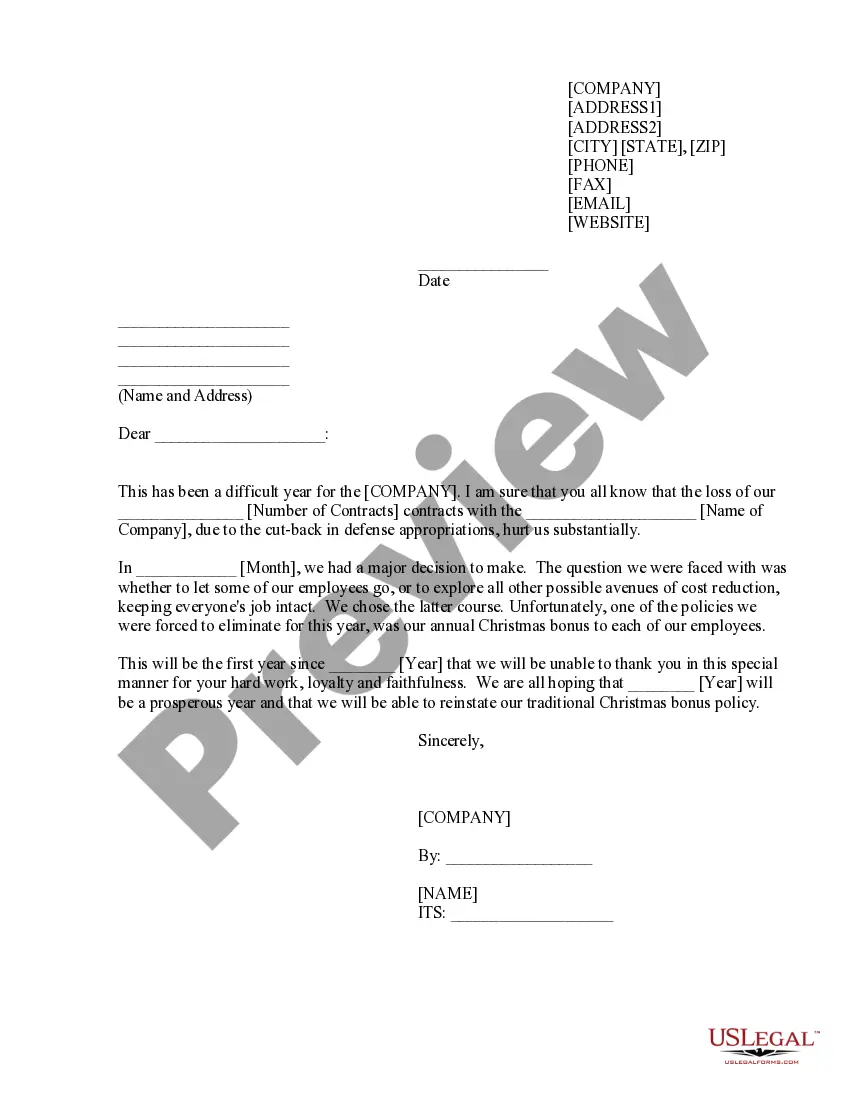

Pennsylvania Sample Letter for Petition to Close Estate and For Other Relief

Description

How to fill out Sample Letter For Petition To Close Estate And For Other Relief?

If you need to complete, acquire, or print legal document templates, use US Legal Forms, the biggest selection of legal kinds, that can be found on-line. Take advantage of the site`s simple and practical lookup to obtain the files you require. Various templates for organization and specific uses are categorized by groups and states, or search phrases. Use US Legal Forms to obtain the Pennsylvania Sample Letter for Petition to Close Estate and For Other Relief with a number of click throughs.

In case you are presently a US Legal Forms consumer, log in in your account and then click the Down load option to get the Pennsylvania Sample Letter for Petition to Close Estate and For Other Relief. Also you can entry kinds you previously saved within the My Forms tab of your own account.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for the proper area/region.

- Step 2. Make use of the Preview method to look over the form`s articles. Do not neglect to read the outline.

- Step 3. In case you are unhappy with all the kind, use the Search industry near the top of the monitor to discover other versions of the legal kind design.

- Step 4. After you have discovered the shape you require, click the Purchase now option. Opt for the rates plan you like and put your qualifications to register for an account.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal account to perform the purchase.

- Step 6. Select the format of the legal kind and acquire it on the device.

- Step 7. Full, modify and print or indicator the Pennsylvania Sample Letter for Petition to Close Estate and For Other Relief.

Every legal document design you buy is the one you have eternally. You have acces to each and every kind you saved inside your acccount. Go through the My Forms segment and decide on a kind to print or acquire once more.

Remain competitive and acquire, and print the Pennsylvania Sample Letter for Petition to Close Estate and For Other Relief with US Legal Forms. There are millions of expert and condition-certain kinds you can utilize to your organization or specific requires.

Form popularity

FAQ

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.

Strategies to Avoid Probate in Pennsylvania Joint Ownership. ... Payable-on-Death Designations for Bank Accounts. ... Transfer-on-Death Registration for Securities. ... Revocable Living Trusts. ... Life Insurance. ... Gifts.

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated.

For example, any assets in a living trust or jointly owned under joint tenancy with survivorship rights are considered non-probate assets. In addition, a payable-on-death account is exempt. Retirement accounts are also considered immune from the probate process.

In Pennsylvania, the courts shortcut probate for any estate worth $50,000 or under.

Simplified Probate for Small Estates Not all estates must go through a long and expensive probate process. Pennsylvania offers a simplified probate process for small estates, which state law defines as estates that contain no more than $50,000 in assets.