Pennsylvania Sample Letter for Insufficient Funds

Description

How to fill out Sample Letter For Insufficient Funds?

Are you presently inside a situation in which you need documents for sometimes business or specific uses almost every day? There are a lot of legitimate papers web templates available on the net, but finding versions you can depend on is not simple. US Legal Forms gives a huge number of type web templates, such as the Pennsylvania Sample Letter for Insufficient Funds, that happen to be published to satisfy federal and state specifications.

Should you be presently familiar with US Legal Forms website and have a merchant account, simply log in. After that, you are able to acquire the Pennsylvania Sample Letter for Insufficient Funds design.

Should you not offer an accounts and need to begin to use US Legal Forms, adopt these measures:

- Obtain the type you need and make sure it is for the appropriate city/region.

- Take advantage of the Review key to check the form.

- Browse the information to actually have selected the right type.

- In case the type is not what you`re trying to find, make use of the Lookup area to obtain the type that meets your requirements and specifications.

- When you find the appropriate type, just click Buy now.

- Choose the rates program you want, fill out the specified information to create your account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Select a practical document file format and acquire your duplicate.

Discover each of the papers web templates you may have bought in the My Forms food selection. You may get a further duplicate of Pennsylvania Sample Letter for Insufficient Funds whenever, if possible. Just click the required type to acquire or produce the papers design.

Use US Legal Forms, one of the most considerable collection of legitimate types, to save time as well as stay away from errors. The assistance gives expertly produced legitimate papers web templates that you can use for a selection of uses. Generate a merchant account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

If you receive a customer payment by cheque that is dishonoured by your bank (also called a bounced cheque), you can reverse the payment. After you reverse it, the invoice will show as outstanding. If it's unlikely that you'll receive a payment, you'll also need to account for a bad debt.

Contact the customer Explain the situation to them. Ask the customer to pay with cash or credit card. If you can't reach the customer by phone, you can try sending a bounced check letter to customer. Tell the customer why you are contacting them.

_________ (Amount). The cheque was deposited in ____________ (Branch) but due to __________________ (Insufficient amount/ signature differ/cheque stale/date error/payee name differ/ any other difference ? Mention reason) cheque got bounced. I request you to kindly provide me with the returned cheque at the earliest.

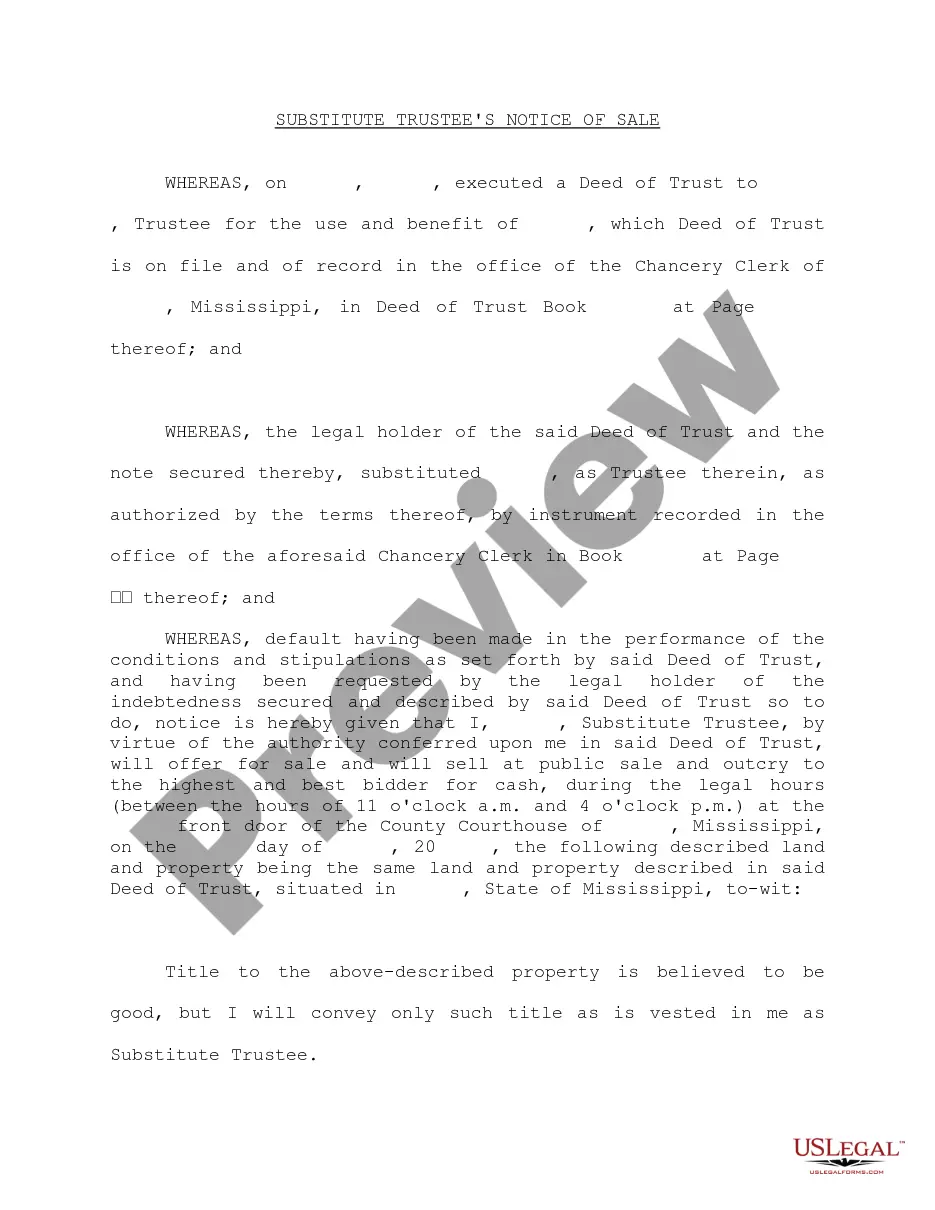

This letter serves as notice that your check number __________________,drawn on _______________________Bank or Credit Union, dated _________________, in the amount of $________________, made payable to _____________________, has been refused payment by your bank for the reason of lack of funds, insufficient funds, stop ...

The Demand Letter Your demand letter must request that you be paid the full amount of the check, any bank fees and the cost of mailing the demand. It also tells the person who gave you the bad check, that if they do not pay within 30 days of your mailing the demand letter, you can sue for the check plus damages.

It is recommended that you call them and write them a letter detailing the situation at hand. On the phone it is important to remain courteous but firm; you cannot let the person explain away the bounced check.

Synonyms of bouncing check (noun a check that bounces) bad check. bounced check. bouncing paper. forgery. insufficient funds. kited check. not enough to cover. overdraft.

Send certified mail. The check you wrote for $________, dated ______, which was made payable to _____________(write your/payee's name here), was returned by ______________ (write name of bank) because ____________(account was closed OR the account had insufficient funds).