Pennsylvania Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

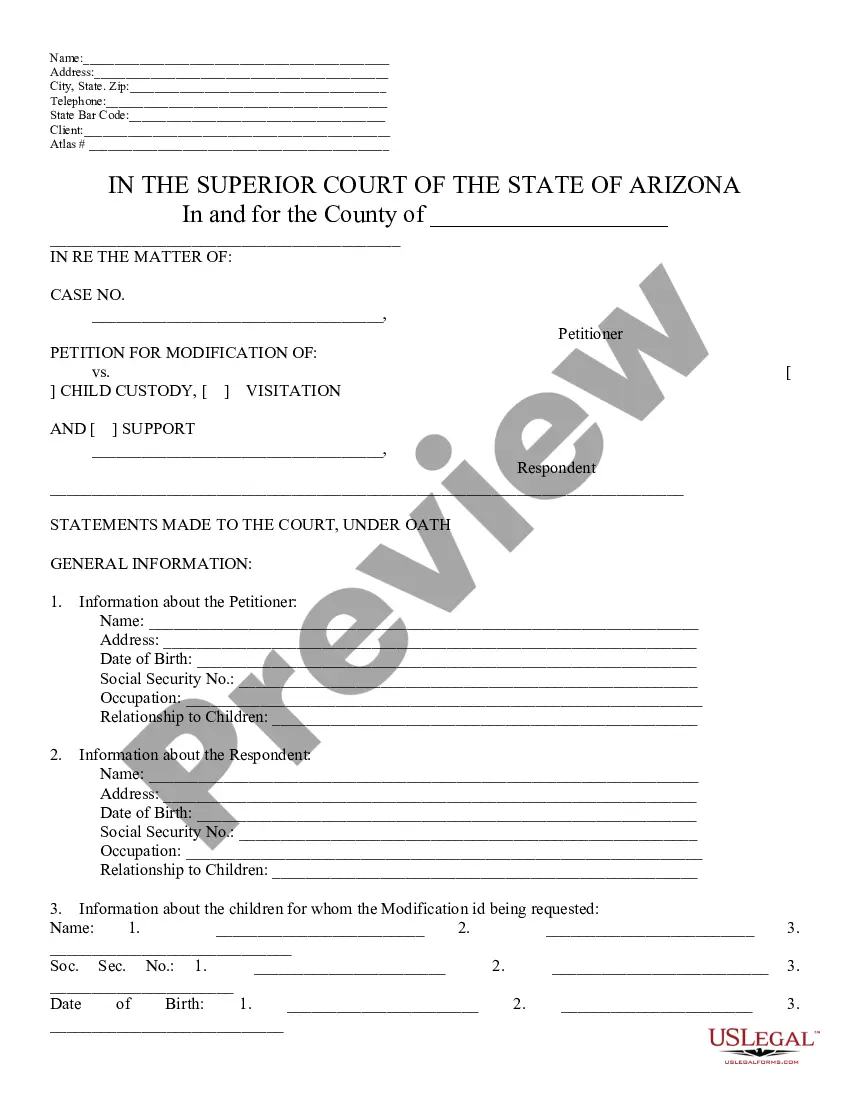

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by types, jurisdictions, or keywords.

You can quickly locate the latest versions of forms such as the Pennsylvania Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

Check the form details to ensure you have chosen the correct one.

If the form doesn't meet your requirements, utilize the Search bar at the top of the page to find one that does.

- If you have a subscription, Log In and retrieve the Pennsylvania Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from the US Legal Forms local library.

- The Get button will be visible on every form you review.

- You can access all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Make sure you have selected the correct form for your city/county.

- Click the Preview button to review the form's content.

Form popularity

FAQ

If you do not receive a 1099-S after selling your home, it is important to understand your reporting obligations. While you may still be required to report the sale to the IRS, the absence of a 1099-S does not automatically imply that you are exempt from capital gains tax. Consider using the Pennsylvania Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption to clarify your situation and consult with a tax professional for guidance.

Generally, the gain on the sale of a principal residence occurring on or after Jan. 1, 1998 is exempt from Pennsylvania personal income tax. Likewise, no loss may be taken because such a transaction is not entered into for profit or gain.

A Section 121 Exclusion is an Internal Revenue Service rule that allows you to exclude from taxable income a gain of up to $250,000 from the sale of your principal residence. A couple filing a joint return gets to exclude up to $500,000.

A Section 121 Exclusion is an Internal Revenue Service rule that allows you to exclude from taxable income a gain of up to $250,000 from the sale of your principal residence. A couple filing a joint return gets to exclude up to $500,000.

Qualifying for the Exclusion In general, to qualify for the Section 121 exclusion, you must meet both the ownership test and the use test. You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale.

When you sell your principal residence or when you are considered to have sold it, usually you do not have to report the sale on your income tax and benefit return and you do not have to pay tax on any gain from the sale.

There are three conditions attending the exemption: (1) the property sold must be the principal residence; (2) there must be full utilization of the proceeds within 18 calendar months from the date of sale of the property; and (3) the documentary requirements provided in the pertinent Revenue Regulations are complied

While homeowners can claim this exclusion an unlimited number of times, it can only be claimed once every two years. To meet eligibility requirements, you'll need to ensure that you don't claim the exclusion more than once in two years.

When you sell your principal residence or when you are considered to have sold it, usually you do not have to report the sale on your income tax and benefit return and you do not have to pay tax on any gain from the sale.

Generally, the gain on the sale of a principal residence occurring on or after Jan. 1, 1998 is exempt from Pennsylvania personal income tax. Likewise, no loss may be taken because such a transaction is not entered into for profit or gain.