Pennsylvania Sample Letter for Mobile Home Insurance Policy

Description

How to fill out Sample Letter For Mobile Home Insurance Policy?

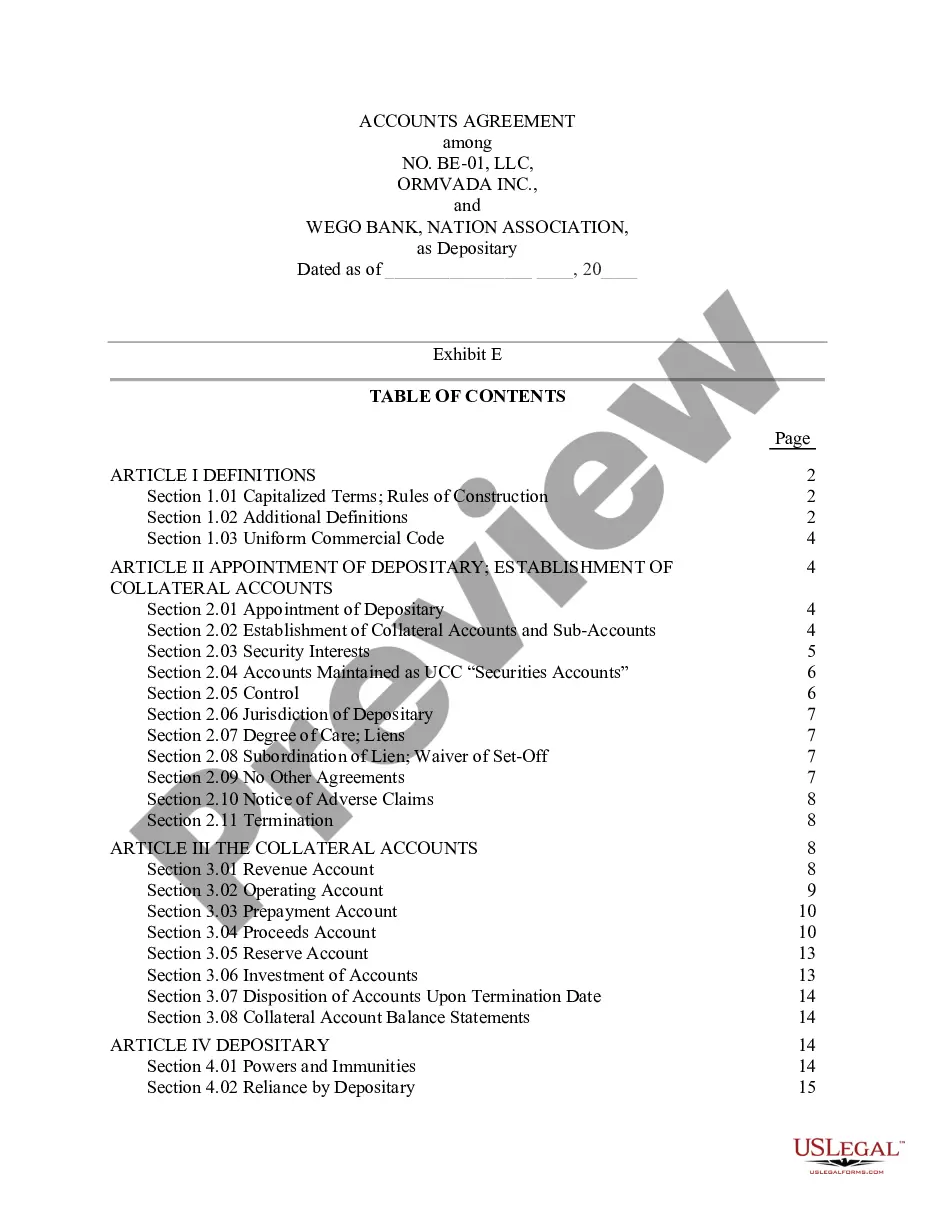

Finding the right lawful papers web template can be a struggle. Obviously, there are a variety of themes accessible on the Internet, but how do you get the lawful type you need? Utilize the US Legal Forms internet site. The service delivers thousands of themes, like the Pennsylvania Sample Letter for Mobile Home Insurance Policy, that can be used for company and private demands. Each of the kinds are checked by professionals and meet up with federal and state needs.

In case you are already listed, log in to your account and then click the Down load switch to have the Pennsylvania Sample Letter for Mobile Home Insurance Policy. Use your account to check with the lawful kinds you possess purchased in the past. Visit the My Forms tab of the account and obtain another duplicate from the papers you need.

In case you are a brand new customer of US Legal Forms, allow me to share easy guidelines that you should stick to:

- Very first, be sure you have selected the right type for the city/region. You may look over the form making use of the Review switch and look at the form description to make sure it is the right one for you.

- If the type fails to meet up with your expectations, make use of the Seach discipline to get the proper type.

- Once you are sure that the form would work, click the Buy now switch to have the type.

- Pick the pricing prepare you would like and type in the required information and facts. Build your account and pay for the transaction using your PayPal account or Visa or Mastercard.

- Pick the data file format and download the lawful papers web template to your system.

- Complete, edit and print out and sign the acquired Pennsylvania Sample Letter for Mobile Home Insurance Policy.

US Legal Forms is the greatest catalogue of lawful kinds where you will find a variety of papers themes. Utilize the service to download appropriately-produced paperwork that stick to express needs.

Form popularity

FAQ

A letter of claim should include the identity of the parties involved, the nature of the dispute, the key dates, the facts that support the claim, the monies owed and the remedy to the situation.

Travel and utility trailers, pop-ups, and any RV that is pulled are protected against liability claims by the liability coverage on the towing vehicle. But you still need a travel trailer policy in order to cover physical damage to your trailer.

When you file a claim, you'll be asked to provide some basic details, such as where and when the accident or incident took place, contact information for everyone involved and a description of what happened. You might also be asked to give an estimated cost of the damage from the accident?if you have that available.

If you are asked to provide a letter as proof of insurance, you should contact your insurance company (or employer, if applicable) directly and request such a document.

How to write an effective complaint letter Be clear and concise. ... State exactly what you want done and how long you're willing to wait for a response. ... Don't write an angry, sarcastic, or threatening letter. ... Include copies of relevant documents, like receipts, work orders, and warranties.

Sample Template Date:________ From. Name of the Insurance Claiming Person. Address __________ ... Dear Sir/ Madam, SUBJECT: DIRECT CLAIM LETTER. ... I hope to hear from you soon regarding payment of my amount. I will appreciate an effort from your end to avoid any more problems in the future.

In order to write a successful insurance claim letter, start with an introduction who you are, why you are writing, contact information and the details on your property. This will help the insurance adjuster understand the most important details and how to get in touch with you when there are questions.

An insurance claim is a request to the insurance company for payment after a policyholder experiences a loss covered by their policy. For example, if a home is damaged by a fire and the homeowner has insurance, they will file a claim to begin the process of the insurance company paying for the repairs.