Pennsylvania Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship Including Purchase Of Real Property?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates you can download or create.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can find the latest editions of documents like the Pennsylvania Agreement for Sale of Business by Sole Proprietorship inclusive of Purchase of Real Property in mere moments.

If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

If you’re satisfied with the form, confirm your choice by clicking on the Buy now button. Then select the pricing plan you prefer and provide your details to register for an account.

- If you already have an account, Log In to download the Pennsylvania Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property from the US Legal Forms library.

- The Download option will be available on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to help you begin.

- Ensure you have selected the correct form for your city/state.

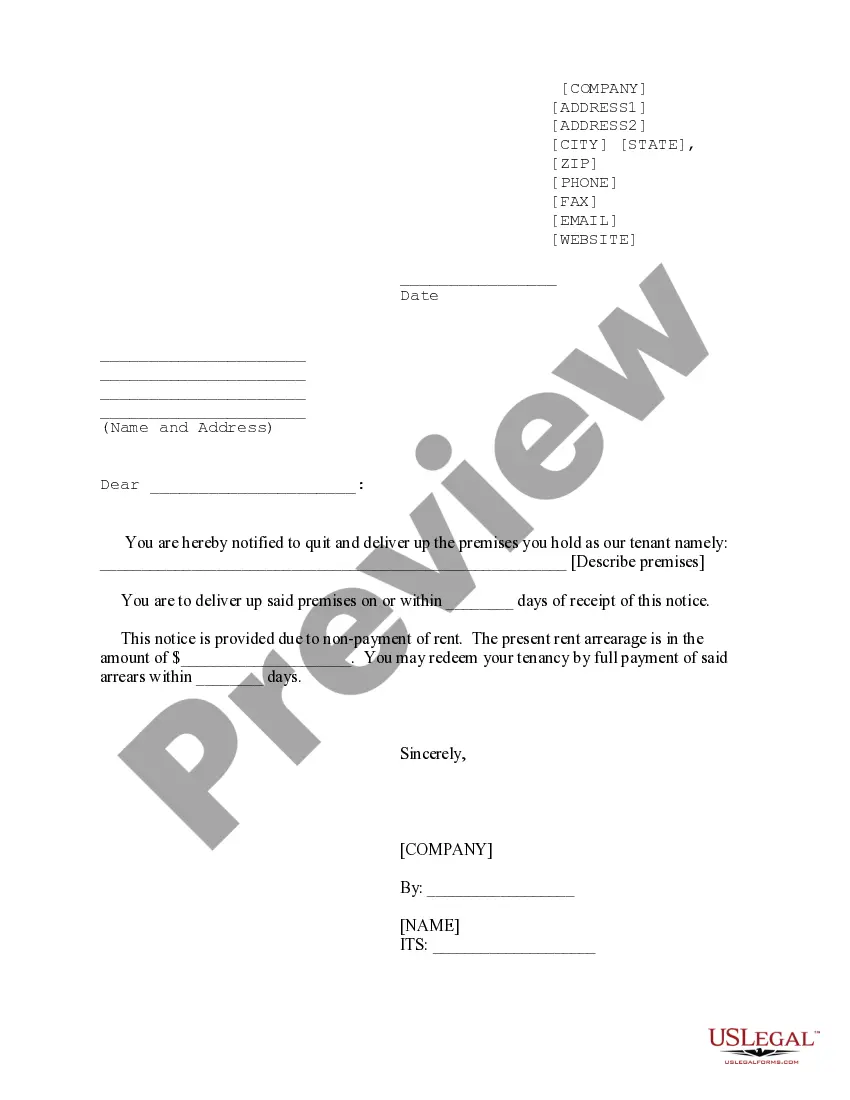

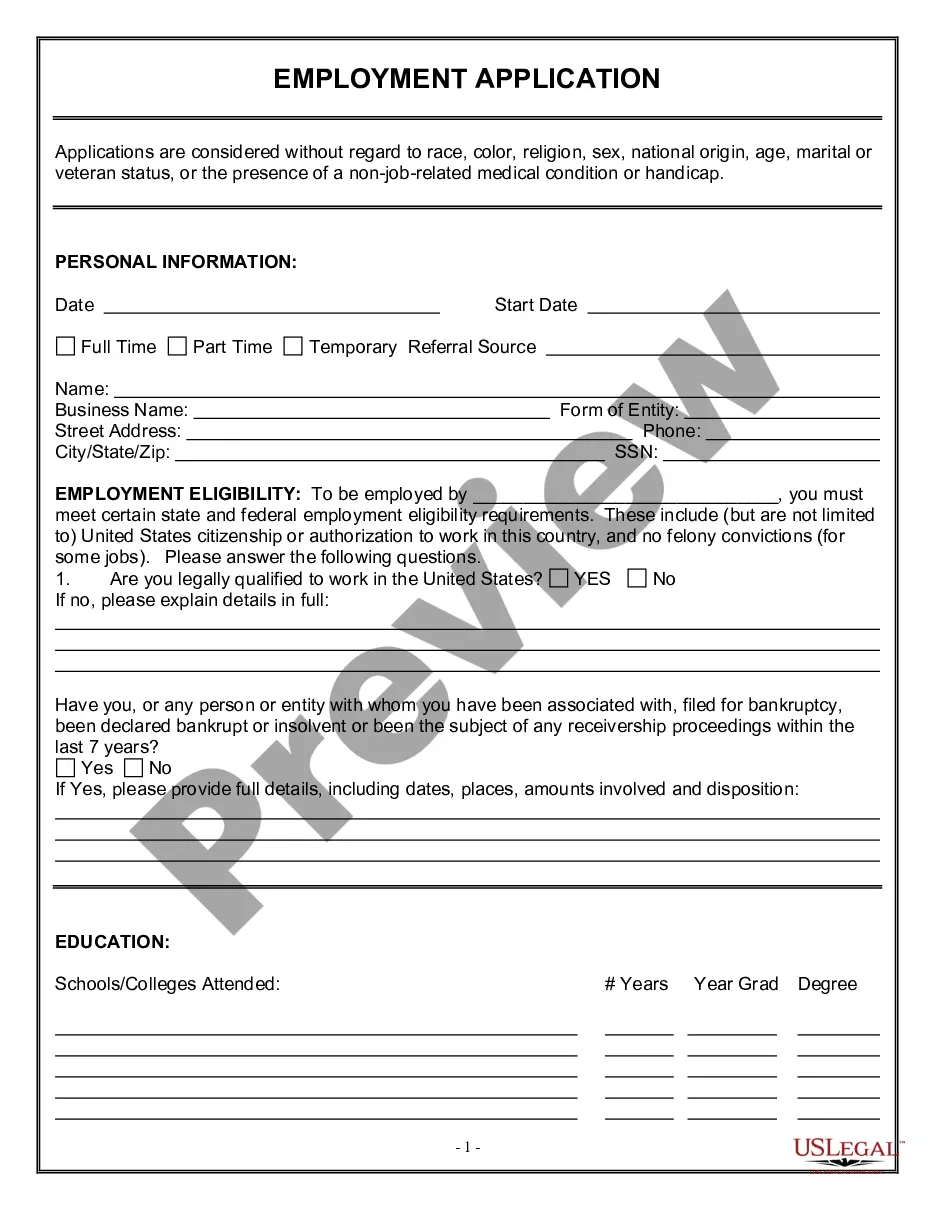

- Click the Preview option to examine the form’s content.

Form popularity

FAQ

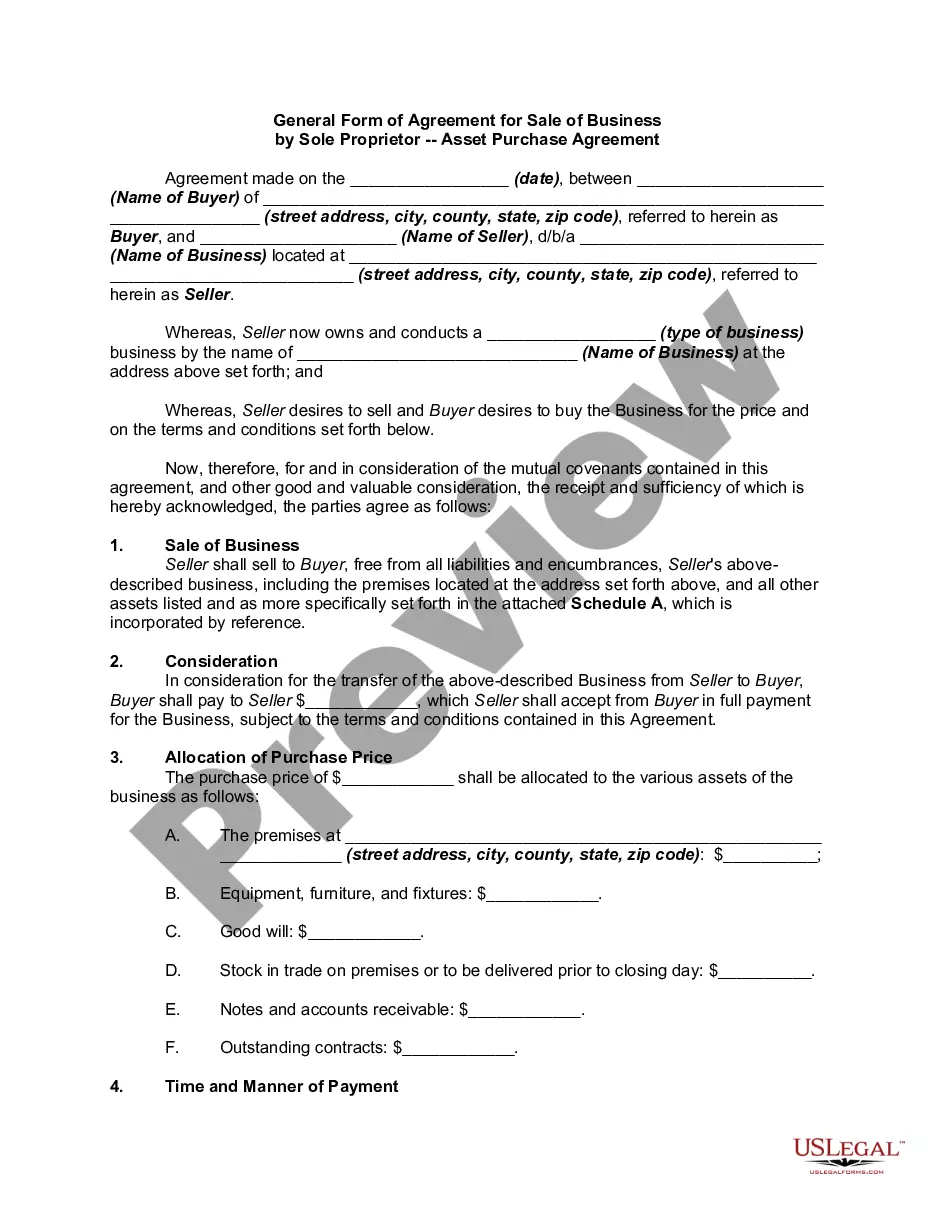

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

In the financial markets, a sale is an agreement between a buyer and seller regarding the price of a security, and delivery of the security to the buyer in exchange for the agreed-upon compensation.

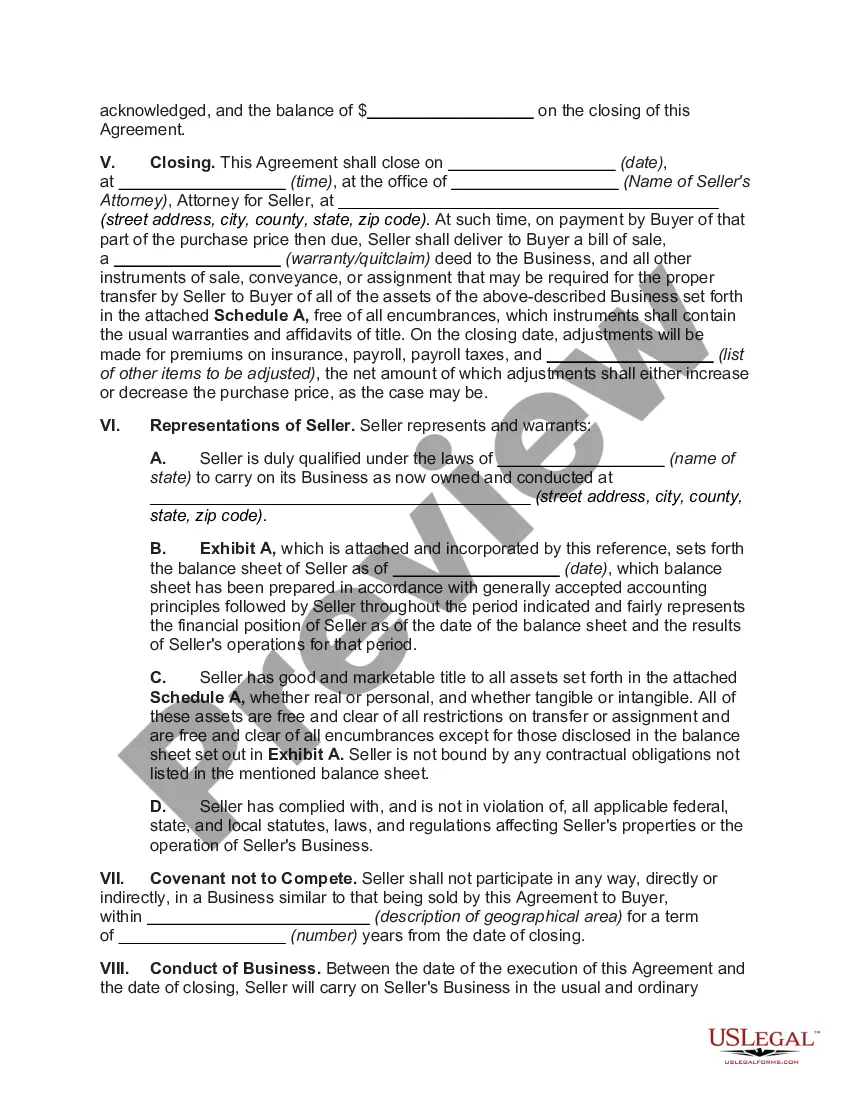

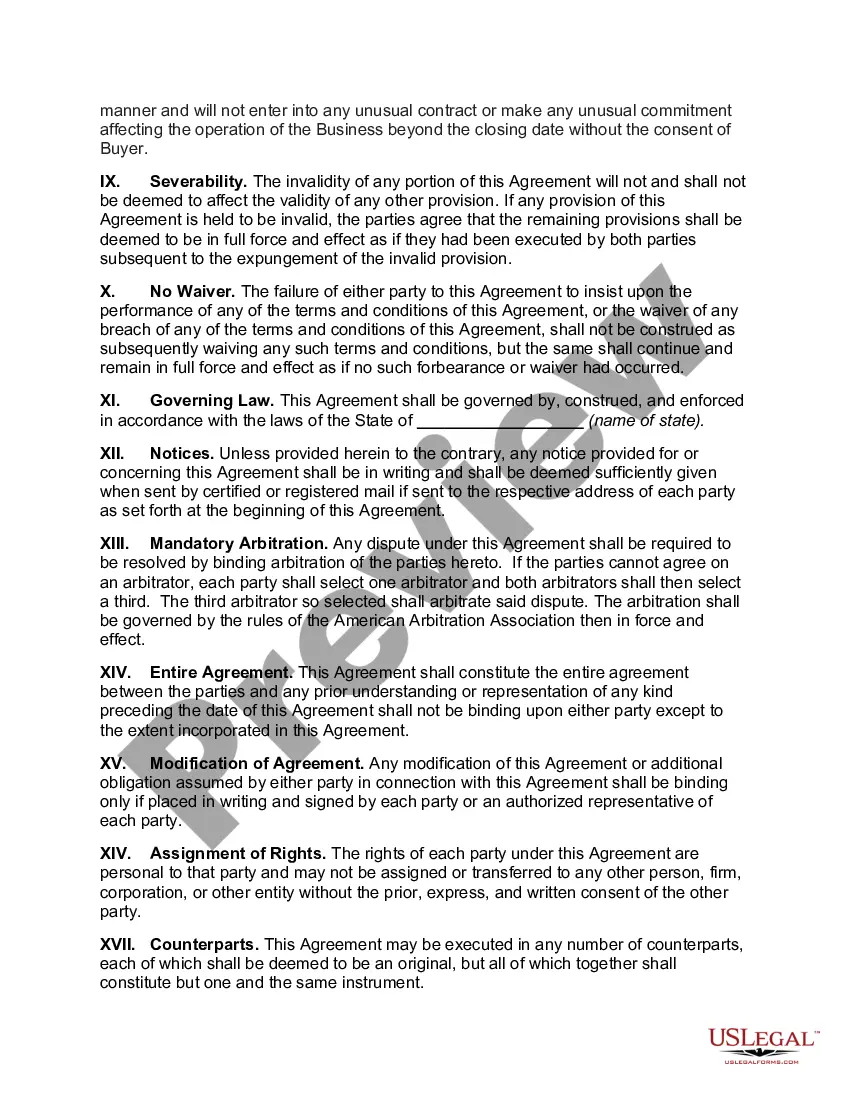

A business sale agreement is a legal document that describes and records the price and other details when a business owner sells the business. It is the final step to transfer ownership after negotiations for the transaction have been completed.

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

Deal; trade; transaction; dealing; dealings.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

15 Tactics For Successful Business NegotiationsListen and understand the other party's issues and point of view.Be prepared.Keep the negotiations professional and courteous.Understand the deal dynamics.Always draft the first version of the agreement.Be prepared to play poker and be ready to walk away.More items...?

Affordable business financing. Crazy fast.Identity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.