Pennsylvania Receipt of Payment for Obligation

Description

How to fill out Receipt Of Payment For Obligation?

It is possible to devote hours on the web looking for the lawful papers web template which fits the state and federal demands you want. US Legal Forms gives a large number of lawful kinds which are reviewed by experts. You can actually acquire or print out the Pennsylvania Receipt of Payment for Obligation from my service.

If you have a US Legal Forms bank account, you may log in and then click the Obtain key. Afterward, you may comprehensive, modify, print out, or indicator the Pennsylvania Receipt of Payment for Obligation. Each and every lawful papers web template you acquire is the one you have permanently. To have an additional backup for any purchased kind, check out the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms internet site for the first time, follow the easy instructions below:

- Initial, make sure that you have selected the correct papers web template for your area/area of your choice. Look at the kind information to make sure you have selected the correct kind. If readily available, make use of the Preview key to appear throughout the papers web template too.

- If you wish to discover an additional version of your kind, make use of the Lookup industry to find the web template that meets your needs and demands.

- After you have discovered the web template you desire, click on Get now to continue.

- Choose the rates program you desire, enter your references, and register for your account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal bank account to pay for the lawful kind.

- Choose the structure of your papers and acquire it for your gadget.

- Make modifications for your papers if necessary. It is possible to comprehensive, modify and indicator and print out Pennsylvania Receipt of Payment for Obligation.

Obtain and print out a large number of papers templates utilizing the US Legal Forms site, which offers the greatest selection of lawful kinds. Use skilled and state-distinct templates to handle your organization or person needs.

Form popularity

FAQ

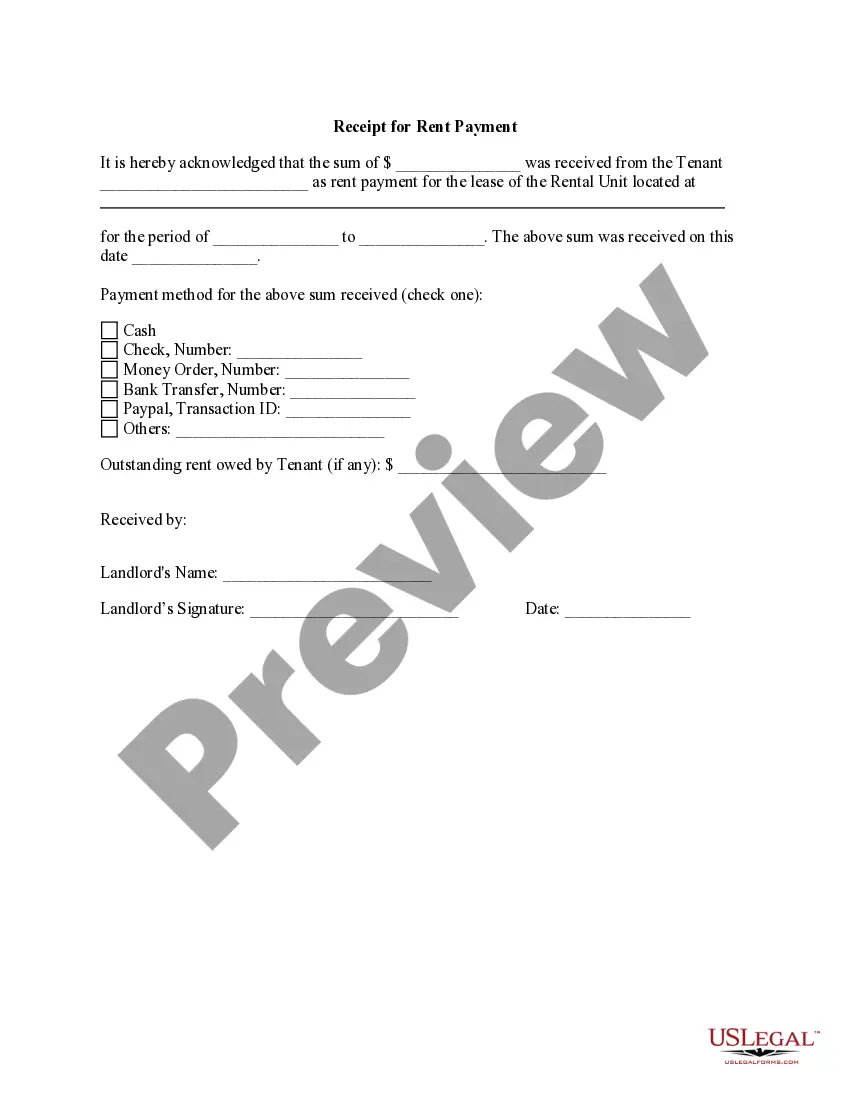

Here's a guide to what needs to be included on a payment receipt: Title: Mark the document as a payment receipt. Business Name and Contact Information: Clearly state the name of the business, its address, and contact details. Payment Date: Specify the exact date the payment was received.

No matter how you're making your receipt, every receipt you issue should include: The number, date, and time of the purchase. Invoice number or receipt number. The number of items purchased and price totals. The name and location of the business the items have been bought from. Any tax charged. The method of payment.

A receipt is any document that contains the following five IRS-required elements: Name of vendor (person or company you paid) Transaction date (when you paid) Detailed description of goods or services purchased (what you bought) Amount paid. Form of payment (how you paid ? cash, check, or last four digits of credit card)

How to write a receipt of payment The label ?Payment Receipt? Your business name and contact details. The original invoice number. The payment date. The amount paid. Any remaining balance due.

A receipt should include the date of the transaction, the name of the business, a description of the goods or services provided, and the amount paid. It may also include the payment method used, taxes, discounts, and the business contact information.

"Subcontractor." A person who has contracted to furnish labor or materials to or has performed labor for a contractor or another subcontractor in connection with a contract.

A payment receipt is a document given to a customer as proof of full or partial payment for a product or service. Start invoicing for free. A payment receipt is also referred to as a 'receipt for payment'.