Pennsylvania Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

Are you currently in a position where you need documents for various business or personal activities almost daily.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of document templates, such as the Pennsylvania Withheld Delivery Notice, which are designed to meet federal and state requirements.

Once you find the appropriate form, click Get now.

Select a payment plan you prefer, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Pennsylvania Withheld Delivery Notice template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is applicable to your specific area/county.

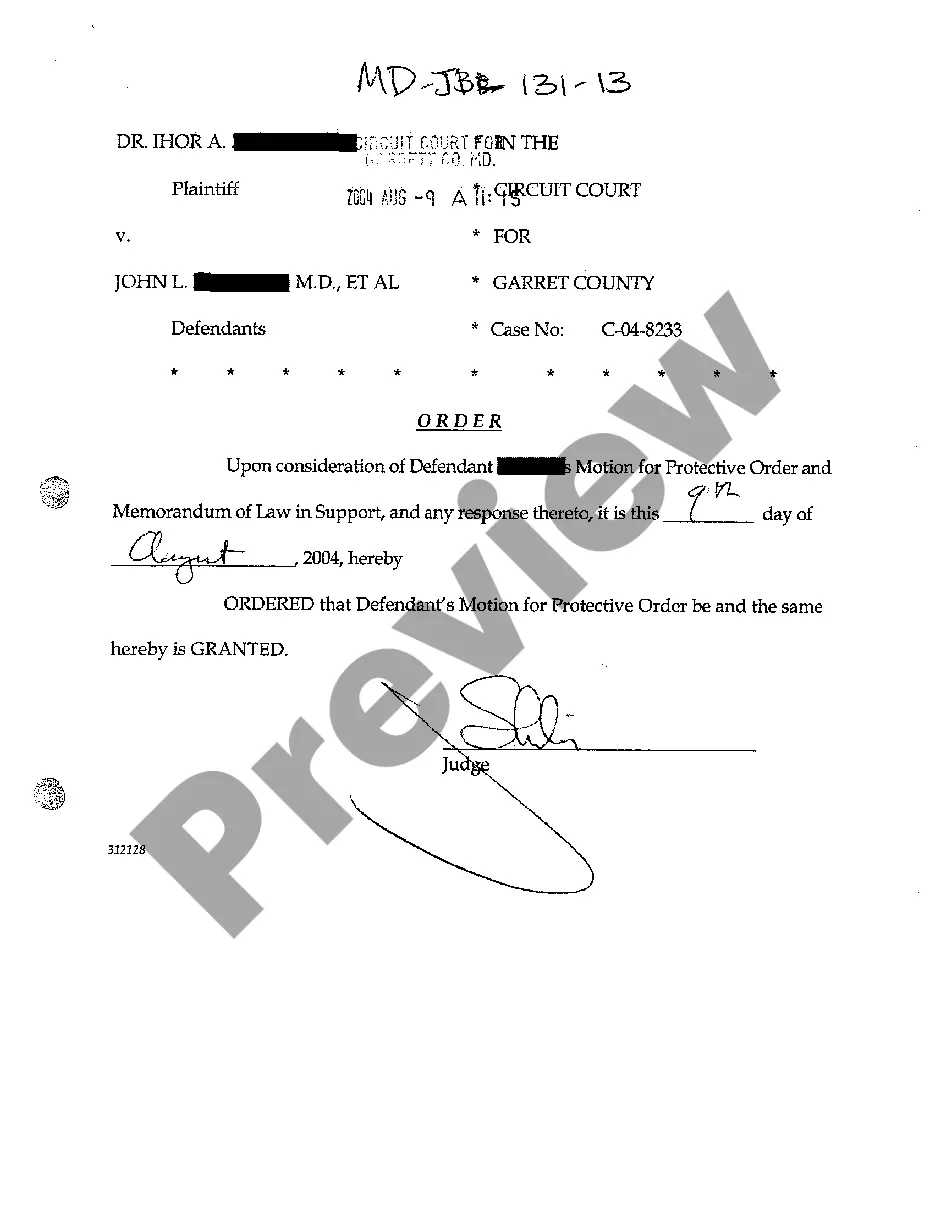

- Utilize the Review button to examine the document.

- Check the description to confirm you have chosen the correct form.

- If the document isn't what you need, use the Search field to find a form that fits your requirements.

Form popularity

FAQ

Employers are required to withhold PA personal income tax at a flat rate of 3.07 percent of compensation from resident and nonresident employees earning income in Pennsylvania. This rate remains in effect unless you receive notice of a change from the Department of Revenue.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

40 form is the Pennsylvania Department of Revenue's official paper form that the state's residents use to file state income taxes. Pennsylvania is one of the 41 U.S. states that require residents to pay a personal income tax each year.

Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax (EIT) and Local Services Tax (LST) on behalf of their employees working in PA.

Purpose. Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial situa- tion changes. Photocopies of this form are acceptable.

Taxpayers can utilize a new online filing system to file their 2020 Pennsylvania personal income tax returns for free. Visit mypath.pa.gov to access the new system, which also allows taxpayers to make payments, view notices, update account information and find the answers to frequently asked questions.

The following states require state tax withholding whenever federal taxes are withheld. We will apply the state's default with- holding rate to the taxable portion of your distribution if you reside in: Iowa, Kansas, Maine, Massachusetts, Nebraska, Oklahoma, or Virginia. You may not elect out of state withholding.

Pennsylvania requires employers to withhold state income tax from their employees' wages and remit the amounts withheld to the Revenue Department. Every employer that has an office or does business in Pennsylvania that pays compensation must withhold state income tax from each payment of wages to employees.

Is PA a mandatory withholding state? Pennsylvania law requires the withholding of PA personal income tax from compensation of resident employees for services performed either within or outside PA, and from wages of nonresident employees for services performed within PA.