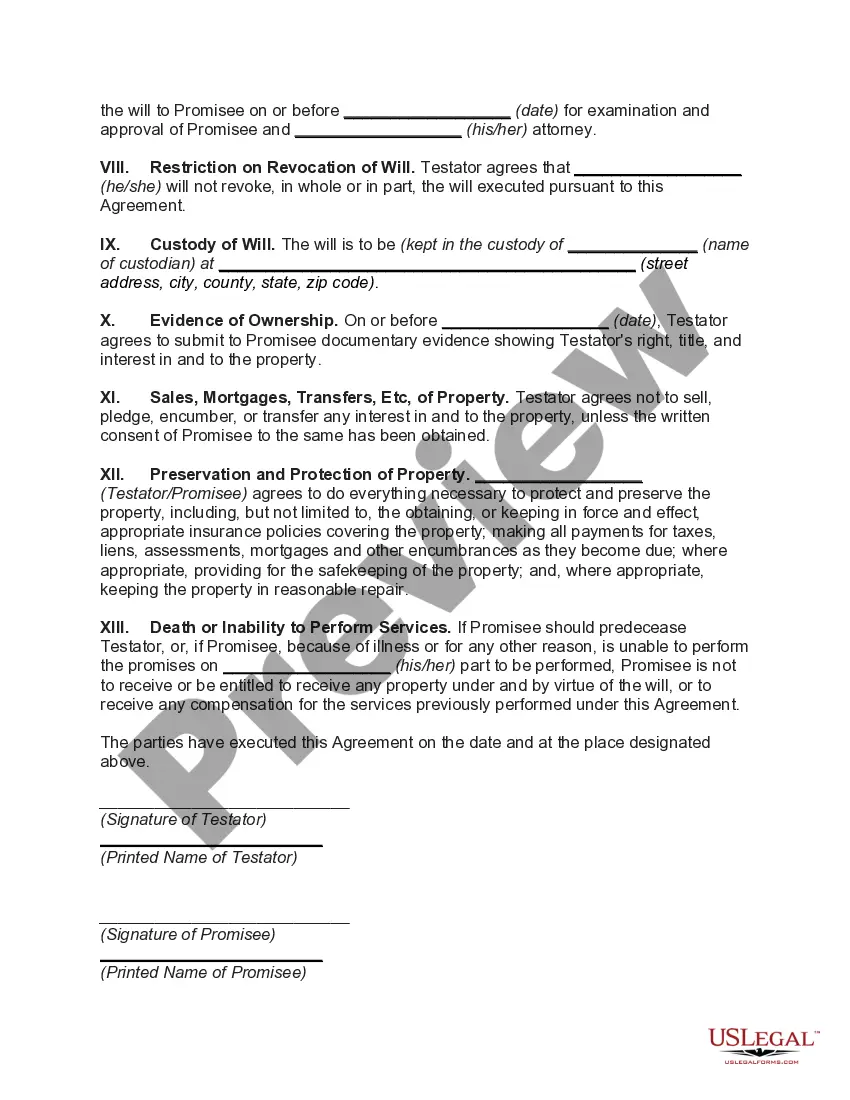

Pennsylvania Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator

Description

How to fill out Agreement To Devise Or Bequeath Property To A Person Performing The Personal Services Of Lifetime Care For A Future Testator?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can quickly find the most recent forms such as the Pennsylvania Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator.

If you already have a subscription, Log In and download the Pennsylvania Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator from the US Legal Forms catalog. The Download button will appear on each form you view. You gain access to all previously saved forms in the My documents section of your account.

Proceed to payment. Use a Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Pennsylvania Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator. Each template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you want. Access the Pennsylvania Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct form for your city/county.

- Click the Preview button to view the content of the form.

- Read the form description to ensure you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the correct one.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

Simple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.

In Pennsylvania, there is no set deadline for filing probate. However, the law requires that the inheritance tax be wholly paid within nine months after the person's passing unless there has been a request for an extension.

A gift given by means of the will of a decedent of an interest in real property.

2. The Right to Bequeath: Testamentary Freedom and the Individuality of Property. From the book Inherited Wealth.

6. Paying the administrative expenses and all the debts of the estate. The estate needs to pay for the funeral, probate fees, attorney fees and other administrative expenses first. The secured creditors are paid next, and then the unsecured creditors are paid with whatever is left.

There is no specific deadline for filing probate after someone dies in Pennsylvania. However, the law does require that within three months of the death, creditors, heirs, and beneficiaries are notified of the death. Then, within six months, an inventory of assets must be prepared and filed with the Register of Wills.

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.

How Long Does PA Probate Take? Generally, beneficiaries should expect to wait 2 years to receive their inheritance.

Legacy, also called Bequest, in law, generally a gift of property by will or testament. The term is used to denote the disposition of either personal or real property in the event of death.

What is the difference between these two phrases? Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.