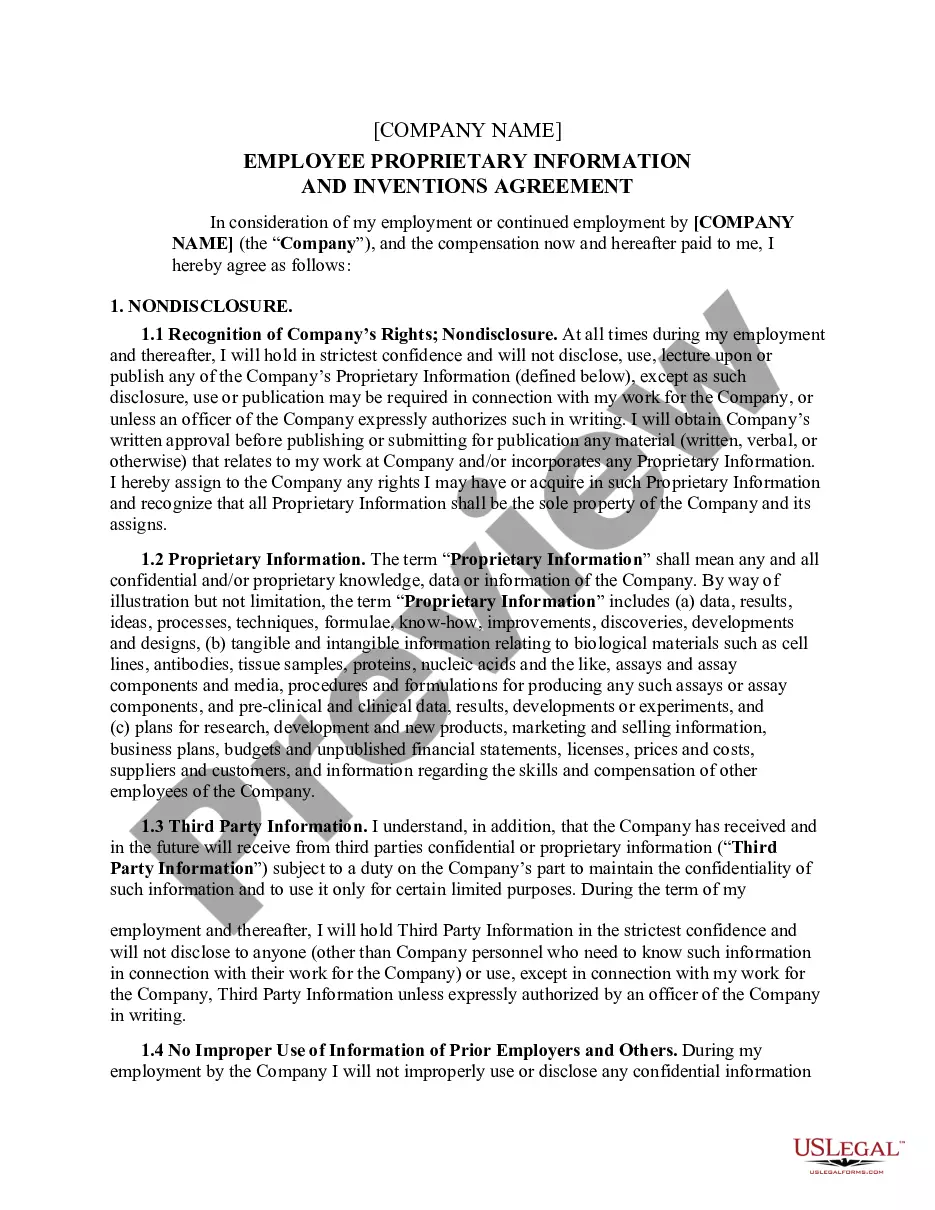

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

You might spend hours online attempting to locate the proper legal document format that complies with state and federal requirements you need.

US Legal Forms offers a vast collection of legal forms that are examined by professionals.

You can conveniently download or print the Pennsylvania Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary using our service.

If available, utilize the Review button to examine the document format as well. If you wish to obtain an additional version of your form, use the Search field to find the format that meets your requirements and specifications.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Pennsylvania Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

- Every legal document format you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- Firstly, ensure that you have chosen the correct document format for your county/town of preference.

- Review the form outline to confirm you have selected the right form.

Form popularity

FAQ

Yes, non-residents are subject to Pennsylvania's inheritance tax if they inherit property located within the state. This applies regardless of the beneficiary's home state, making it essential for non-residents to understand the implications of a Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. For individuals dealing with cross-state inheritances, consulting with a legal expert can clarify tax responsibilities.

In Pennsylvania, the family exemption allows surviving spouses and minor children to receive up to $3,500 without incurring inheritance tax. This exemption is an important aspect of the state's tax structure, particularly when executing a Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. It helps ease the financial burden during difficult times by ensuring that key family members receive support without immediate taxation.

Yes, a beneficiary can transfer their interest in a trust, which is often done by an assignment process. Using the Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary ensures that the transfer is clear and legally binding. Consulting a legal professional can aid in making this process smoother and compliant.

Setting up a trust can present several pitfalls, such as high administrative costs, tax implications, and the potential for family disputes. If not structured correctly, it could lead to confusion about beneficiary rights. Carefully considering options like the Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can help mitigate these risks.

A beneficiary typically has the power to receive distributions from the trust per its terms, request information about the trust, and in some cases, influence trust management. However, these powers depend on the specific language of the trust document. Understanding these rights is crucial when considering a Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

A fundamental mistake parents often make is overlooking the need for periodic reviews of the trust provisions. Changes in family circumstances, financial situations, or laws can affect trust effectiveness. Utilizing solutions like the Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can prevent future complications.

One downside of a trust is that it can create limitations on how assets are accessed or distributed. Additionally, trusts can have setup and maintenance costs that may outweigh the benefits in some cases. Therefore, understanding the implications of the Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is essential for long-term planning.

Yes, a beneficiary can assign their interest in the trust to another party, but this typically requires specific legal documentation. The Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is designed for this purpose. Be sure to consult with a legal professional to ensure the assignment is valid and complies with trust laws.

Establishing a trust can potentially reduce Pennsylvania inheritance tax liability if properly structured. However, the effects can vary based on the specific terms and type of trust established. It is crucial to consult with a legal expert to understand how a Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary may apply in your situation.

Assignment of beneficial interest refers to the act of transferring the rights to benefit from a trust or its assets to another party. This process is formalized through the appropriate legal documentation, such as the Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. This transfer can help individuals manage their interests more effectively.