Pennsylvania Disputed Open Account Settlement

Description

How to fill out Disputed Open Account Settlement?

Locating the appropriate authentic document format can be challenging. It goes without saying that there are numerous templates available online, but how do you acquire the authentic type you require? Take advantage of the US Legal Forms website. The service offers thousands of templates, including the Pennsylvania Disputed Open Account Settlement, which can be utilized for both business and personal needs. All forms are reviewed by experts and comply with federal and state regulations.

If you are currently registered, Log In to your account and click on the Obtain button to locate the Pennsylvania Disputed Open Account Settlement. Use your account to browse the legal forms you have purchased previously. Visit the My documents section of your account and download another copy of the document you need.

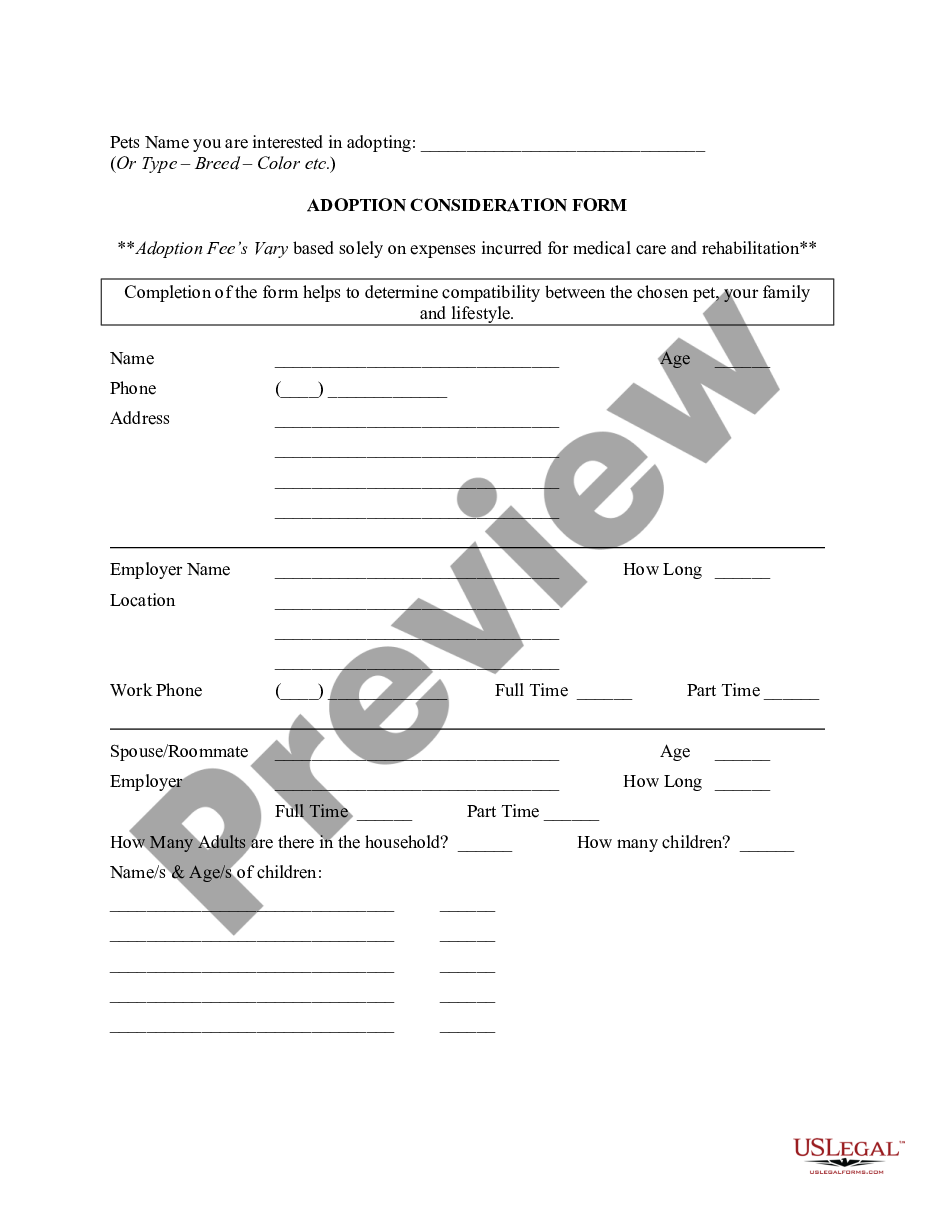

If you are a new user of US Legal Forms, here are some simple instructions for you to follow: First, ensure you have selected the correct type for your region. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the right form. Once you are confident that the form is correct, click on the Acquire now button to obtain the form. Choose the pricing plan you prefer and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the submission format and download the authentic document format to your device. Complete, edit, print, and sign the acquired Pennsylvania Disputed Open Account Settlement.

With US Legal Forms, you can efficiently navigate the complexities of legal documentation.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Utilize the service to download professionally crafted documents that adhere to state requirements.

- Thousands of templates are accessible for both personal and business use.

- All forms are validated by professionals to ensure compliance with regulations.

- The platform allows for easy access to previously purchased forms.

- Creating an account is straightforward and allows for secure transactions.

Form popularity

FAQ

A Family Settlement Agreement is often the easiest way to close an estate in PA because it does not involve any judicial proceedings. If all of the heirs and administrators of the estate agree, a contract can be prepared detailing all of the distributions and payments that have been made.

How long will probate take? Settling an uncontested estate takes anywhere from 9 months to 18 months. However, property can often be transferred before the probate process is fully complete.

Section 3392 states that all creditor claims shall be paid in the following order: (1) the costs of administering the decedent's estate, which includes any probate fees, attorneys' fees, or personal representative commissions; (2) the family exemption, which is $3,500.00 for each family member who resided with the ...

The Commonwealth of Pennsylvania's Right to Know Law (RTKL), 65 P. S. §§ 67.101-67.3104, provides citizens the right of access to public records, and sets forth the conditions under which a document maintained by a Commonwealth agency is deemed a public record.

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of ...

Typically, fees ? such as fiduciary, attorney, executor, and estate taxes ? are paid first, followed by burial and funeral costs. If the deceased member's family was dependent on him or her for living expenses, they will receive a ?family allowance? to cover expenses.

The cause of action of an account stated is based on principles of contract law. There must be an express or implied agreement between the creditor and debtor that the debtor owes the amount set forth in the account.

Individuals can receive inheritance money in different ways including through a trust and from a will, which can come with restrictions, or as a beneficiary on a bank or retirement account.