Pennsylvania Complex Deed of Trust and Security Agreement

Description

How to fill out Complex Deed Of Trust And Security Agreement?

Are you currently within a placement that you need to have documents for both enterprise or person purposes virtually every day? There are a variety of lawful document templates available on the net, but discovering ones you can depend on is not easy. US Legal Forms provides thousands of type templates, such as the Pennsylvania Complex Deed of Trust and Security Agreement, which are created to fulfill state and federal requirements.

If you are currently knowledgeable about US Legal Forms website and also have an account, simply log in. After that, you are able to obtain the Pennsylvania Complex Deed of Trust and Security Agreement format.

Should you not have an bank account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the type you need and make sure it is to the appropriate city/state.

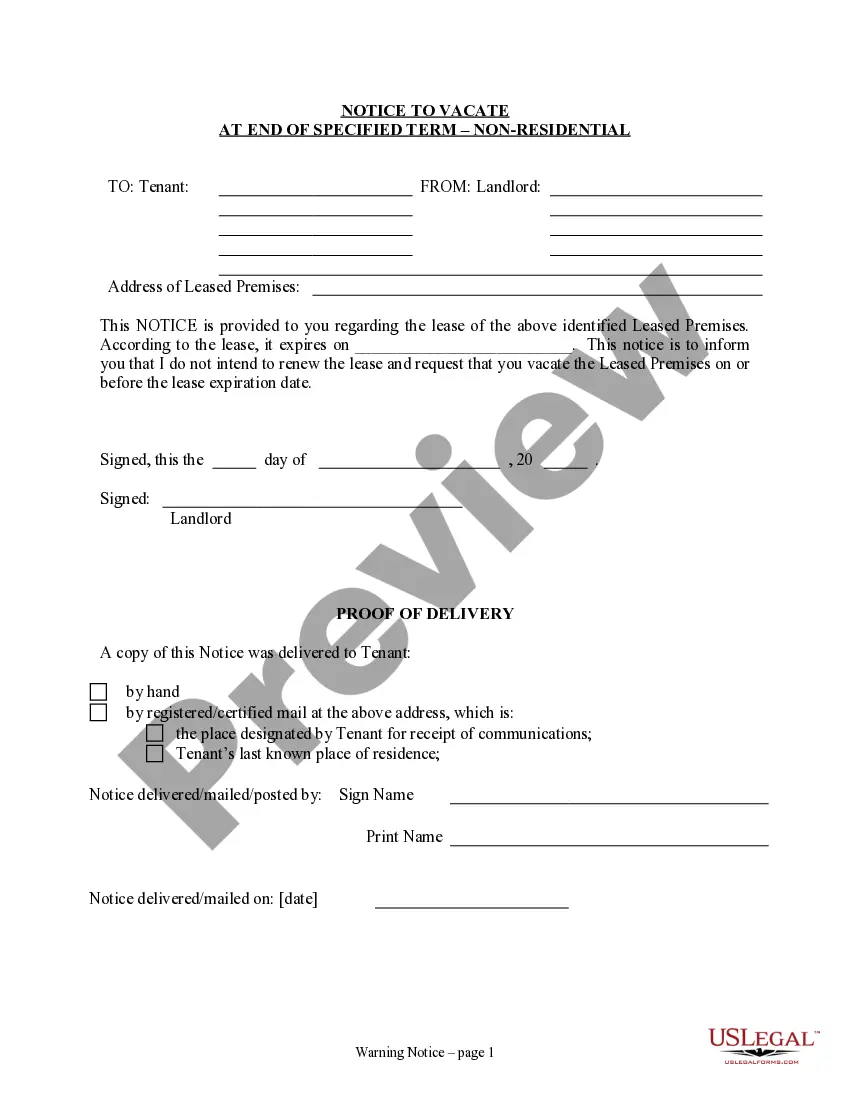

- Take advantage of the Review key to check the form.

- Read the outline to ensure that you have chosen the correct type.

- In case the type is not what you are searching for, use the Search discipline to get the type that meets your needs and requirements.

- When you get the appropriate type, click Acquire now.

- Opt for the pricing strategy you desire, complete the specified information and facts to make your money, and pay for the order using your PayPal or bank card.

- Decide on a hassle-free paper format and obtain your version.

Locate each of the document templates you possess purchased in the My Forms food list. You can obtain a extra version of Pennsylvania Complex Deed of Trust and Security Agreement at any time, if needed. Just select the required type to obtain or print the document format.

Use US Legal Forms, the most extensive selection of lawful kinds, to save lots of time as well as steer clear of blunders. The support provides skillfully created lawful document templates that can be used for a range of purposes. Produce an account on US Legal Forms and begin generating your life easier.

Form popularity

FAQ

Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

In Pennsylvania, real estate cannot be transferred via a TOD deed. Instead, the owner of the property can utilize a will, a living trust, or joint ownership to transfer property upon death. These methods should be discussed with an experienced estate planning attorney to understand their implications fully.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to pay off the loan.

When property is ?held in trust,? there is a divided ownership of the property, ?generally with the trustee holding legal title and the beneficiary holding equitable title.? The trust itself owns nothing because it is not an entity capable of owning property.

The security deed is an interest in real estate which gives legal title of property to the lender of the mortgage for the term of the mortgage note. Trust deed is a written instrument legally conveying property to a trustee often used to secure an obligation such as a mortgage or promissory note.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.

In Pennsylvania, a living trust is a legal agreement in which the testator's assets, including bank accounts, home, securities, etc., can be transferred and handled by an individual, including the testator, or corporation, such as a trust or bank.