxable to Pennsylvania.