A motion to release property is a pleading asking a judge to issue a ruling that will result in the release of property or a person from custody. When property is held in custody, a motion to release must be filed in order to get it back. There are a number of situations where this may become necessary. These can include cases where property is confiscated and the cause of the confiscation is later deemed spurious, as well as situations where people deposit money with a court as surety in a case or in response to a court order. For example, someone brought to small claims court and sued for back rent might write a check to the court for the amount owed, and the landlord would need to file a motion to release for the court to give him the money.

Pennsylvania Motion to Release Property from Levy upon Filing Bond

Description

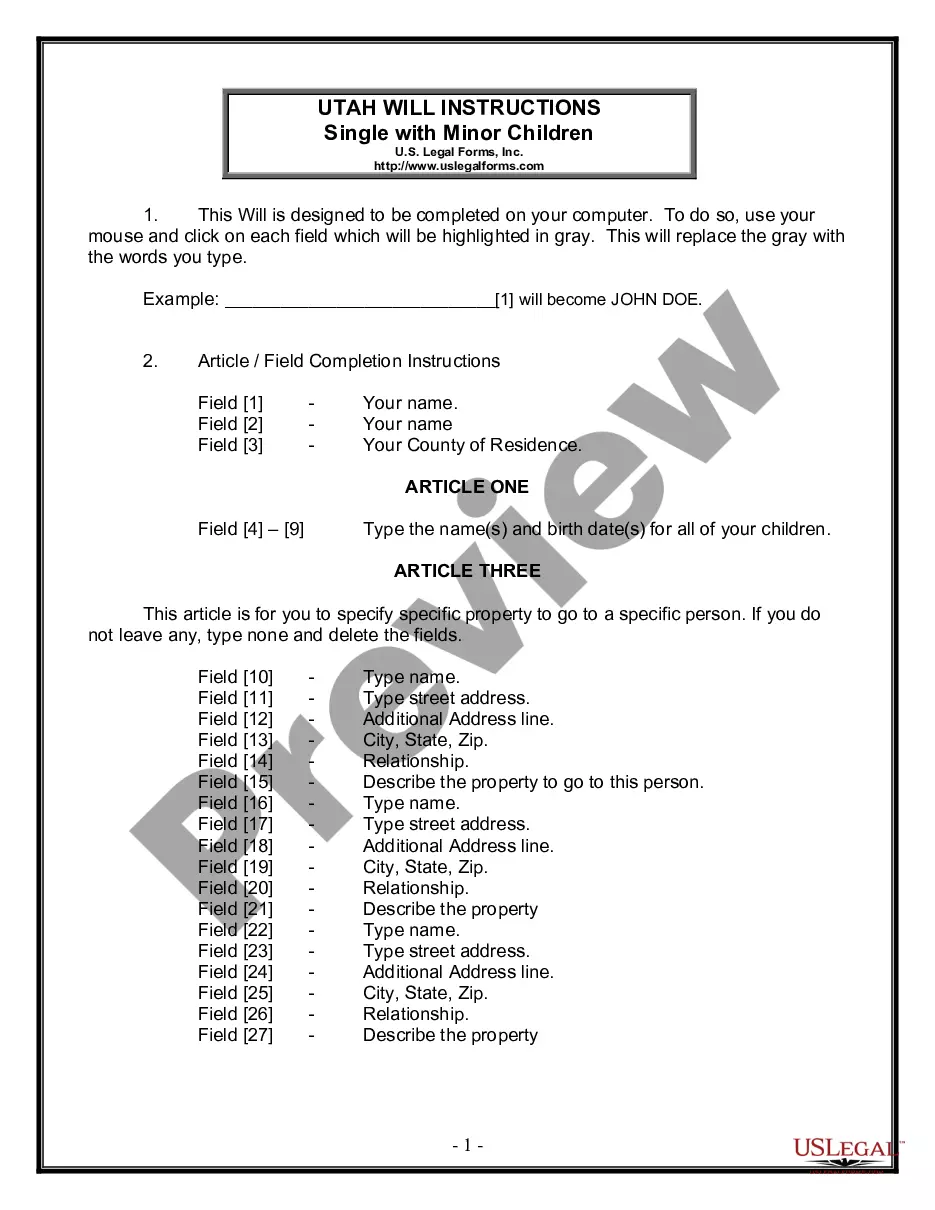

How to fill out Motion To Release Property From Levy Upon Filing Bond?

You are able to commit several hours on-line attempting to find the legitimate record design which fits the federal and state requirements you will need. US Legal Forms supplies a large number of legitimate kinds that are reviewed by pros. You can actually obtain or print out the Pennsylvania Motion to Release Property from Levy upon Filing Bond from our support.

If you have a US Legal Forms account, you can log in and then click the Acquire option. Following that, you can full, edit, print out, or signal the Pennsylvania Motion to Release Property from Levy upon Filing Bond. Every single legitimate record design you buy is the one you have eternally. To get another duplicate of the acquired develop, check out the My Forms tab and then click the related option.

If you work with the US Legal Forms web site initially, stick to the basic recommendations beneath:

- Very first, ensure that you have selected the proper record design for the area/metropolis of your choosing. See the develop information to make sure you have chosen the proper develop. If offered, use the Review option to check with the record design at the same time.

- If you want to locate another variation from the develop, use the Search field to find the design that fits your needs and requirements.

- After you have identified the design you would like, click Purchase now to continue.

- Pick the pricing prepare you would like, type in your credentials, and register for an account on US Legal Forms.

- Total the financial transaction. You can use your charge card or PayPal account to pay for the legitimate develop.

- Pick the format from the record and obtain it to the product.

- Make changes to the record if needed. You are able to full, edit and signal and print out Pennsylvania Motion to Release Property from Levy upon Filing Bond.

Acquire and print out a large number of record layouts making use of the US Legal Forms site, that provides the biggest variety of legitimate kinds. Use skilled and express-certain layouts to tackle your business or person requirements.

Form popularity

FAQ

Except as otherwise provided by another statute, a judgment for a specific sum of money shall bear interest at the lawful rate from the date of the verdict or award, or from the date of the judgment, if the judgment is not entered upon a verdict or award.

Rule 588 - Motion for Return of Property (A) A person aggrieved by a search and seizure, whether or not executed pursuant to a warrant, may move for the return of the property on the ground that he or she is entitled to lawful possession thereof.

The lien will stay in effect for five years, but can be renewed, if the debtor does not sell the property within that time period.

--An action may be brought, under procedures prescribed by general rules, to recover damages for the death of an individual caused by the wrongful act or neglect or unlawful violence or negligence of another if no recovery for the same damages claimed in the wrongful death action was obtained by the injured individual ...

Pennsylvania judgments are valid for 5 years. Judgments can be revived every 5 years and should be revived if a creditor is attempting to actively collect on the debt. Judgments also act as a lien against real property for up to 20 years or longer if properly revived.

The creditor can often place a lien on your property, such as a house or car. The lien must usually be paid off before you can sell the property. Seize assets. Sometimes, a creditor can get a court order to seize other assets or personal property you own, such as a vehicle or real estate, to satisfy the debt.

The sheriff may take your money or other property to pay the judgment at any time after thirty (30) days after the date on which this notice is served on you. You may have legal rights to defeat the judgment or to prevent your money or property from being taken.