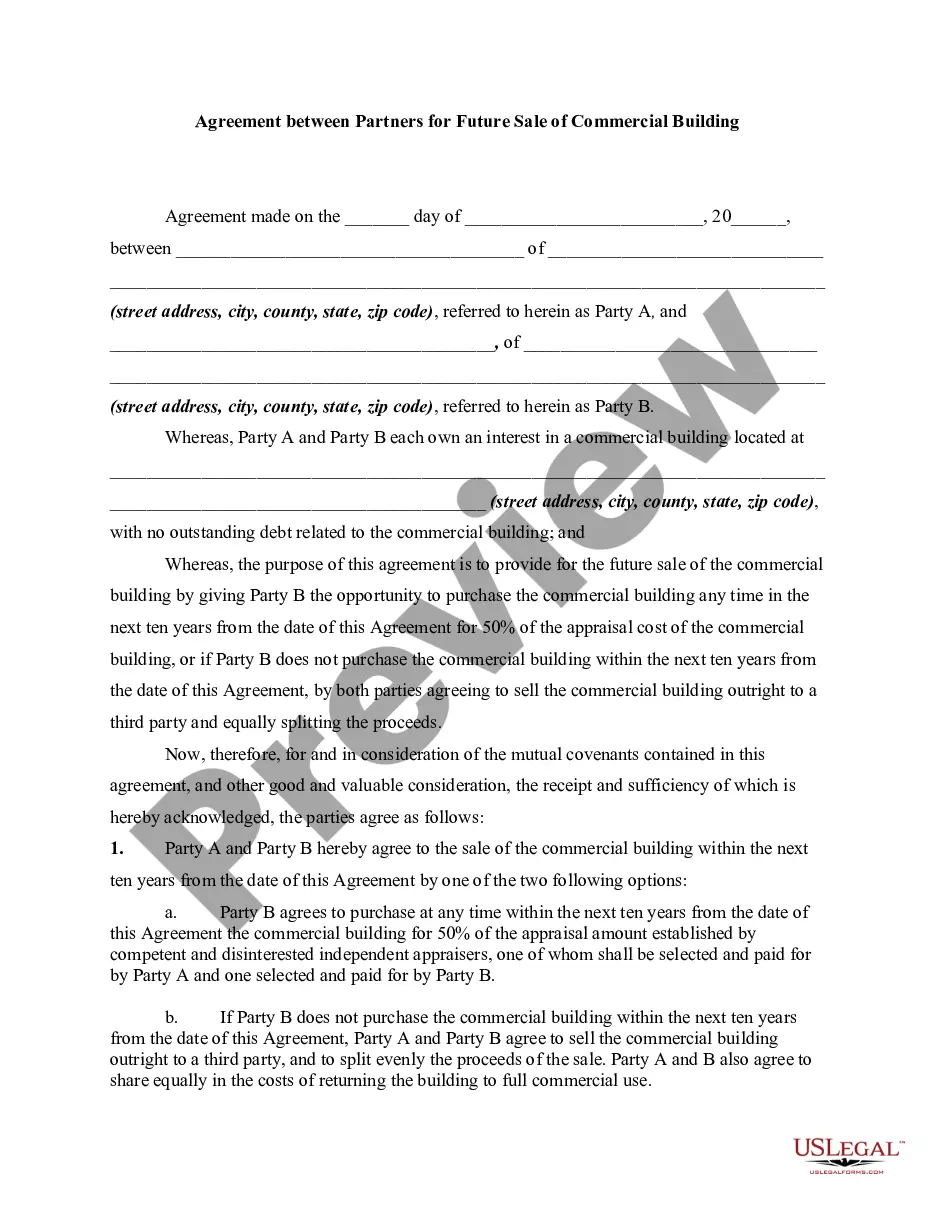

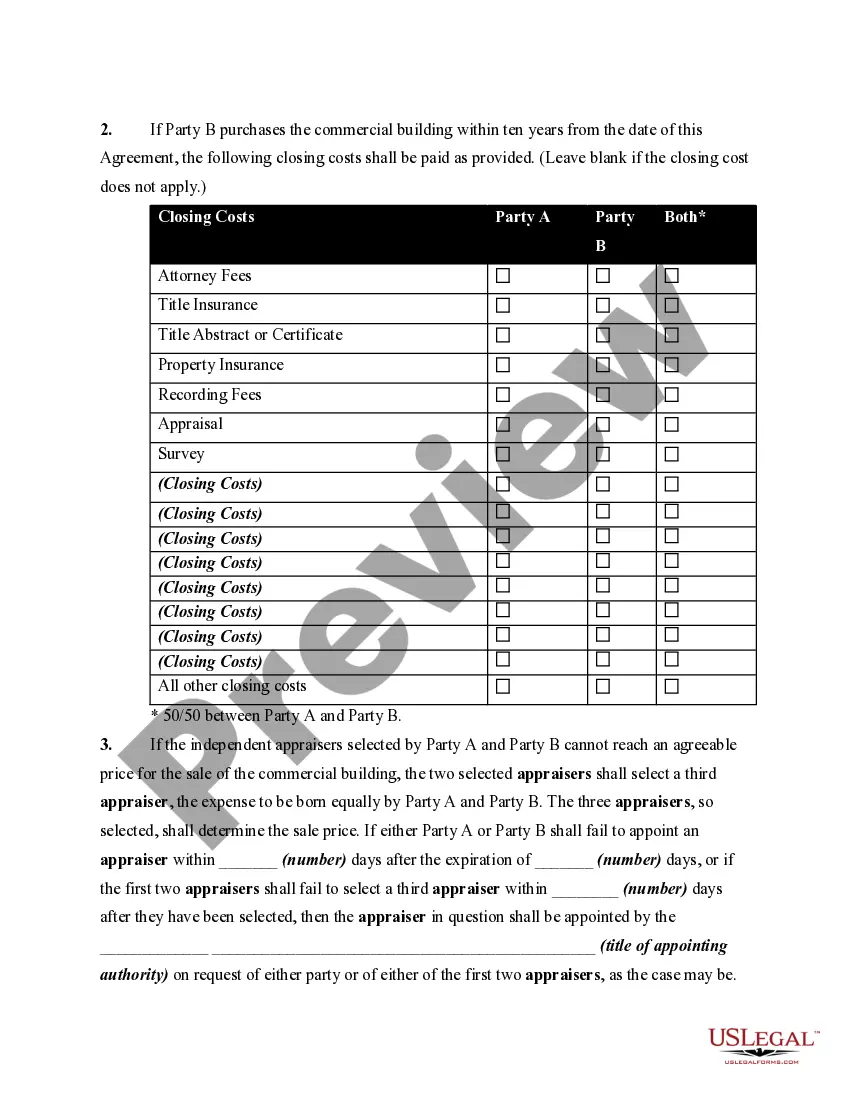

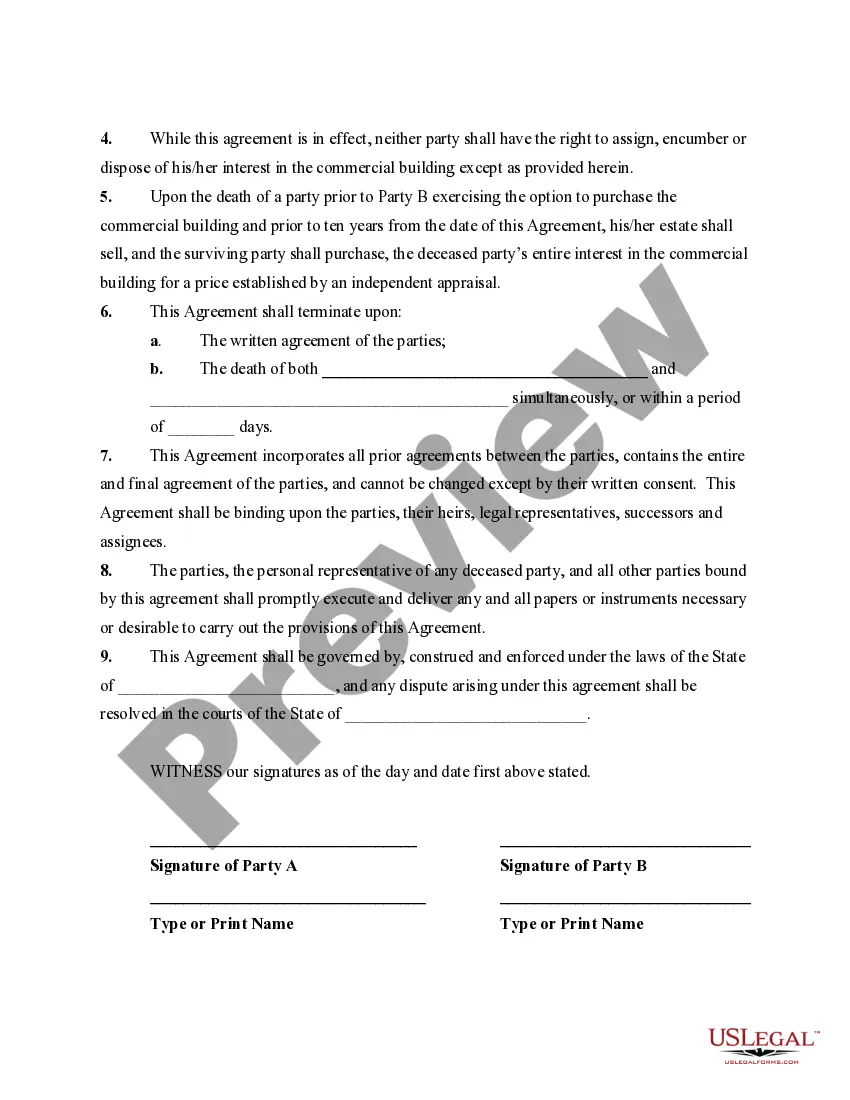

This Agreement between Partners for Future Sale of Commercial Building is used to provide for the future sale of a commercial building by giving one party the opportunity to purchase the commercial building any time in the next ten years from the date of this agreement, or by both parties agreeing to sell the commercial building outright to a third party and equally splitting the proceeds at the end of the ten-year period.

Pennsylvania Agreement between Partners for Future Sale of Commercial Building

Description

How to fill out Agreement Between Partners For Future Sale Of Commercial Building?

Are you currently in the situation where you require documents for either business or personal reasons nearly every day.

There are numerous legal document templates accessible online, but finding forms you can trust is challenging.

US Legal Forms offers a vast collection of template forms, such as the Pennsylvania Agreement between Partners for Future Sale of Commercial Building, which are designed to meet federal and state regulations.

Select the pricing plan you prefer, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Pennsylvania Agreement between Partners for Future Sale of Commercial Building template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Click the Preview button to view the form.

- Verify the details to ensure you have selected the accurate form.

- If the form is not what you are looking for, use the Search field to find the form that suits your requirements.

- Once you have the correct form, click Purchase now.

Form popularity

FAQ

In Pennsylvania, partnerships are typically taxed as pass-through entities. This means that income is reported on each partner's personal tax return rather than at the partnership level. When drafting your Pennsylvania Agreement between Partners for Future Sale of Commercial Building, it’s important to understand this aspect to properly allocate income and tax responsibilities among partners.

Yes, interest income is generally subject to local tax in Pennsylvania. This includes any interest earned on investments or bank accounts related to your partnership. Recognizing how interest income applies to your financial agreements, such as the Pennsylvania Agreement between Partners for Future Sale of Commercial Building, can help prevent tax issues.

Taxable income for Pennsylvania local tax generally includes net profits from businesses and other income streams. If your partnership engages in real estate transactions as outlined in your Pennsylvania Agreement between Partners for Future Sale of Commercial Building, this income will typically be subject to tax. It is wise to consult a tax professional to ensure proper compliance.

Certain organizations and entities are exempt from Pennsylvania local tax. For example, nonprofit organizations or government entities often qualify for exemptions. If you are discussing your Pennsylvania Agreement between Partners for Future Sale of Commercial Building, it's essential to clarify if your partnership may qualify for such exemptions.

Yes, partnership income is subject to Pennsylvania local tax. This means that if you enter into a Pennsylvania Agreement between Partners for Future Sale of Commercial Building, you may need to report this income. Understanding local tax obligations will help you manage your financial responsibilities more effectively.

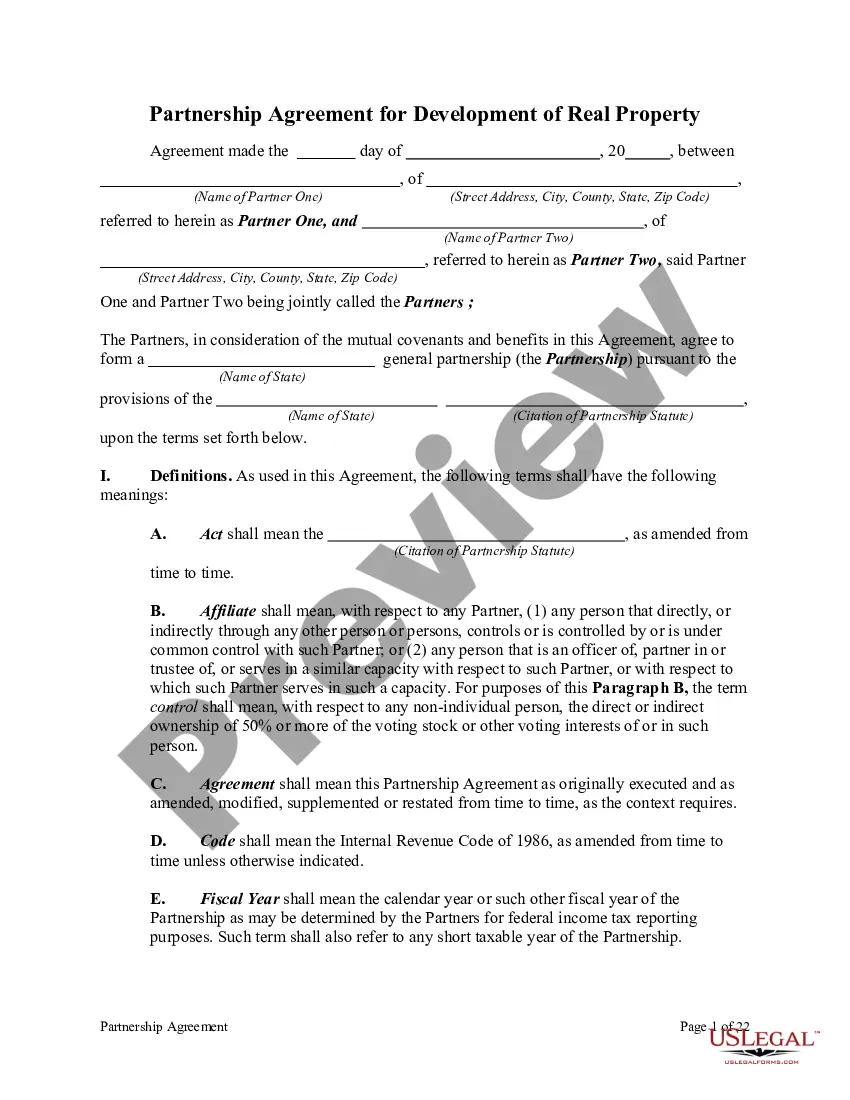

The contents of a partnership agreement should include the partners’ names, business name and purpose, financial contributions, and a method for profit and loss sharing. It is also vital to include terms for dispute resolution and procedures for adding or removing partners. A Pennsylvania Agreement between Partners for Future Sale of Commercial Building ensures these aspects are clearly articulated, providing a foundation for the partnership.

A commercial partnership agreement is a legal document that outlines the terms and conditions of a business partnership. It details each partner's contributions, roles, profit-sharing, and processes for resolving disputes. For those entering into a Pennsylvania Agreement between Partners for Future Sale of Commercial Building, this type of agreement helps establish legal frameworks for a successful partnership.

Yes, you can write your own partnership agreement, but it is essential to include all necessary details to protect all partners. Utilizing templates can streamline this process and ensure all critical elements are covered. A Pennsylvania Agreement between Partners for Future Sale of Commercial Building can easily be drafted using the resources available at uslegalforms, ensuring you capture all important aspects.

Key components of a partnership agreement include the business’s name, the purpose of the partnership, details on capital contributions, profit distribution methods, and provisions for termination. These elements ensure that all partners have a clear understanding of their obligations. A well-drafted Pennsylvania Agreement between Partners for Future Sale of Commercial Building can serve as a valuable reference point for smooth operations.

A partnership agreement should outline the business name and purpose, terms of capital contributions, profit and loss distribution, and procedures for resolving disputes. These elements ensure that every partner understands their rights and obligations. When drafting a Pennsylvania Agreement between Partners for Future Sale of Commercial Building, incorporating these details protects all partners' interests.