Pennsylvania Auto Expense Travel Report

Description

How to fill out Auto Expense Travel Report?

If you need to thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by category and state, or keywords.

Step 4. Once you've found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to download the Pennsylvania Auto Expense Travel Report with just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Pennsylvania Auto Expense Travel Report.

- You can also access documents you've previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Confirm that you have selected the form for your specific city/state.

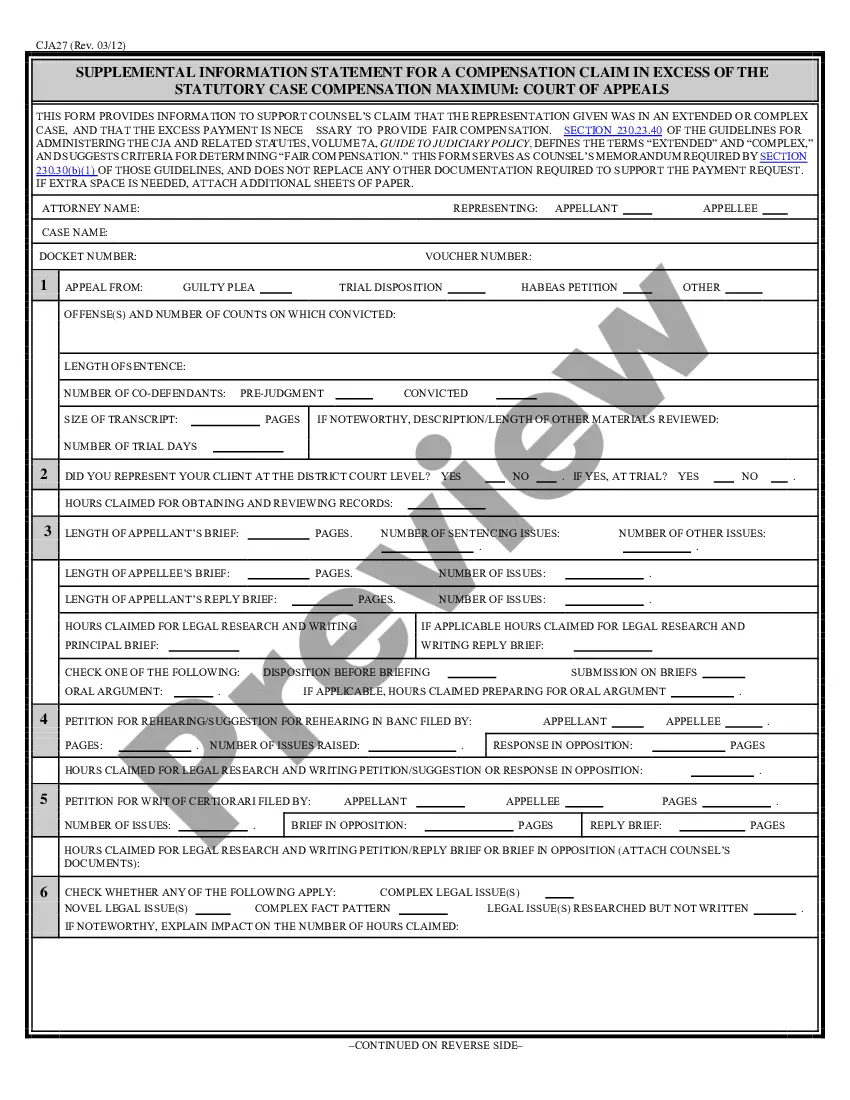

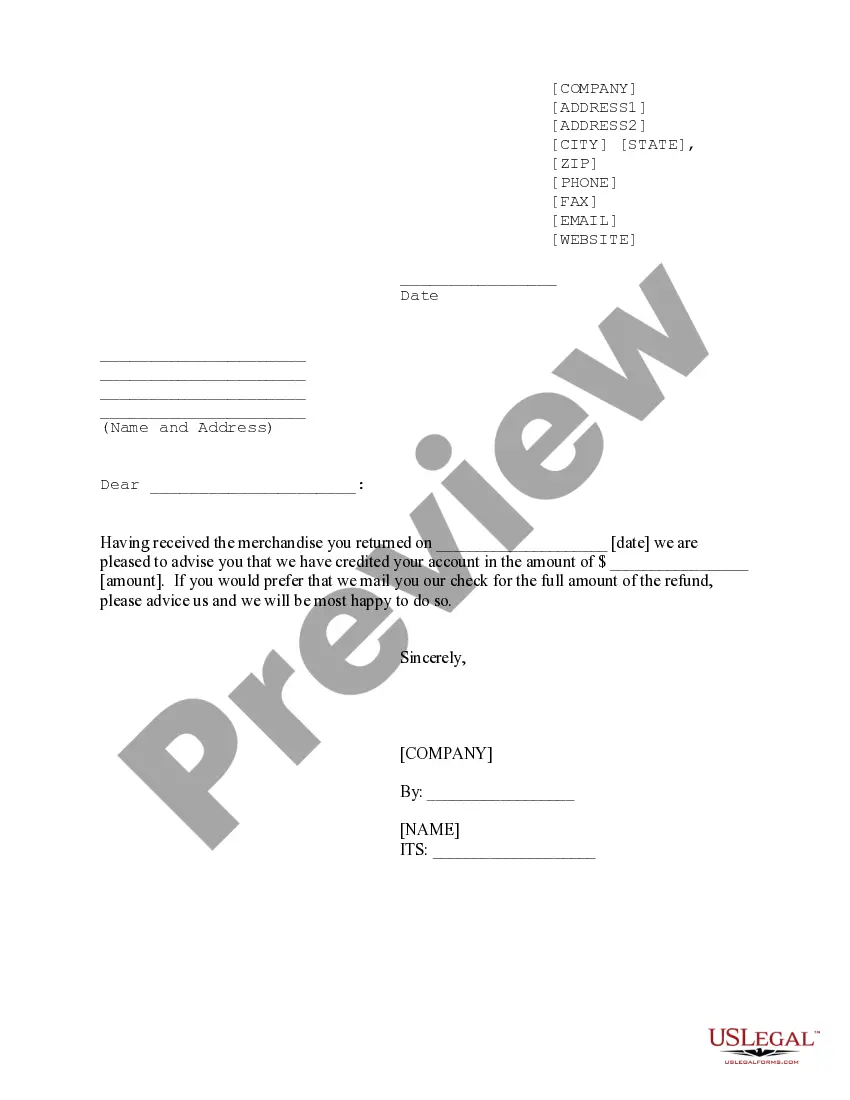

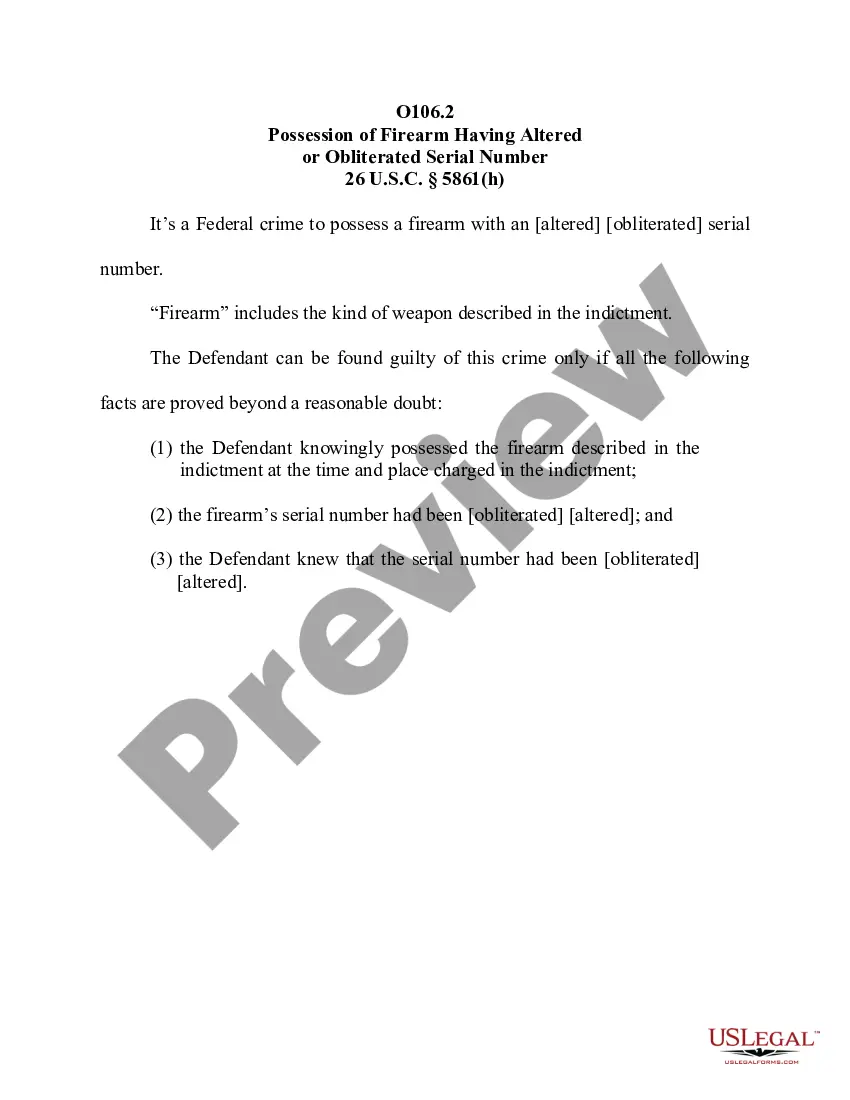

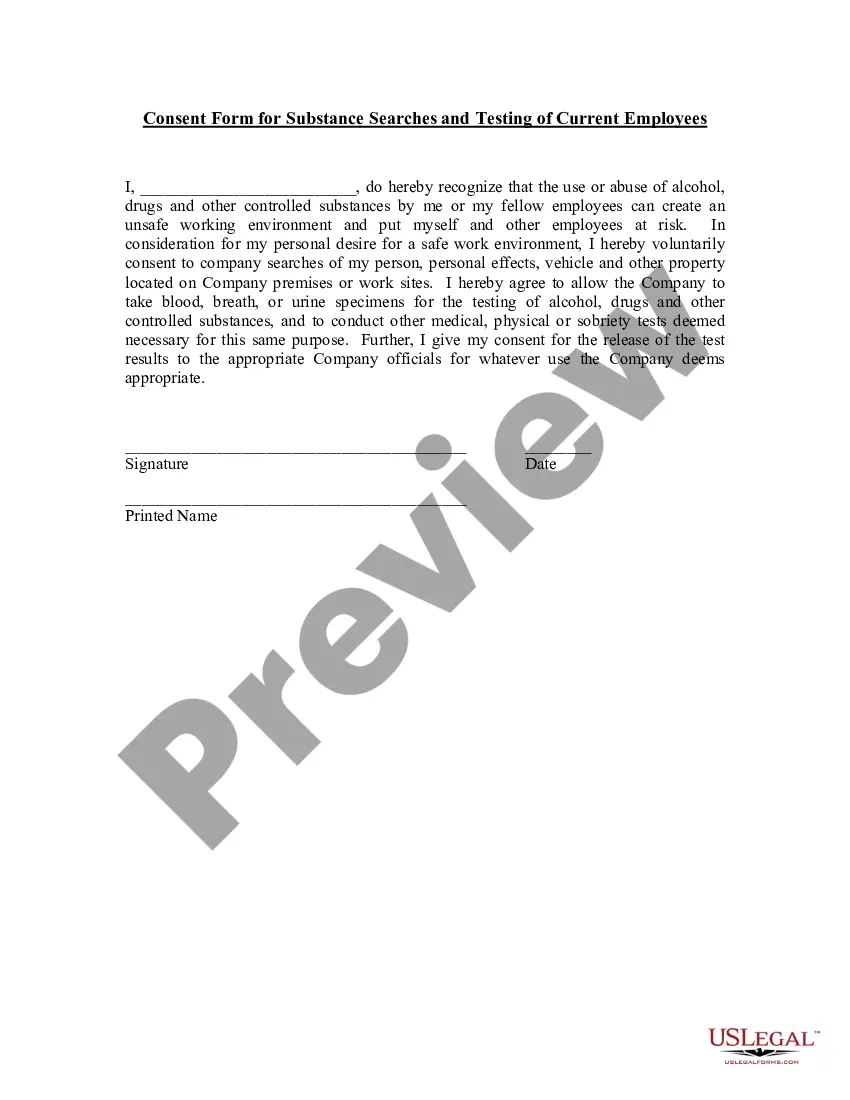

- Step 2. Use the Review option to check the content of the form. Be sure to read the details.

- Step 3. If you are not satisfied with the form, utilize the Lookup field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Filling out an expense form is a straightforward process. Begin by listing all necessary details such as the date and the business purpose, followed by the amounts for each expense. The Pennsylvania Auto Expense Travel Report is designed to help you compile this information effectively, making it easier to submit for reimbursement.

Yes, Pennsylvania law requires employers to reimburse employees for mileage incurred during work-related travel. This reimbursement is based on the federal rate, but companies may have their own policies. It's essential to track your mileage accurately using the Pennsylvania Auto Expense Travel Report to ensure you get reimbursed for all eligible expenses.

Writing out expenses involves documenting each expense clearly on your report or form. Include the date, amount, purpose, and any necessary receipts. The Pennsylvania Auto Expense Travel Report provides a structured way to capture all this information, making it easier to present during audits or when seeking reimbursement.

Yes, you can claim mileage on your taxes in Pennsylvania under certain conditions. You must keep detailed records of your business travel, including dates and mileage. By utilizing the Pennsylvania Auto Expense Travel Report, you can easily track this information and ensure compliance with state regulations for tax deductions.

Filling out a travel expense report involves documenting your travel dates, destinations, and the purpose of your trip. Be sure to include all related costs, such as transportation, meals, and lodging. Utilizing the Pennsylvania Auto Expense Travel Report template can streamline the process, save you time, and help ensure compliance with your organization’s policies.

To properly fill out an expense form, first gather all relevant receipts and documentation. Then, enter details such as the date, amount spent, and the purpose of the expense. The Pennsylvania Auto Expense Travel Report will guide you in categorizing your expenses accurately, ensuring a smooth reimbursement process.

The PA per diem rate is outlined by the state and can vary by the city and other factors. To ensure you receive proper reimbursement, it's essential to stay updated with the Pennsylvania state guidelines or GSA recommendations. Using a Pennsylvania Auto Expense Travel Report can assist you in documenting these expenses effectively and simplify the reimbursement process.

The Permanent Change of Station (PCS) per diem rate is designed for military personnel and their families during relocation. This rate helps cover daily living expenses while moving to a new duty station. To ensure you account for all allowances correctly, integrating a Pennsylvania Auto Expense Travel Report can facilitate precise documentation and reporting during your move.

The going rate for per diem per day varies significantly depending on the state and city of travel. For Pennsylvania, you should check the latest rates published by the GSA, which typically publishes updates annually. This information is crucial for accurately compiling your Pennsylvania Auto Expense Travel Report, ensuring all expenses align with government standards.

To calculate per diem, first, determine the destination's daily allowance based on government guidelines. Next, consider any additional expenses not covered by the daily rate, like lodging and transportation. You can easily track these expenses using a Pennsylvania Auto Expense Travel Report, ensuring you document all relevant information for accurate reimbursement.