Pennsylvania Investment Club Partnership Agreement

Description

How to fill out Investment Club Partnership Agreement?

If you require to sum up, acquire, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you need.

A variety of templates for business and personal purposes are categorized by type and region, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan that suits you and enter your details to register for an account.

Step 5. Execute the transaction. You may use your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to discover the Pennsylvania Investment Club Partnership Agreement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Pennsylvania Investment Club Partnership Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are new to US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the template, take advantage of the Search feature at the top of the screen to find other versions of your legal document template.

Form popularity

FAQ

The SEC generally does not regulate investment clubs. But since each investment club is unique, each club will need to decide if it has any registration requirements. Membership interests in the investment club may be securities under the Securities Act of 1933 (Securities Act).

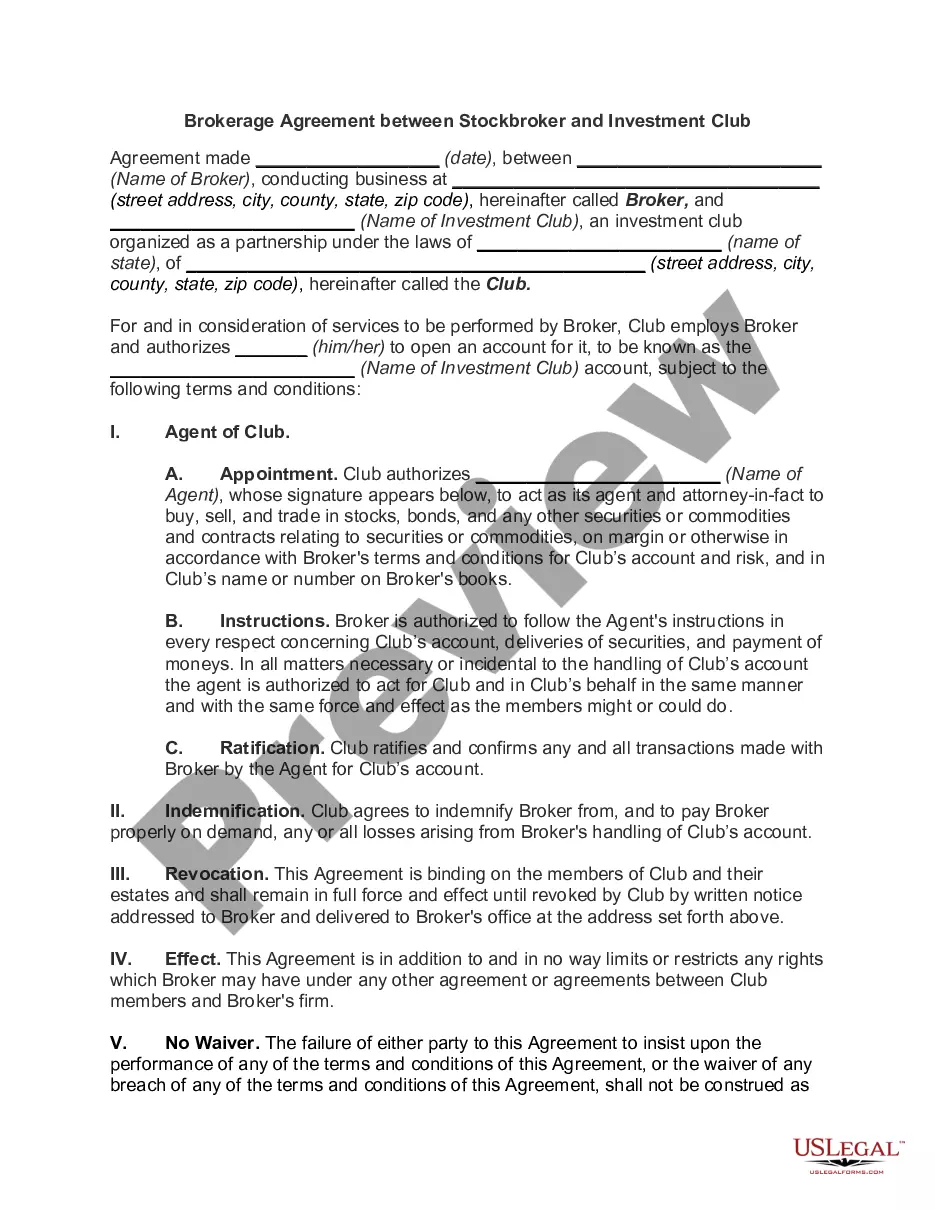

Step 1: Find Potential Members for Your Stock Investment Club.Step 2: Hold Meetings With Potential Members to Organize.Step 3: Form a Legal Entity and Create a Partnership Agreement.Step 4: Establish Club Operating Procedures.Step 5: Open a Brokerage Account for Investing in the Stock Market.More items...?

Investment clubs will usually form a legal entity, such as a partnership or limited liability company (LLC).

You can think of an investment club as a small-scale mutual fund where decisions are made by a committee of non-professional club members. Clubs can be informal or established as a legal entity such as a partnership. Either way, the club may be subject to regulatory oversight and must account for taxes properly.

Investment Clubs That Buy and Sell TogetherMembers of clubs that invest in a single portfolio often form a legal partnership or a limited liability company (LLC) or partnership (LLP).

A partnership is classified as an investment partnership if at least 90 percent of its assets are investments in stocks, bonds, options, and similar intangible assets, and at least 90 percent of its income is derived from that kind of asset.

When you start an investment club, you are starting a business and you need to decide on what type of business operating structure you will use. Different business types have different operating, federal and state reporting and taxation requirements. We recommend you operate as a general partnership.

An investment club refers to a group of people who pool their money to make investments. Usually, investment clubs are organized as partnershipsafter the members study different investments, the group decides to buy or sell based on a majority vote of the members.

Investment Clubs That Buy and Sell TogetherMembers of clubs that invest in a single portfolio often form a legal partnership or a limited liability company (LLC) or partnership (LLP).

General Partnerships are preferred by most clubs since they allow the taxes to pass through to partner personal tax returns, and therefore, have minimal costs and minimal paperwork. General Partnerships are the least costly business structure.