Pennsylvania Charity Subscription Agreement

Description

How to fill out Charity Subscription Agreement?

If you need to finalize, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search to locate the documents you require. A range of templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Pennsylvania Charity Subscription Agreement in just a few clicks.

Every legal document template you purchase belongs to you for a long time. You have access to every form you have downloaded in your account. Click the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Pennsylvania Charity Subscription Agreement with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log Into your account and click the Download button to retrieve the Pennsylvania Charity Subscription Agreement.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have selected the form for the correct city/state.

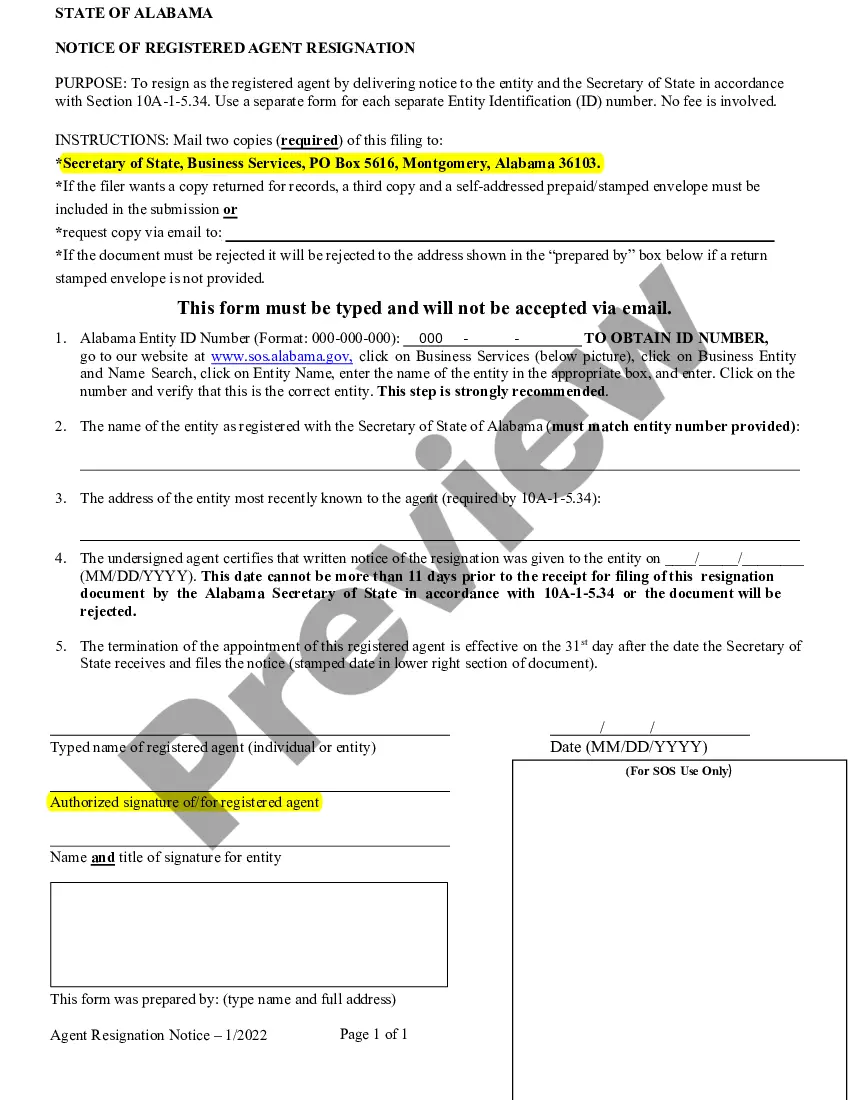

- Step 2. Use the Preview option to review the form's details. Remember to read through the information carefully.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your details to register for the account.

- Step 5. Complete the purchase. You can use your Visa, MasterCard, or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and save it to your device.

- Step 7. Complete, edit, and print or sign the Pennsylvania Charity Subscription Agreement.

Form popularity

FAQ

Setting up a charitable organization requires careful planning and adherence to legal requirements. Begin by drafting your mission statement and organizational structure. Don’t forget to register with the state by filing the necessary forms, like the BCO 10, and consider using a Pennsylvania Charity Subscription Agreement to define how donations will be managed and utilized.

The Bureau of Corporations and Charitable Organizations maintains the records repository of more than 3 million companies that do business in the Commonwealth and serves as the centralized filing office for Uniform Commercial Code financing statements.

It is a unilateral promise without consideration. California Civil Code Section 1146 defines a gift as follows: A gift is a transfer of personal property, made voluntarily, and without consideration. Section 1147 says that a verbal gift is generally unenforceable unless the means of obtaining possession and control

All Charitable Incorporated Organisations (CIOs) must register with the Charity Commission, regardless of their annual income. CIOs do not formally exist as charities until they are registered.

If your organization is soliciting contributions from Pennsylvania residents and is not excluded or exempt, it must file a BCO-10 registration statement for its most recently completed fiscal year; a copy of its IRS 990 return; and the appropriate financial statements within 30 days of receiving more than $25,000 in

When we think of a charitable contribution, we think of a contribution that is freely given. However, most courts view charitable pledges as legally enforceable commitments.

Through the Bureau of Corporations and Charitable Organizations (BCCO), the department assists Pennsylvania business owners and entrepreneurs with starting, sustaining and expanding their companies.

In California, a pledge is enforceable as a binding contract only if there is consideration. In certain other states, the rules are less strict: Even a promise to make a payment to a charitable organization without anything given in return may be enforceable as a matter of public policy.

Register with Valassis (Save.com) to stop receiving its mailers.Stop direct mail delivery by filling out this form.Call Valassis' Consumer Assistance Line toll-free at 1-800-437-0479.

200bThe Department protects the public's health and safety by licensing more than one million business and health professionals; promotes the integrity of the electoral process; supports economic development through corporate registrations and transactions; maintains registration and financial information for thousands of