Pennsylvania Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

Selecting the ideal legal document web template can be a challenge.

Clearly, there are numerous designs accessible online, but how can you locate the legal format you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Pennsylvania Sample Letter for Withheld Delivery, which you can use for both business and personal purposes.

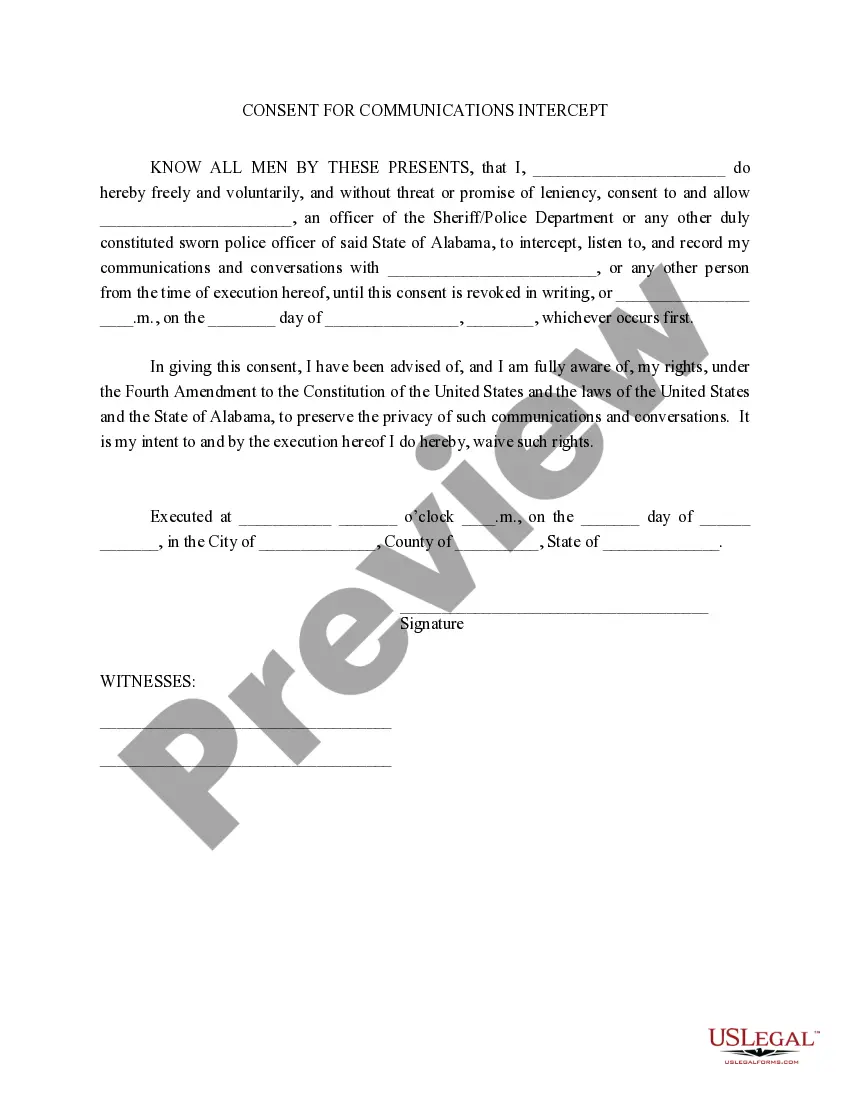

You can preview the document using the Review option and read the document description to ensure it is the right one for you.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click on the Download button to get the Pennsylvania Sample Letter for Withheld Delivery.

- Use your account to search through the legal documents you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, make sure you have chosen the correct document for your city/state.

Form popularity

FAQ

A certified letter from the Pennsylvania Department of Revenue indicates that the matter is urgent and requires your immediate attention. This may relate to compliance issues, audits, or significant tax obligations. Responding appropriately with a Pennsylvania Sample Letter for Withheld Delivery can ensure your position is clearly articulated.

A letter from the Pennsylvania Department of Revenue typically means you need to address a tax matter. This could involve payment reminders, requests for documentation, or notices of audits. Understanding the context of the letter is crucial, and if in doubt, using a Pennsylvania Sample Letter for Withheld Delivery to respond can streamline your communication.

Receiving a letter from the Pennsylvania Department of Treasury often pertains to state funds or tax information, possibly regarding unclaimed property or tax liabilities. This correspondence may require your attention to resolve any outstanding issues. If you need assistance, a Pennsylvania Sample Letter for Withheld Delivery can facilitate a clearer dialogue.

Yes, Pennsylvania does have a state withholding form, known as the PA-W4. This form allows employees to designate the amount of state tax to be withheld from their paychecks. If you need clarity regarding withholding issues, a Pennsylvania Sample Letter for Withheld Delivery can be an effective way to communicate with your employer.

You may receive a letter from the Pennsylvania Department of Revenue for various reasons, such as requesting additional information, notifying you of a tax review, or informing you of an outstanding balance. It's essential to read the letter carefully and follow the instructions provided. If you need to respond formally, consider using a Pennsylvania Sample Letter for Withheld Delivery.

The PA Department of Revenue is the state agency responsible for collecting taxes, enforcing tax laws, and administering tax programs in Pennsylvania. It ensures compliance with tax regulations, processes tax returns, and issues refunds. If you encounter issues, a Pennsylvania Sample Letter for Withheld Delivery may assist in clarifying any misunderstandings.

The PA 40 Schedule C form is a document used in Pennsylvania for reporting income from self-employment. It details your business income and expenses, allowing the Pennsylvania Department of Revenue to assess your state taxes accurately. If you need a Pennsylvania Sample Letter for Withheld Delivery, it can help explain your self-employment status.

To write a complaint letter regarding a late delivery, be direct and factual. Include specifics like the expected delivery date and any inconvenience caused by the delay. Referencing a Pennsylvania Sample Letter for Withheld Delivery can give you a strong framework to ensure your complaint is taken seriously and addressed properly.

In a complaint email about delivery, begin with a polite introduction and then specify the problem. Clearly outline the details of the missed delivery, including any previous communications regarding the issue. A Pennsylvania Sample Letter for Withheld Delivery can assist you in crafting an email that is both effective and to the point.

Start your complaint letter about late delivery by stating the delivery details, including the expected date and the actual arrival date. Express your disappointment and restate your request for timely service. For structure and guidance, consider using a Pennsylvania Sample Letter for Withheld Delivery to enhance the letter's effectiveness.